58

| 2012 annual report prysmian group

bilancio consolidato >

Relazione della gestione

INCOME STATEMENT

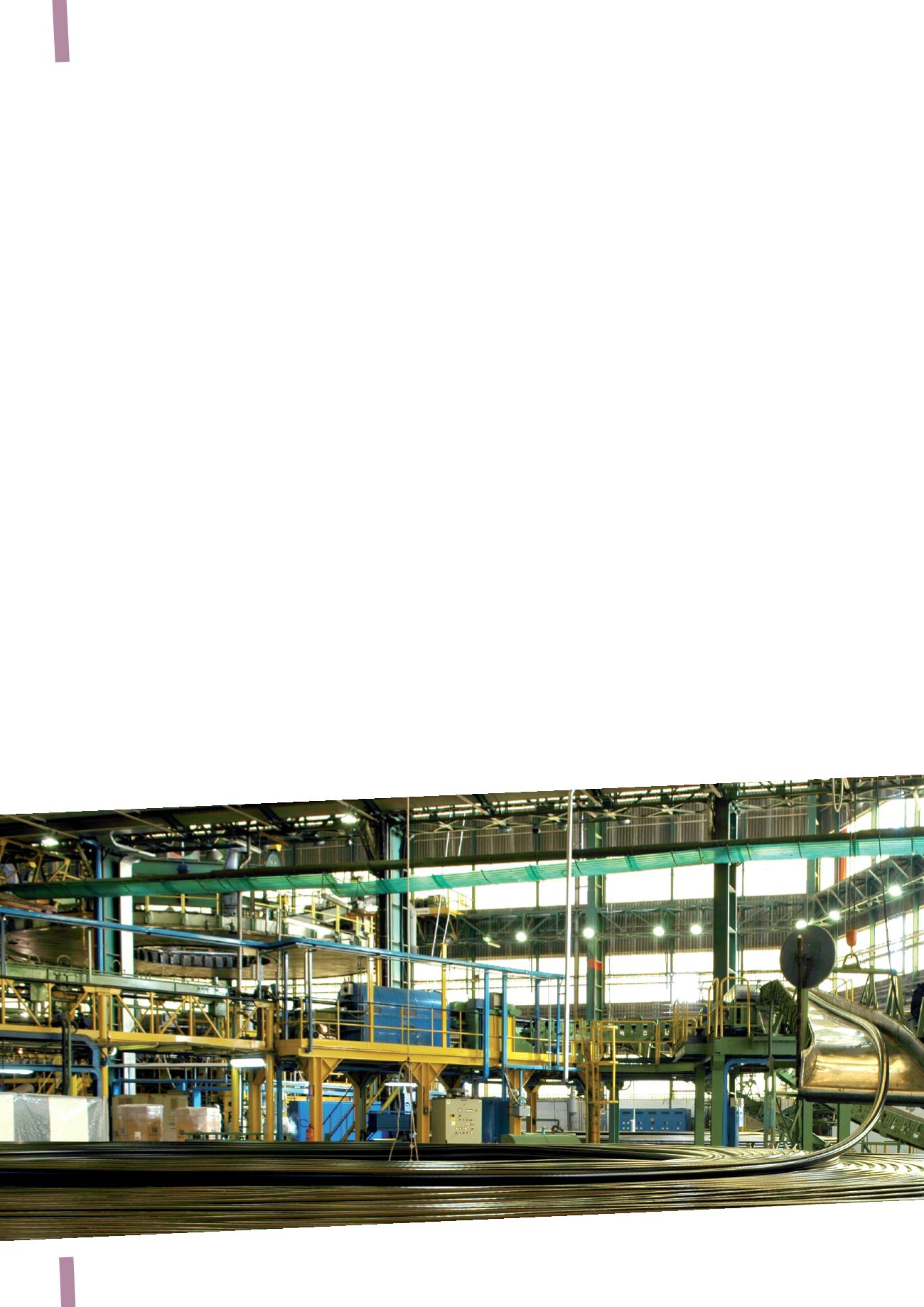

The net result for 2012 was a profit of Euro 171 million, versus a consolidated loss of Euro 145

million at 31 December 2011.

The Group’s sales came to Euro 7,848 million at the end

of 2012, compared with Euro 7,583 million at 31 December

2011, posting a positive change of Euro 265 million (+3.5%).

Compared with the pro-forma figure of Euro 7,973 million, the

Group’s sales posted a negative change of Euro 125 million

(-1.6%).

This decrease was due to the following factors:

• positive exchange rate effects of Euro 177 million (+2.2%);

• negative change of Euro 159 million (-2.0%) in sales prices

due to fluctuations in metal prices (copper, aluminium and

lead);

• positive change of Euro 46 million (+0.6%) for the

line-by-line consolidation of Telcon Fios e Cabos para

Telecomuniçaoes S.A. starting from the second quarter;

• positive change of Euro 6 million (+0.1%) for the

consolidation of Global Marine Systems Ltd as from

November 2012;

• negative change of Euro 54 million (-0.7%) due to non-

consolidation of the results of Ravin Cables Limited

(India) and Power Plus Cable CO LLC (Middle East – 49%

consolidated) since 1 April 2012;

• organic decrease in sales of Euro 141 million (-1.8%).

Despite the organic decrease in sales, reflecting uncertainties

in European markets throughout the period that intensified in

the second half of the year, the strategic validity of the Draka

Group’s acquisition and integration is nonetheless confirmed.

The enlargement of the Group’s perimeter has made it

possible to improve the geographical distribution of sales, in

favour of markets in Northern Europe, North America and Asia

in general, as well as to extend the product range offered. This

has allowed the Group to offset the steep decline in demand

in Southern Europe and in lower value-added businesses,

like Trade & Installers and Power Distribution. The efforts

to improve customer service, combined with technological

innovation, quality improvements and increased flexibility of

production in its high value-added businesses (High Voltage,

Submarine, Industrial Cables) have allowed the Group to

quickly take advantage of market opportunities, in conditions

of extremely tough competition.

Adjusted EBITDA amounted to Euro 647 million, up 13.9%

from Euro 568 million in the prior year equivalent period and

up 10.4% from the pro-forma figure of Euro 586 million at 31

December 2011. The like-for-like increase is attributable to

positive performances, particularly by the Telecom segment

and by the Energy segment’s Industrial business area and