Group Historical Dividends

Historical Dividend

2024

Based on the results for 2023, the Board of Directors will recommend to the Shareholder’ Meeting that a dividend of €0.70 per share be distributed (+16.7% vs. €0.60 distributed last year). The total pay-out will be approximately €191 million. If approved, the dividend will be paid out from 24 April 2024, with record date on 23 April 2024 and ex-dividend date on 22 April 2024.

| No OF SHARES WITH DIVIDEND RIGHT | 272,816,043 |

| GROSS DIVIDEND PER SHARE | € 0.70 |

| CUMULATED DIVIDENDS | € 191 m |

| EARNINGS PER SHARE | € 1.94 |

| PAY-OUT RATIO | 36% |

Other years

2022

Toggle Details

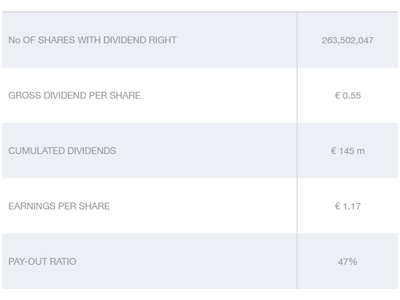

Based on the 2021 results, the Board of Directors of Prysmian S.p.A. recommended to the Shareholders' Meeting, held on the 12 April 2022 in single call, the distribution of a dividend of €0.55 per share, involving a total pay-out of approximately €145 million. The dividend was paid out from 21 April 2022 to those shares outstanding on the ex-div date of 19 April 2022.

2021

Toggle Details

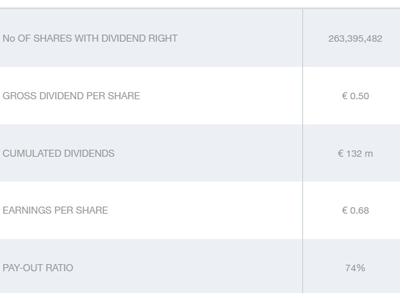

Based on the 2020 results, the Board of Directors of Prysmian S.p.A. recommended to the Shareholders' Meeting, held on the 28 April 2021 in single call, the distribution of a dividend of €0.50 per share, involving a total pay-out of approximately €132 million. The dividend was paid out from 26 May 2021 to those shares outstanding on the ex-div date of 24 May 2021.

2020

Toggle Details

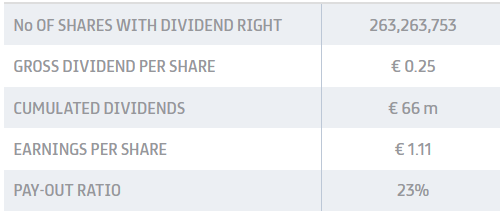

Based on the 2019 results, the Board of Directors of Prysmian S.p.A. recommended to the Shareholders' Meeting, held on the 28 April 2020 in single call, the distribution of a dividend of €0.25 per share, involving a total pay-out of approximately €66 million. The dividend was paid out from 20 May 2020 to those shares outstanding on the ex-div date of 18 May 2020.

2019

Toggle Details

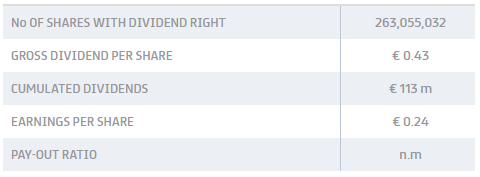

Based on the 2018 results, the Board of Directors of Prysmian S.p.A. recommended to the Shareholders' Meeting, held on the 6 June 2019 in single call, the distribution of a dividend of €0.43 per share, involving a total pay-out of approximately €113 million. The dividend was paid out from 26 June 2019 to those shares outstanding on the ex-div date of 24 June 2019.

2018

Toggle Details

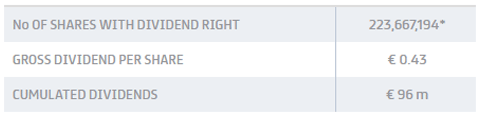

Based on the 2017 results, the Board of Directors of Prysmian S.p.A. recommended to the Shareholders' Meeting, held on the 12 April 2018 in single call, the distribution of a dividend of €0.43 per share, involving a total pay-out of approximately €96 million. The dividend was paid out from 25 April 2017 to those shares outstanding on the ex-div date of 23 April 2017.

2017

Toggle Details

Based on the 2017 results, the Board of Directors of Prysmian S.p.A. recommended to the Shareholders' Meeting, held on the 12 April 2017 in single call, the distribution of a dividend of €0.43 per share, involving a total pay-out of approximately €91 million. The dividend was paid out from 26 April 2017 to those shares outstanding on the ex-div date of 24 April 2017.

2016

Toggle Details

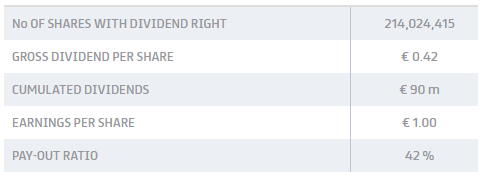

Based on the 2015 results, the Board of Directors of Prysmian S.p.A. will recommend to the Shareholders' Meeting, to be held on the 13 April 2016 in single call, the distribution of a dividend of €0.42 per share, involving a total pay-out of approximately €90 million. The dividend, if approved by the Shareholders' Meeting, will be paid out from 20 April 2016 to those shares outstanding on the ex-div date of 18 April 2016.

2015

Toggle Details

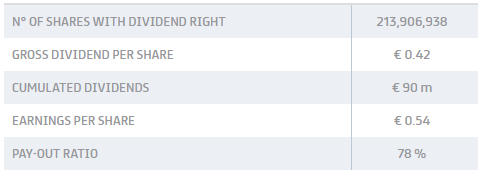

Based on the 2014 results, the Board of Directors of Prysmian S.p.A. will recommend to the Shareholders' Meeting, to be held on the 16 April 2015 in single call, the distribution of a dividend of €0.42 per share, involving a total pay-out of approximately €90 million. The dividend, if approved by the Shareholders’ Meeting, will be paid out from 22 April 2015 to those shares outstanding on the ex-div date of 20 April 2015.

2014

Toggle Details

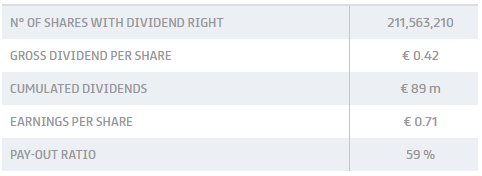

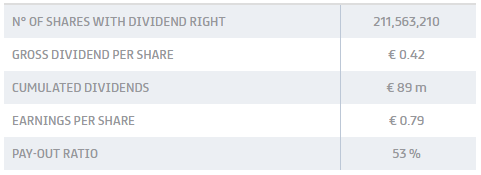

Based on the 2013 results, the Board of Directors of Prysmian S.p.A. recommended to the Shareholders' Meeting, held on the 16 April 2014 in single call, the distribution of a dividend of €0.42 per share, involving a total pay-out of approximately €89 million. The dividend, approved by the Shareholders’ Meeting, was paid out from 25 April 2014 to those shares outstanding on the ex-div date of 22 April 2014.

2013

Toggle Details

Based on the 2012 results, the Board of Directors of Prysmian S.p.A. recommended to the Shareholders' Meeting, held on the 16 April 2013 in single call, the distribution of a dividend of €0.42 per share, involving a total pay-out of approximately €89 million. The dividend, approved by the Shareholders’ Meeting, was paid out from 25 April 2013 to those shares outstanding on the ex-div date of 22 April 2013.

2012

Toggle Details

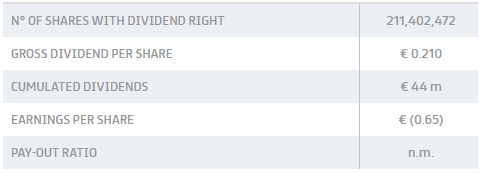

Based on the 2011 results, the Board of Directors of Prysmian S.p.A. recommended to the Shareholders' Meeting, held on the 18 April 2012 in single call, the distribution of a dividend of €0.21 per share, involving a total pay-out of approximately €44 million. The dividend, approved by the Shareholders' Meeting, was paid out from 26 April 2012 to those shares outstanding on the ex-div date of 23 April 2012.

2011

Toggle Details

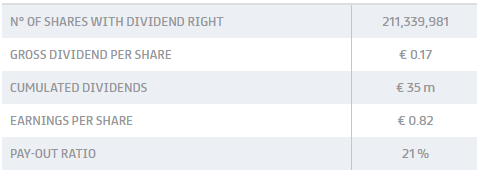

Based on the 2010 results, the Board of Directors of Prysmian S.p.A. will recommend to the Shareholders' Meeting, to be held on the April 14, 2011 in single call, the distribution of a dividend of €0.17 per share, involving a total pay-out of approximately €35 million. The dividend, if approved by the Shareholders' Meeting, will be paid out from April 21, 2011 to those shares outstanding on the ex-div date of April 18, 2011.

2010

Toggle Details

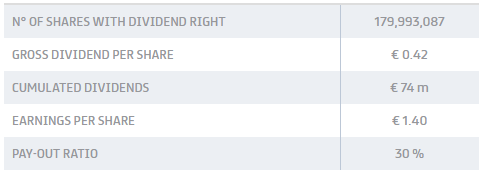

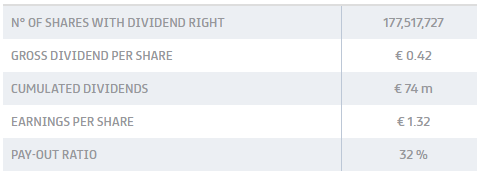

Based on the 2009 results, the Board of Directors of Prysmian S.p.A. will recommend to the Shareholders' Meeting, to be held on the April 15, 2010 in single call, the distribution of a dividend of €0.42 per share, involving a total pay-out of approximately €74 million. The dividend, if approved by the Shareholders' Meeting, will be paid out from April 22, 2010 to those shares outstanding on the ex-div date of April 19, 2010.

2009

Toggle Details

Based on the 2008 results, the Board of Directors of Prysmian S.p.A. will recommend to the Shareholders' Meeting, to be held on the April 9, 2009 in single call, the distribution of a dividend of €0.42 per share, involving a total pay-out of approximately €74 million. The dividend, if approved by the Shareholders' Meeting, will be paid out from 23 April 2009 to those shares outstanding on the ex-div date of 20 April 2009.

2008

Toggle Details

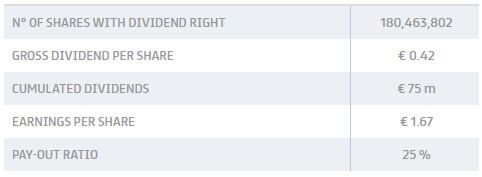

Based on the 2007 results, the Board of Directors of Prysmian S.p.A. will recommend to the Shareholders' Meeting, to be held on the April 15, 2008 in single call, the distribution of a dividend of €0.42 per share, involving a total pay-out of approximately €75 million. The dividend, if approved by the Shareholders' Meeting, will be paid out from April 24, 2008 to those shares outstanding on the ex-div date of April 21, 2008.