62

| 2012 annual report prysmian group

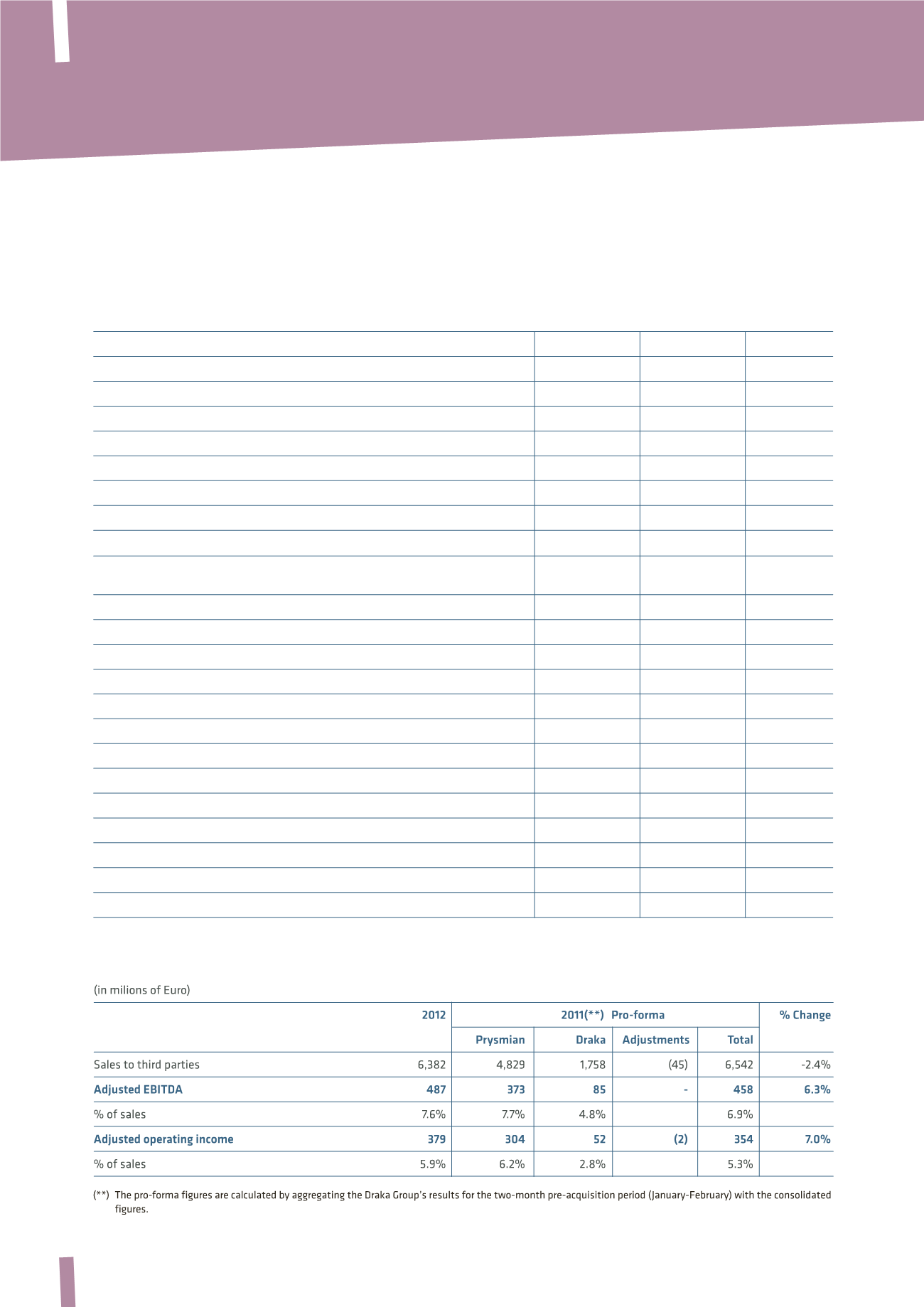

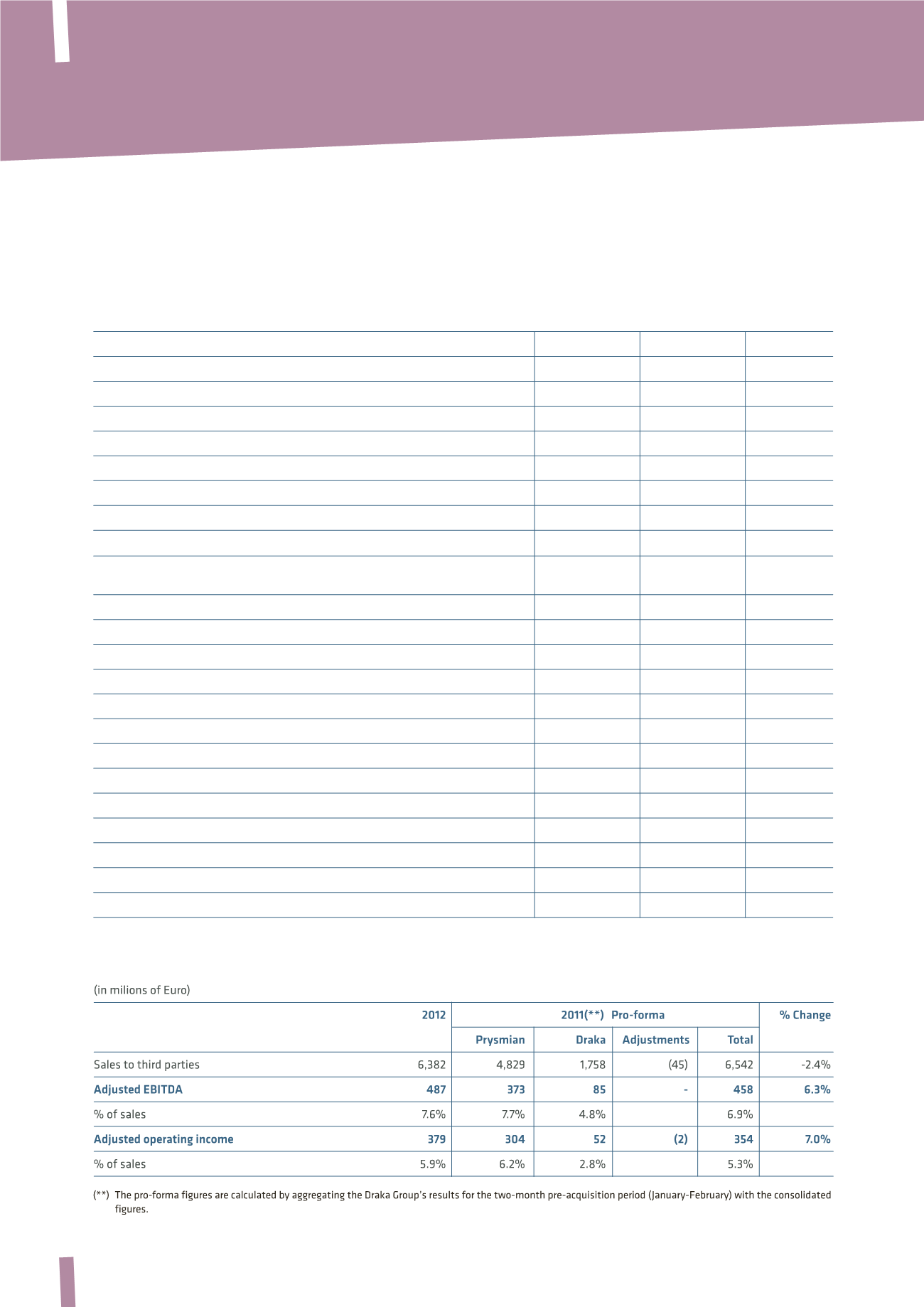

ENERGY BUSINESS

Sales were generally stable while profitability has increased.

(*) Includes the Draka Group’s results for the period 1 March – 31 December 2011.

(in millions of Euro)

2012

2011 (*)

% Change

2010

Sales to third parties

6,382

6,268

1.8%

4,121

Adjusted EBITDA

487

447

8.9%

351

% of sales

7.6%

7.1%

8.5%

EBITDA

417

186

124.2%

339

% of sales

6.5%

2.9%

8.2%

Amortisation and depreciation

(108)

(99)

9.4%

(71)

Adjusted operating income

379

348

8.8%

280

% of sales

5.9%

5.5%

6.8%

Reconciliation of EBITDA to Adjusted EBITDA

EBITDA (A)

417

186

124.2%

339

Non-recurring expenses/(income):

Company reorganisation

53

42

10

Antitrust

1

205

3

Draka integration costs

4

2

-

Tax inspections

1

-

(2)

Environmental remediation and other costs

3

5

1

Italian pensions reform

1

-

-

Other non-recurring expenses

10

-

-

Release of Draka inventory step-up

-

8

-

Gains on disposal of assets held for sale

(3)

(1)

-

Total non-recurring expenses/(income) (B)

70

261

12

Adjusted EBITDA (A+B)

487

447

8.9%

351

Consolidated Financial Statements >

Directors’ Report