57

(**) The pro-forma figures are calculated by aggregating the Draka Group’s results for the two-month pre-acquisition period (January-February) with the consolidated

figures.

In accordance with the integration process, started in 2011, as

from 2012 the Group’s results are being analysed as a whole

(without distinguishing any more between the two Prysmian

and Draka groups). The figures for full year 2012 are compared

with those from the consolidated financial statements at

31 December 2011, and, in the case of the key performance

indicators, with those presented on a pro-forma basis in which

Draka’s results are reported as if they had been consolidated

from 1 January 2011.

The Prysmian Group’s sales in 2012 came to Euro 7,848 million,

compared with Euro 7,583 million at 31 December 2011.

The increase of Euro 265 million (+3.5%) is mostly attributable

to the consolidation of the Draka Group’s 2011 results from

1 March 2011 (sales in the first two months of that year were

equal to Euro 390 million).

However, sales for 2012 were down on the 2011 pro-forma

figure of Euro 7,973 million, reporting a decrease of Euro 125

million (-1.6%).

Assuming a consistent group perimeter and excluding changes

in metal prices and exchange rates, the organic change in sales

was negative (-1.8%), analysed between the two operating

segments as follows:

• Energy -1.4%;

• Telecom -3.5%.

The above organic change in sales excludes for the Telecom

segment, the consolidation of the remaining 50% of Telcon

Fios e Cabos para Telecomuniçaoes S.A. for the period 1 April

– 31 December 2012, and for the Energy segment, both the

consolidation of the results of Global Marine Systems Ltd in

the period November - December 2012 and the effect of not

consolidating the results of Ravin Cables Limited (India) and

Power Plus Cable CO LLC (Middle East) for the second, third

and fourth quarters of 2012. It has been impossible for the

Prysmian Group to be able to obtain reliable, updated financial

information about these last two companies since the second

quarter of 2012; as a result, the consolidation includes their

figures only up until 31 March 2012.

The Energy segment managed to almost entirely make up

for the contraction in volumes in the Trade & Installers and

Power Distribution businesses reported in Central and South

European markets, thanks to major international submarine

projects and the recovery in demand in North and South

America. The Telecom segment suffered a setback in demand

for its optical fibre cables business, particularly in the second

half of the year, due to a downturn reported in the American

continent that neutralised the positive trend in the first few

months of the year.

Group Adjusted EBITDA (before Euro 101 million in non-

recurring expenses) came to Euro 647 million, posting an

increase of Euro 79 million (+13.9%) on the corresponding

figure at 31 December 2011 of Euro 568 million, and an increase

of Euro 61 million (+10.4%) on the 2011 pro-forma figure. The

change against pro-forma reflects increased contributions by

both the Energy and Telecom segments, partly due to targeted

actions to rationalise and contain fixed costs.

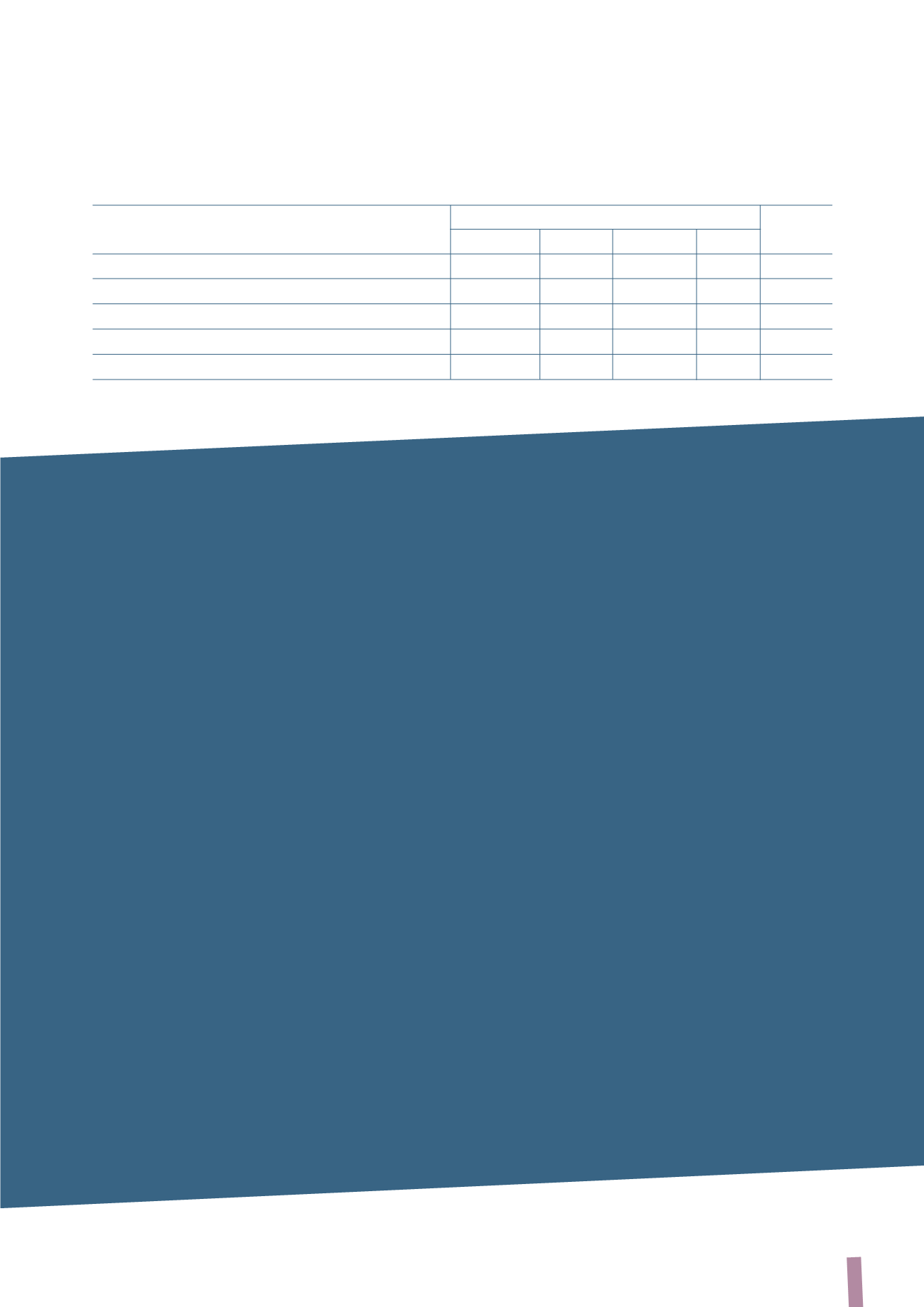

(in milions of Euro)

2012

2011(**)

Pro-forma

% Change

Prysmian

Draka Adjustments

Total

Sales

7,848

5,363

2,669

(59)

7,973

-1.6%

Adjusted EBITDA

647

419

167

-

586

10.4%

% of sales

8.2%

7.8%

6.3%

7.3%

Adjusted operating income

483

342

107

(14)

435

11.1%

% of sales

6.2%

6.4%

4.0%

5.5%