QUARTERLY OVERVIEW

6

Prysmian Group Insight

Gradual recovery expected in 2014

FY target impacted by Western Link

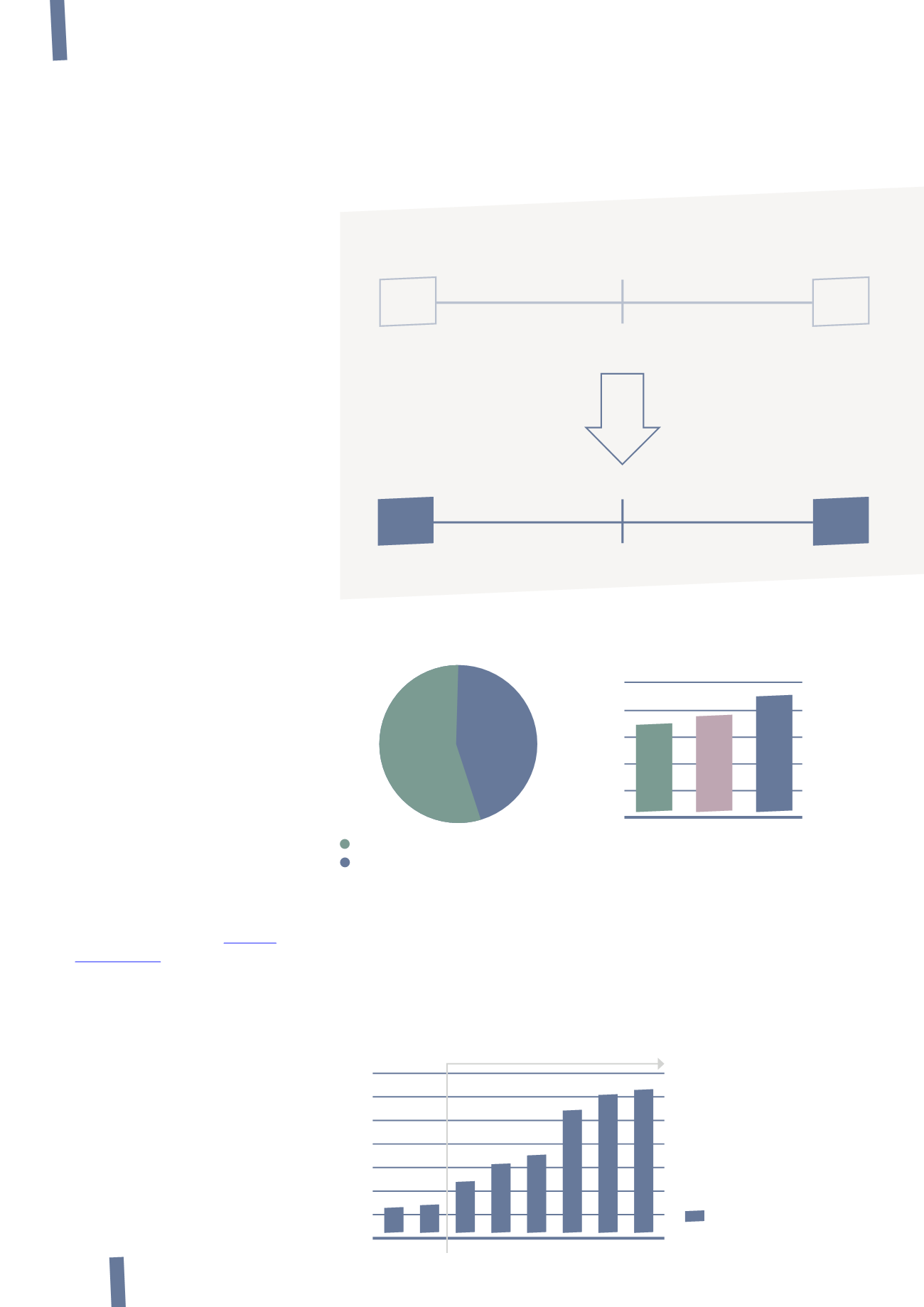

Target Price*

Brokers’ Recommendation*

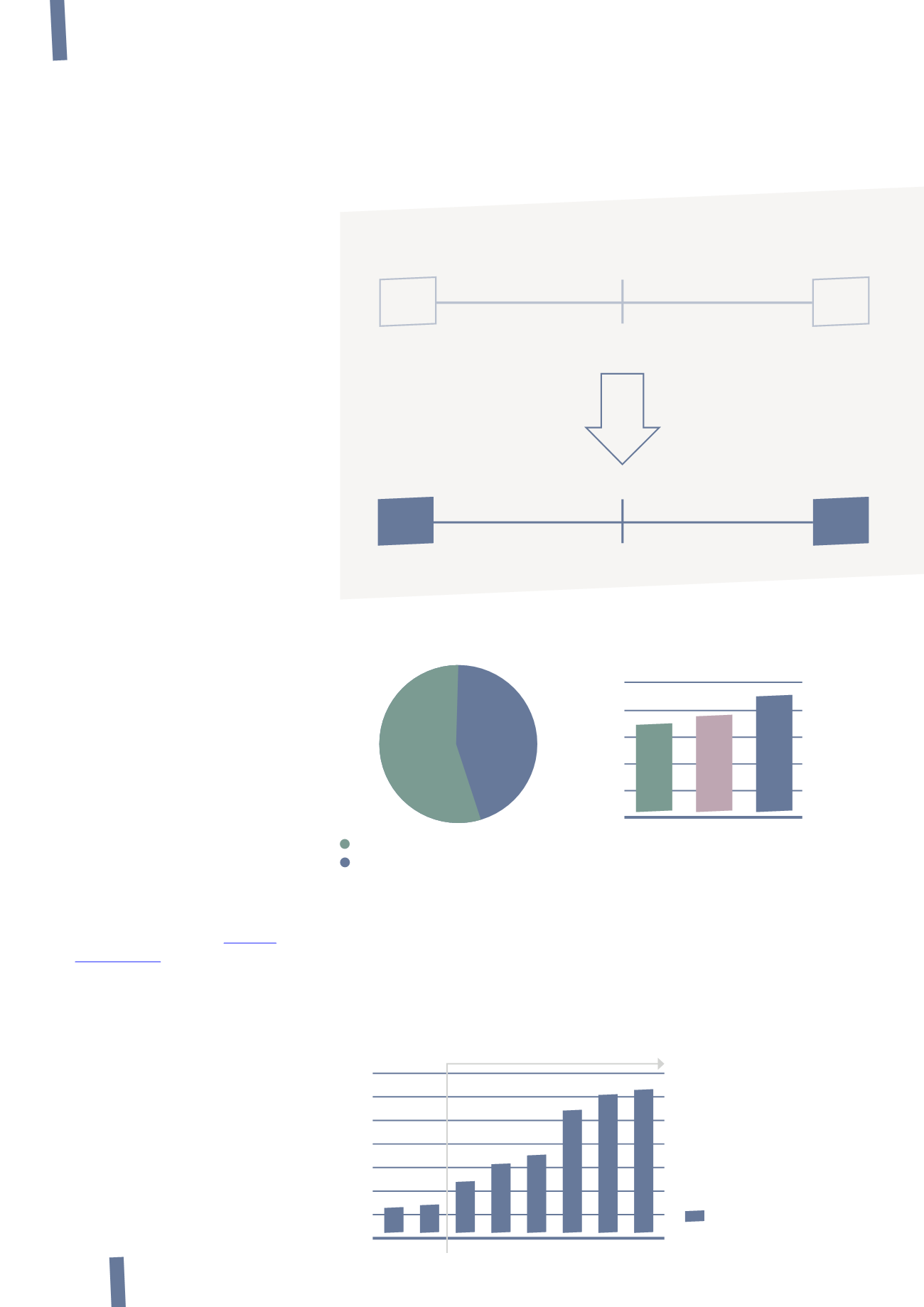

FY 2014 Adj. EBITDA target Vs FY 2013 (€613 million)

Min

2008

Initial expected

Adj.EBITDA FY Target

Current Adj.EBITDA

FY Target

Mid-point €625 million

Mid-point €555 million

-€70

million

Assuming FY’14 €70m negative

Western Link effect based on

current visibility on production

issue (final assessment to be

completed in the next quarters)

Neutral

Positive

0

0

5

200

10

400

15

600

20

800

25

1000

1200

1400

Average

2009

Max

2010 2011 J 2011 A 2012 2013 2014

16.5 18.6

22.5

The macroeconomic environment in

the first part of 2014, especially in

those areas hardest hit by the crisis,

has shown signs of stabilisation

and improvement compared with

the recessionary trend experienced

since the second half of 2011. In

this context, the Group is forecasting

for 2014 that demand for medium

voltage cables for utilities will

continue to slow, especially in

the first half of the year, and that

building wires and products in the

industrial market most exposed to

cyclical trends will make a gradual

recovery over the course of coming

quarters. It also confirms the

positive trend in demand in the high

value-added businesses of power

transmission and offshore Oil &

Gas, as well as the steady recovery

of demand for optical fibre cables

from the record lows reported in

2013. Against this background, and

based on the existing order book,

while also considering the negative

impacts of the Western Link project

and exchange rates, the Group is

forecasting Adjusted EBITDA for

FY 2014 in the range of

€

530-580

million. Excluding the negative

impact of the Western Link project

(estimated at

€

70 million for the full

year) it would have been

€

600-650

million compared to

€

613 million

achieved in 2013.

On 16 April 2014, the

of Prysmian S.p.A. was

held in single call to vote on several

items on the agenda, including

the approval of the 2013 financial

statements, the appointment of a

Director, the authorisation of a share

buy-back and disposal programme,

the approval of a long term incentive

plan for Group’s management and

the proposal to increase the share

capital free of charge to be reserved

to Prysmian Group employees for

the implementation of the long term

incentive plan. The meeting, which

was attended by more than 1,200

shareholders, in person or by proxy,

AGM: number of attendees

42%

*as of May 28, 2014

Public Company (no controlling shareholders)

Number of Shareholders

attending at AGM

Annual General Meeting

representing approx. 59% of the

share capital, approved every item

on the agenda with a majority vote.

The AGM also approved the

58%

• 1

st

Half financial results:

July 31, 2014

• 9 months financial results:

November 6, 2014

Investor calendar

600

530

650

580

distribution of a dividend of Euro

0.42 per share. The dividend was

paid on 25 April 2014, involving a

total pay-out of Euro 89 million.