Consolidated Financial Statements >

Directors’ Report

68

| 2012 annual report prysmian group

TRADE & INSTALLERS

During 2012 the range of products and services was further extended and specialised.

MARKET OVERVIEW

Differing performance of reference markets, affected by credit restrictions in some

European countries.

The Prysmian Group produces a comprehensive range of rigid

and flexible low voltage cables for distributing power to and

within residential and non-residential buildings in compliance

with international standards.

Product development and innovation particularly focuses on

high performance cables, such as Fire-Resistant cables and

Low Smoke zero Halogen (LSOH) cables, which are used in all

those applications where safety must be guaranteed. In fact,

in the event of fire, Fire-Resistant cables continue to operate

and Low Smoke zero Halogen cables have reduced emissions

of toxic gas and smoke.

The reference markets have distinct geographical

characteristics (despite international product standards) both

in terms of customer and supplier fragmentation and the

range of items produced and sold.

Construction industry demand, already depressed in 2011,

declined even more in Central and Southern Europe during

2012, while remaining generally stable in Northern and Eastern

Europe.

Throughout the year, persistent uncertainty about future

prospects for the construction industry prevailed over the

positive effects of stable metal and commodity prices; as

a result, the largest industry players continued to maintain

minimum stocks and constant pressure on sales prices.

During the past year the range of products and services has

been further extended and specialised with the addition of

cables for infrastructure such as airports, ports and railway

stations.

Prysmian Group’s customers for these products cover a

wide spectrum, from international distributors and buying

syndicates to installers and wholesalers.

In Europe, countries like Spain and Italy particularly suffered

because of the negative impact on the property market of their

tough restrictions on bank credit.

Following rising demand for products for infrastructure

projects in the first six months of the year, markets in North

America remained stable in the second half of the year

mainly due to the US presidential election and expectations

concerning energy-efficient construction incentives.

Even in the last quarter of the year, markets in South America

confirmed slightly higher volumes, driven by the industrial and

residential construction sectors.

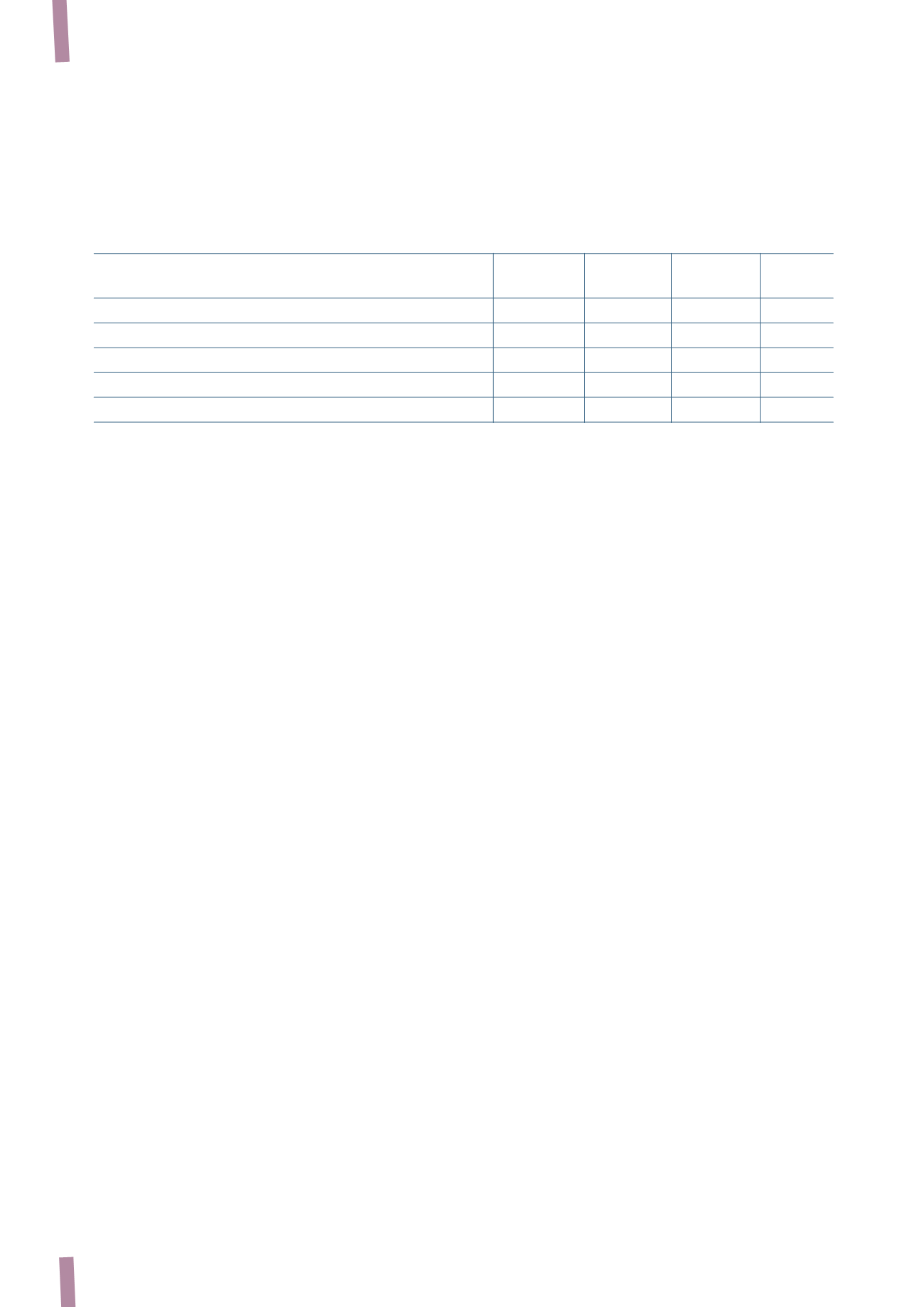

(*) The pro-forma figures are calculated by aggregating the Draka Group’s results for the two-month pre-acquisition period (January-February) with the consolidated

figures.

(in milions of Euro)

2012

2011 (*)

% Change

% Organic

2010

Pro-forma

sales change

Sales to third parties

2,159

2,233

-3.3%

-2.6%

1,465

Adjusted EBITDA

77

73

36

% of sales

3.6%

3.3%

2.4%

Adjusted operating income

49

35

20

% of sales

2.3%

1.6%

1.4%