FTTx adoption in Mena is affected by developments specific to the region as well as familiar global issues such as raw material costs, supply chain issues, and inflation. A key challenge is development of the required infrastructure. The belief that fast fibre is relatively costly is persistent, even though copper’s market share is diminishing. However, the region offers unique opportunities for success.

Adoption of FTTx in the MENA region: challenges and opportunities

Kholoud Al-Dorgham

Director General, Fiber Connect Council MENA

What are the main hurdles to FTTx adoption in MENA?

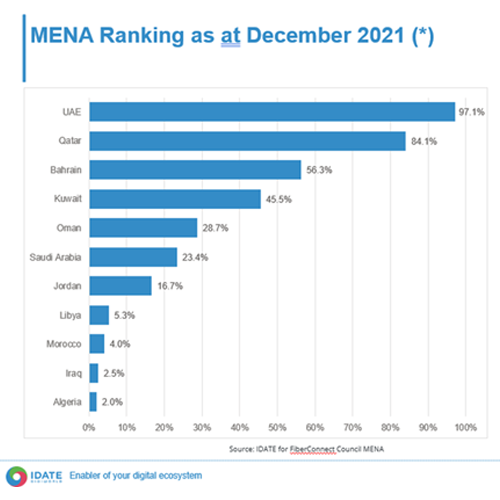

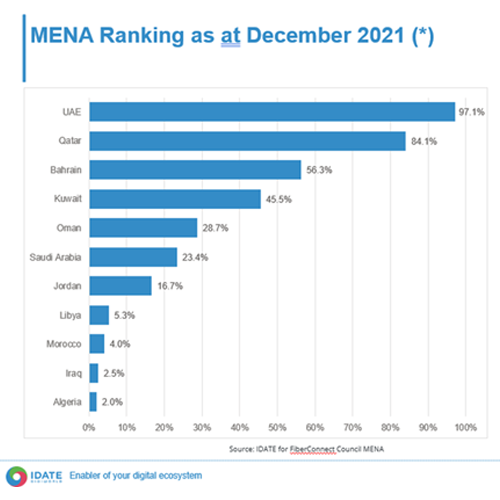

“When it comes to economic, political and infrastructure status, countries in the MENA region are highly diverse. This is reflected in the challenges and hurdles to building FTTx networks So my answer would be: each country has its own challenges. These range from availability of funding and lack of political stability to low return on investment and insufficient government subsidies or public incentives to build. Having said that, we may also note they face hurdles that we also see in other places, for example in the area of skilled labour. However, but it is worth noting that at the same time several countries at the top of the global broadband connectivity ranking, such as United Arab Emirates and Qatar, are in MENA.”

Are these very different per country? Or are there clear regional trends?

“Issues are highly country specific. In some areas, we anticipate a preference for high density solutions using micro trench cabling in densely populated urban areas. In areas with fewer households, we expect aerial solutions will be taken up on a large scale (depending on country regulations). There’s a trend towards finding partners who have strong sustainability score as well as a proven record in quality and innovation. Some countries are building experience with FTTR and a mix of fixed 5G broadband networks. We can also see adaption of Smart City concepts in the planning of new cities, as digital transformation continues to be adopted to a great extent.”

"We expect the Gulf Countries Council countries - Bahrain, Kuwait, Oman, Qatar, Saudi Arabia, and the United Arab Emirates - to reach high maturity and near nationwide coverage relatively soon. Other countries in the region are transparently sharing their plans to upgrade copper networks, replacing them with Fibre Infrastructure.”

What do you consider to be the key drivers for FTTx in MENA?

“One important factor is the young population - more than 60% of people across the region are under the age of 30 - as well as the view that FTTX can help create economic prosperity and improve living conditions for many people. I think high and stable internet connectivity is a necessity and many telecom companies are trying to ensure the supply to this demand through FTTX networks. Another important aspect is the fact that economic growth at corporate and entrepreneurship levels is helping drive more need for such services.”

Which steps do you think governments and regulatory bodies should take to promote adoption across the region?

“As Fiber Connect Council MENA Director General, I could be biased! However, in my opinion, there is a need for the following :

- Public funding or public private partnership specially in low density regions to improve ROI (Return on investment)

- Ease of regulation around right of ways and civil Infrastructure required for FTTX

- Vocational training programs to help create trained and skilled manpower required to build and maintain these networks.”

Regional infrastructure sharing policies, subsidies, a variety of national broadband initiatives, and the extension of FTTH penetration beyond urban areas are driving adoption in MENA. According to Thecla Mbongue, Research Manager for the Middle East and Africa at research company Omdia’s Service Provider Markets Team, fibre broadband subscriptions grew a significant 13% year-on-year across the Middle East, increasing from 26.9 million in Q1 2022 to 30.5 million in Q1of 2023. Omdia has predicted that fibre broadband penetration will grow from 7.62% at the end of 2022 to 11.60% at the end of 2028.

About Fiber Connect Council MENA

The Fiber Connect Council MENA is an esteemed industry association dedicated to promoting and advancing the deployment of fiber-optic networks across the Middle East and North Africa region. As the leading platform for industry professionals, this conference and exhibition brings together experts, decision-makers, and stakeholders from various sectors involved in the fiber-optic ecosystem.