Prysmian makes solid start to the year

Strong cash generation LTM & margin expansion sustained by market trends FY 2024 results expected in the upper end of the guidance range

● ADJ EBITDA AT €412M, WITH IMPROVING MARGINS AT 11.2% (10.7% IN 1Q23)

● MARGIN IMPROVEMENT IN TRANSMISSION AT 13.0%; OVER €18BN BACKLOG

● ADJ. EBITDA IN POWER GRID RISES TO €115M (+57%), MARGIN IMPROVED AT 13.5%

● GROUP NET PROFIT INCREASES TO €185M (€182M IN 1Q23)

● SOUND CASH GENERATION WITH FREE CASH FLOW LTM AT €827M1

● CLEAR PROGRESS ON CLIMATE AMBITIONS: -35% LTM SCOPE 1&2 GHG EMISSIONS

● ENCORE WIRE ACQUISITION WILL GROW PRYSMIAN’S NORTH AMERICA BUSINESS

Massimo Battaini, Chief Executive Officer (CEO), commented: “Prysmian has had an solid start to 2024. The first quarter results highlight an outstanding profitability, driven by the strong performance of the Power Grid and Transmission segments, while the order backlog stands at over € 18 billion. These achievements demonstrate that Prysmian’s commitment to accelerating the energy transition globally, together with its solutions which meet the highest environmental standards, are continuing to deliver positive results. My first year as Prysmian’s CEO is also marked by the signing acquisition of Encore Wire. This transaction is a unique opportunity to further grow and strengthen our position in North America, enhancing the diversification of our business and creating value for all stakeholders.”

FINANCIAL HIGHLIGHTS

The Board of Directors of Prysmian S.p.A. have approved the Group’s consolidated results for the first quarter of 2024.

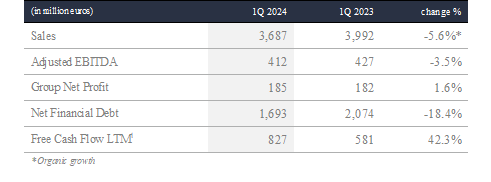

Group Sales amounted to €3,687 million, with a -5.6% organic growth. The Transmission Business reported an organic growth of +1.0% thanks to a consistent execution of interconnection and offshore wind farm projects. Sales in the Power Grid continued to benefit from investments in the grid enhancement, with a robust growth in North America in particular. In Electrification, Renewables continued to post a double-digit growth, while in Industrial & Construction price normalization continued at a slower than expected pace in North America. Sales in the Digital Solutions sharply declined in line with expectation (-31.6% organic growth) mainly due to the US market. A volume recovery is expected in the second part of the year.

Adjusted EBITDA reached €412 million (€427 million in 1Q23), with improving margins at 11.2% compared to 10.7% in 1Q23. Solid improvement in the Transmission Business with adj. EBITDA up 15% at €62 million thanks to the smooth execution and improved project margins. Excellent performance confirmed in Power Grid with the Adj. Ebitda rising to €115 million (+57%) with significant margin improvement at 13.5% (8.6% at 1Q23). In Electrification Business, Adj. Ebitda stood at €203 million vs. €233 million in 1Q23. The improvement in Specialties (Adj Ebitda margin at 11.1% vs 9.8% in 1Q23) were offset by Industrial & Construction where price normalization continued at a slower than expected pace in North America. A sharp market decline, especially in the US, negatively impacted the Digital Solutions in line with expectation, with adj. EBITDA down to €32 million vs €67 at 1Q23, including also lower contribution from YOFC at €3 million (vs. €7 million in 1Q23).

EBITDA amounted to €393 million (€398 million in 1Q23), including net expenses for company reorganisations, non-recurring expenses and other non-operating expenses of €19 million (€29 million in 1Q23).

Net profit increased to €190 million (€187 in 1Q23). Net profit attributable to owners of the parent company amounted to €185 million (€182 million in 1Q23).

Free Cash Flow LTM rose to €827 million, up by 42.3% compared to €581 million in March 2023.

Net Financial Debt fell sharply to €1,693 million at March 2024 (€2,074 million at March 2023), driven by strong cash flow generation.

1FCF excluding Acquisitions & Disposals and Antitrust impact