PURPOSE:

It rewards the medium-term performance on the basis of 3-year objectives

It fosters the alignment of interests towards sustainable value creation in the mid to long-term, reinforcing the retention of key personnel

MAIN CHARACTERISTICS:

LTI Plan consists of two components:

- Performance Shares

- Deferred Shares combined with Matching Shares

Maximum number of shares to be allocated - the maximum number of shares that can be allocated for each participant and to the entire Plan is established

1. Performance Shares

Free shares granted subject to achieving performance conditions

Vesting – 3 years (2023-2025)

Performance conditions

- Cumulated Adjusted EBITDA (20%)

- Cumulated Free Cash Flow (20%)

- Average ROCE (20%)

- Prysmian’s relative Total Shareholder Return (rTSR) compared to a peer group (20%)

- ESG, as measured by a specific scorecard (20%)

Lock-up - 2-year period for a portion of the shares granted as Performance Shares

2. Deferred Shares and Matching Shares

2.1 Deferred Shares

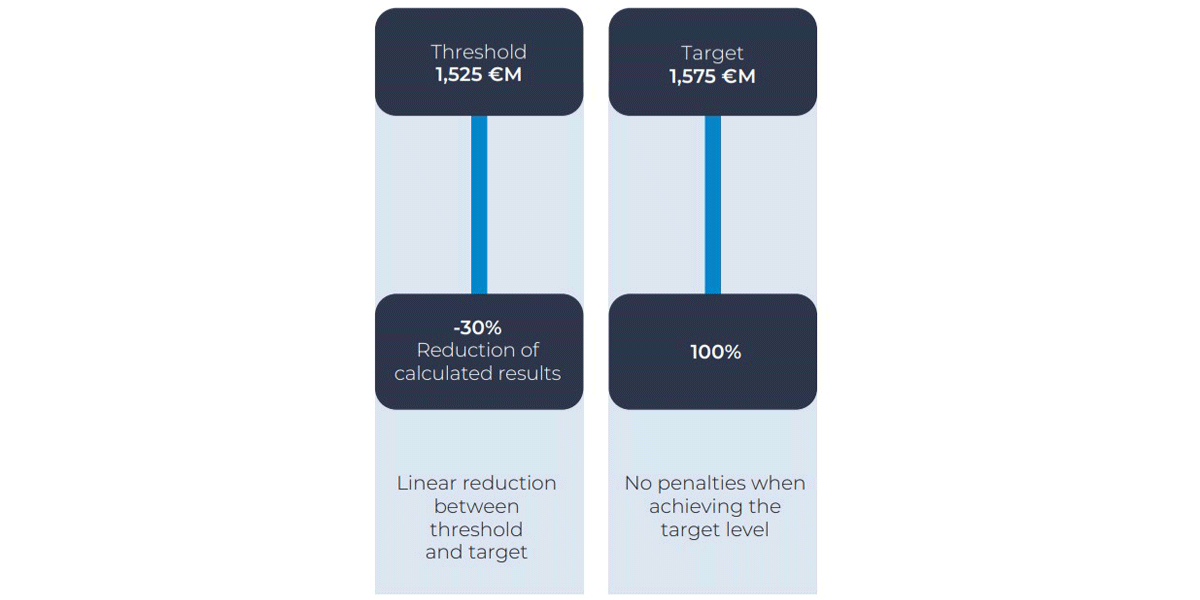

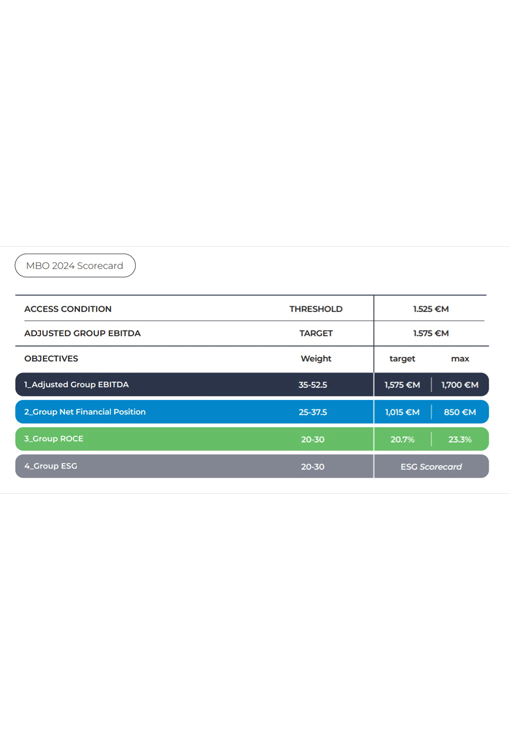

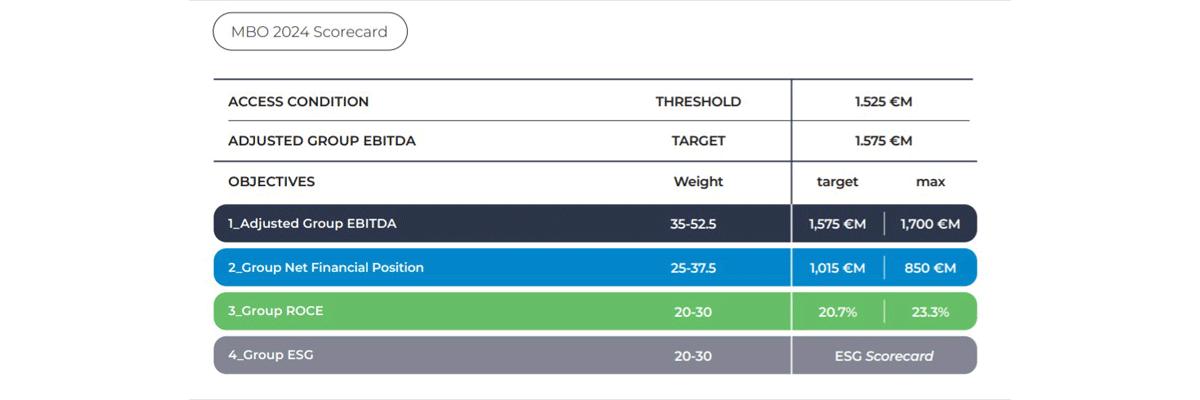

Free and deferred allocation in shares of 50% of the amount accrued under the 2023, 2024 and 2025 MBO Plans

2.2 Matching Shares

Awarding, for each Deferred Share granted, of an additional 0.5 free share; for CEO and Top Management, the Matching Share component is subject to the fulfilment of the ESG performance

AMOUNTS:

Performance shares

CEO: 300-450% of fixed remuneration over 3 years (target-maximum)

Executive Directors/MSR: 200-300% of fixed pay over 3 years (target-maximum)

Deferred shares

CEO/Executive Directors/ MSRs: 50% of the deferred incentive, paid out in shares