Consolidated Financial Statements >

Directors’ Report

56

| 2012 annual report prysmian group

GROUP PERFORMANCE AND RESULTS

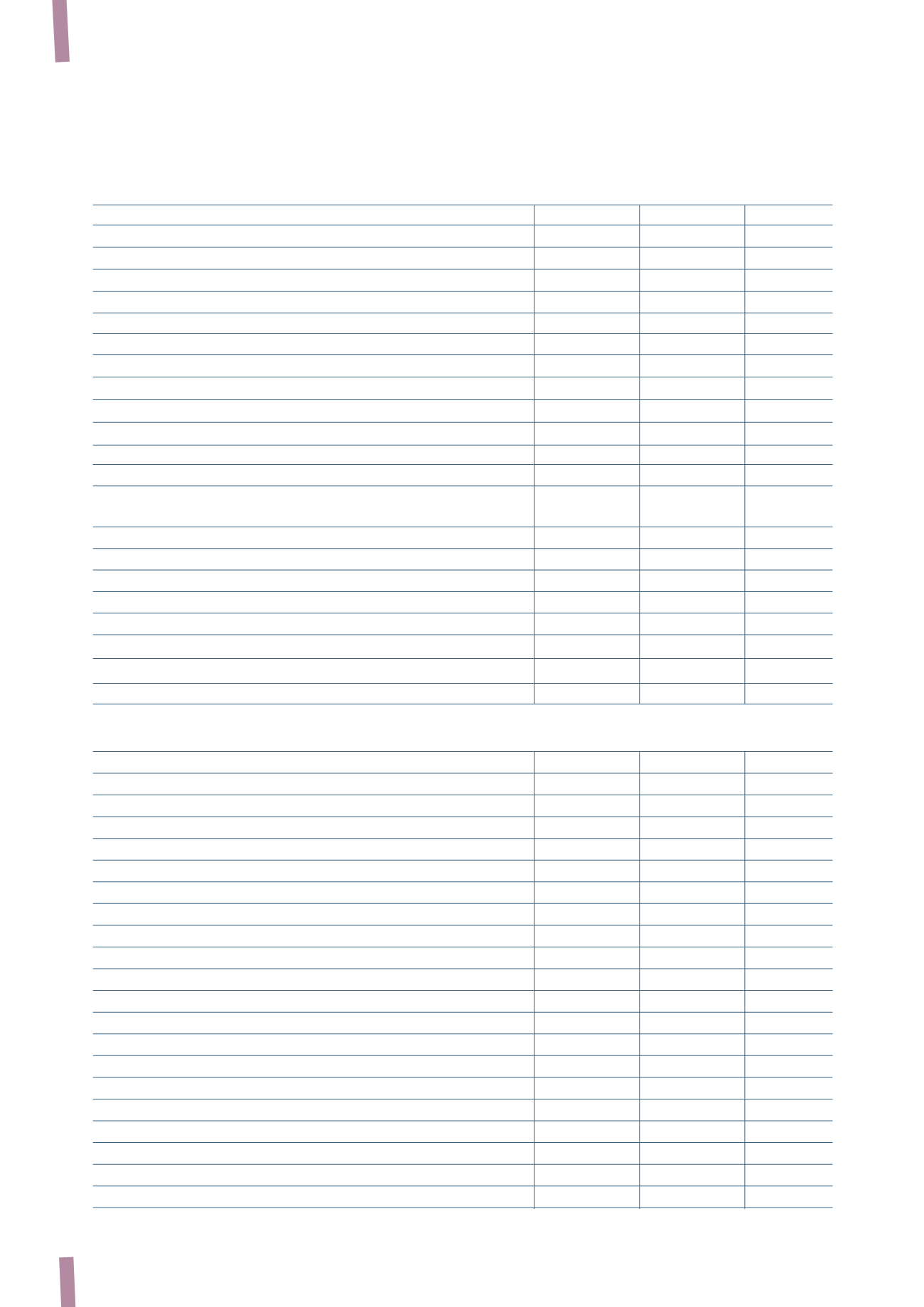

(in millions of Euro)

2012

2011 (*)

% Change

2010

Sales

7,848

7,583

3.5%

4,571

Adjusted EBITDA

647

568

13.9%

387

% of sales

8.2%

7.5%

8.5%

EBITDA

546

269

102.7%

365

% of sales

7.0%

3.4%

8.0%

Fair value change in metal derivatives

14

(62)

28

Remeasurement of minority put option liability

7

(1)

13

Fair value stock options

(17)

(7)

-

Amortisation, depreciation and impairment

(188)

(180)

4,3%

(99)

Operating income

362

19

n.a

307

% of sales

4.6%

0.3%

6.7%

Net finance income/(costs)

(135)

(129)

(96)

Share of income from investments in associates and dividends

from other companies

17

9

2

Profit/(loss) before taxes

244

(101)

n.a

213

% of sales

3.1%

-1.3%

4.7%

Taxes

(73)

(44)

68.0%

(63)

Net profit/(loss) for the year

171

(145)

n.a

150

% of sales

2.2%

-1.9%

3.3%

Attributable to:

Owners of the parent

168

(136)

148

Non-controlling interests

3

(9)

2

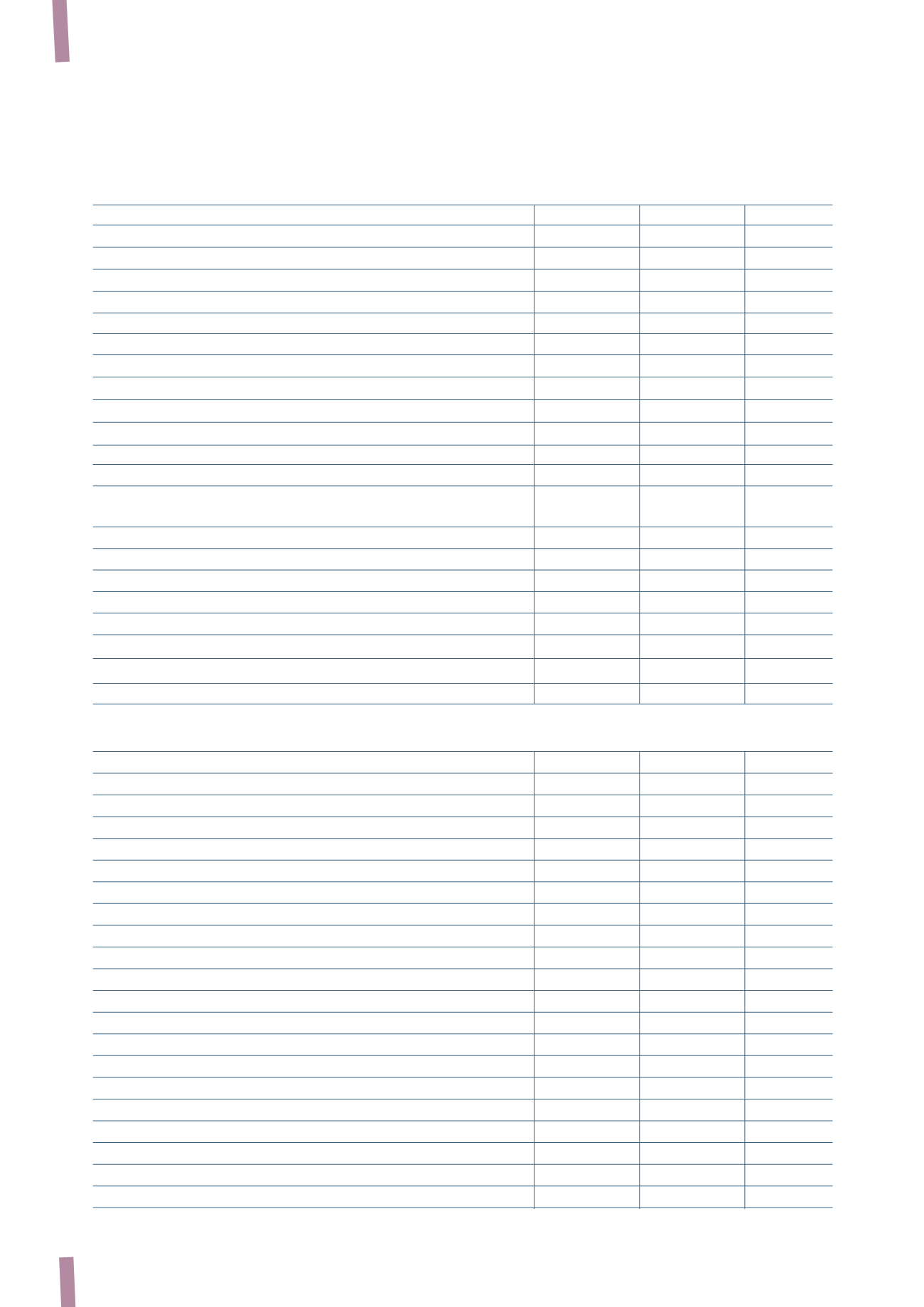

Reconciliation of Operating Income / EBITDA to Adjusted Operating Income / Adjusted EBITDA

Operating income (A)

362

19

n.a

307

EBITDA (B)

546

269

102.7%

365

Non-recurring expenses/(income):

Company reorganisation

74

56

11

Antitrust

1

205

5

Draka integration costs

9

12

-

Tax inspections

3

-

(2)

Environmental remediation and other costs

3

5

1

Italian pensions reform

1

-

-

Other non-recurring expenses

13

-

1

Draka acquisition costs

-

6

6

Effects of Draka change of control

-

2

-

Release of Draka inventory step-up

-

14

-

Gains on disposal of assets held for sale

(3)

(1)

-

Total non-recurring expenses/(income) (C)

101

299

22

Fair value change in metal derivatives (D)

(14)

62

(28)

Fair value stock options (E)

17

7

-

Remeasurement of minority put option liability (F)

(7)

1

(13)

Impairment of assets (G)

24

38

21

Adjusted operating income (A+C+D+E+F+G)

483

426

13.1%

309

Adjusted EBITDA (B+C)

647

568

13.9%

387

(*) Includes the Draka Group’s results for the period 1 March – 31 December 2011.