65

MARKET OVERVIEW

Contraction in energy demand in the first three quarters of the year accentuated geographical

differences and competitive pressures

During 2012, the markets in which the Prysmian Group’s

Utilities business area operates confirmed and in many

cases amplified the signs of uncertainty already appearing

in the second half of 2011. Both the power distribution and

generation markets experienced a decline in demand during

the first nine months of the year and stability in the fourth

quarter, with competitive pressures and differences between

the various geographical areas becoming even greater in the

last three months of the year.

Activities in the High Voltage market - traditionally highly

international both in terms of demand and supply -

were particularly affected by the global macroeconomic

environment and generally slowed compared with the prior

year.

Faced with general uncertainty about future energy

consumption and access to funding, the largest Utilities,

particularly in Europe and North America, adopted an

extremely cautious approach to new investment projects.

Industry demand was therefore limited to rationalisation and/

or maintenance projects - to improve efficiency and reduce

energy generation costs - in Europe, and North and South

America, or to the extension or completion of major initiatives

in the Middle East. Utilities in growing economies, like China

and India, became more and more demanding on the price

front, not only due to an increasing number of competitors but

also because of the need to limit financial exposure in the face

of uncertain investment returns.

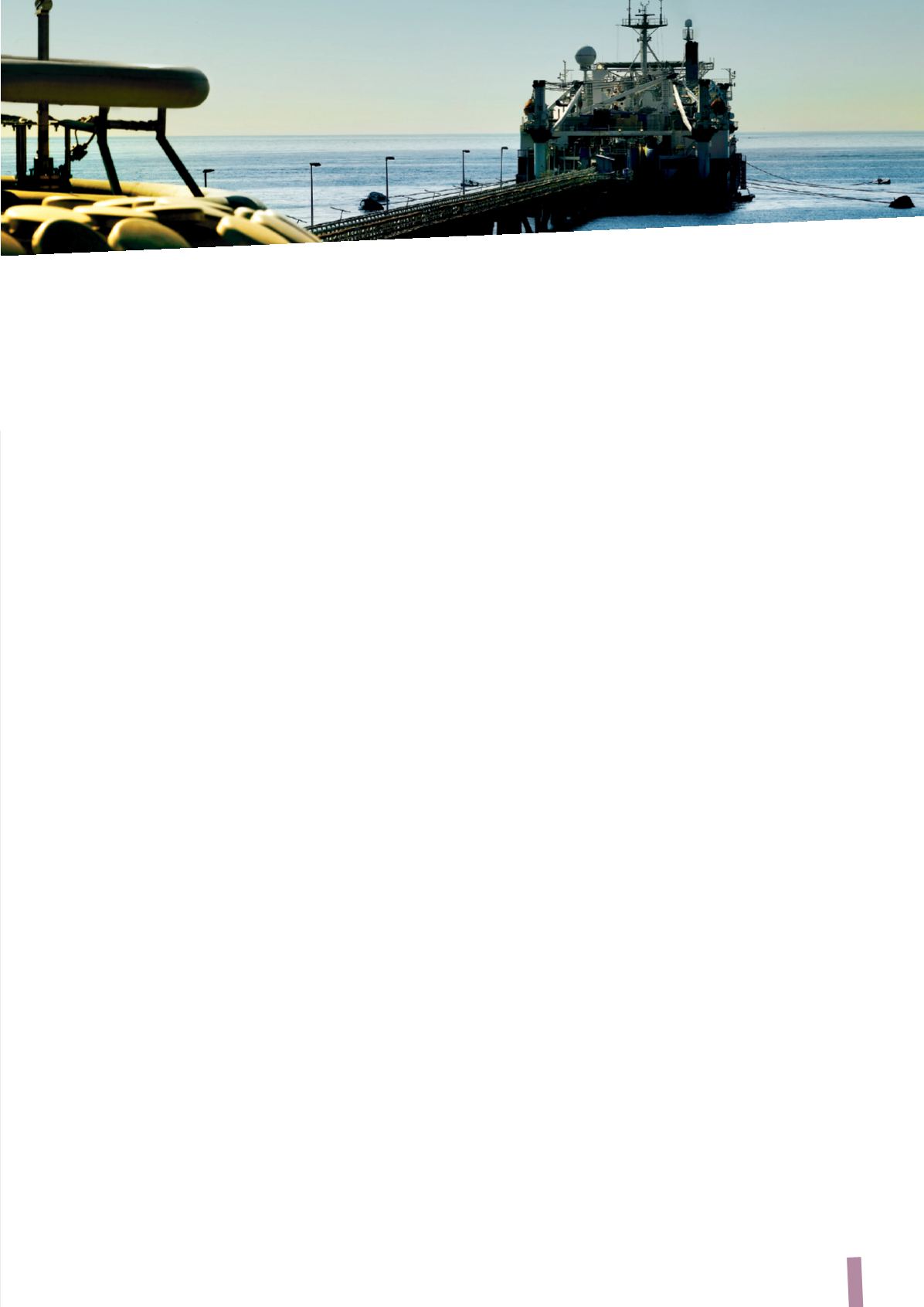

With reference to the Submarine cables business line,

demand rose in 2012 thanks to investments by Utilities to

build new offshore wind farms and commence major new

interconnection projects.

Although this trend was particularly evident in parts of the

world, such as North Europe, the Arab Emirates and emerging

countries in Southeast Asia, where demand for energy has

grown over the past two years, new initiatives also emerged

in areas most affected by the financial crisis, like the

Mediterranean, thanks to infrastructure upgrade projects.

Demand in the Power Distribution business line generally

contracted throughout the period, interrupting the upward

trend in volumes initiated in the prior year.

Energy consumption in the major European countries

declined in the second half of the year, adversely affecting

demand by the major Utilities. The latter have maintained

an extremely cautious approach in view of the difficulties in

forecasting future growth, or else they have concentrated on

restructuring to improve efficiency and reduce costs of supply.

The competitive environment in terms of price and mix has

remained challenging almost everywhere.

In contrast, markets in North America showed slight signs of

a recovery during 2012, after a three-year period during which

operators had reduced work on grids to the bare minimum.

Likewise, the Brazilian market showed signs of vitality in

the first nine months of 2012 and remained largely stable

during the quarter just ended. Thanks to growth in domestic

energy consumption, demand was up on the prior year, even if

accompanied by stiff price competition.

The Network Components market can be broadly divided

into products for high and extra high voltage networks and

products for medium and low voltage use.

As regards the former business line, demand was affected,

especially in the two central quarters of the year, by the

contraction in the High Voltage sector, linked to the type of

investment projects by the major Utilities. Instead, demand was

stable or slightly higher for submarine accessories, as a direct

consequence of projects currently in progress around the world.

The Utilities’ growing focus on price and the challenging

competitive environment in the high voltage cables market

partially spilled over into the Network Components market.

The market for medium and low voltage accessories confirmed

the positive trend in volumes initiated in the prior year, despite

the decrease in demand in the Power Distribution business

line. The positive trend reflects the fact that these products

are normally used in ordinary maintenance of secondary

distribution grids, and are essential for ensuring normal power

supply.