78

| 2012 annual report prysmian group

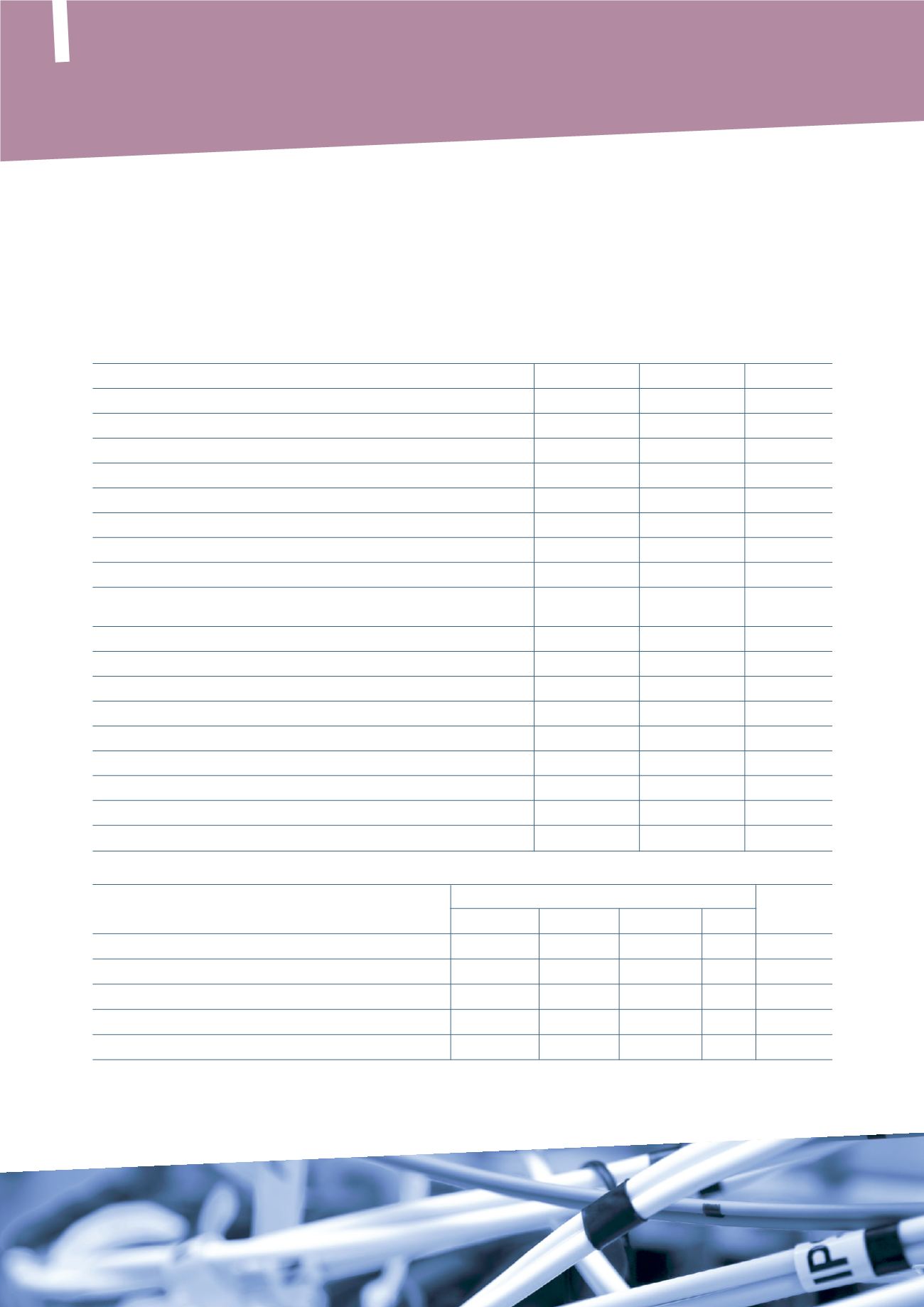

(in milions of Euro)

2012

2011 (*)

% Change

2010

Sales to third parties

1,466

1,315

11.5%

450

Adjusted EBITDA

160

121

32.1%

36

% of sales

10.9%

9.1%

7.9%

EBITDA

138

103

33.9%

36

% of sales

9.4%

7.7%

7.9%

Amortisation and depreciation

(56)

(43)

31.3%

(7)

Adjusted operating income

104

78

33.9%

29

% of sales

7.1%

5.8%

6.3%

Reconciliation of EBITDA to Adjusted EBITDA

EBITDA (A)

138

103

33.9%

36

Non-recurring expenses/(income):

Company reorganisation

16

12

-

Draka integration costs

1

-

-

Tax inspections

2

-

-

Other non-recurring risks

3

-

-

Release of Draka inventory step-up

-

6

-

Total non-recurring expenses/(income) (B)

22

18

-

Adjusted EBITDA (A+B)

160

121

32.1%

36

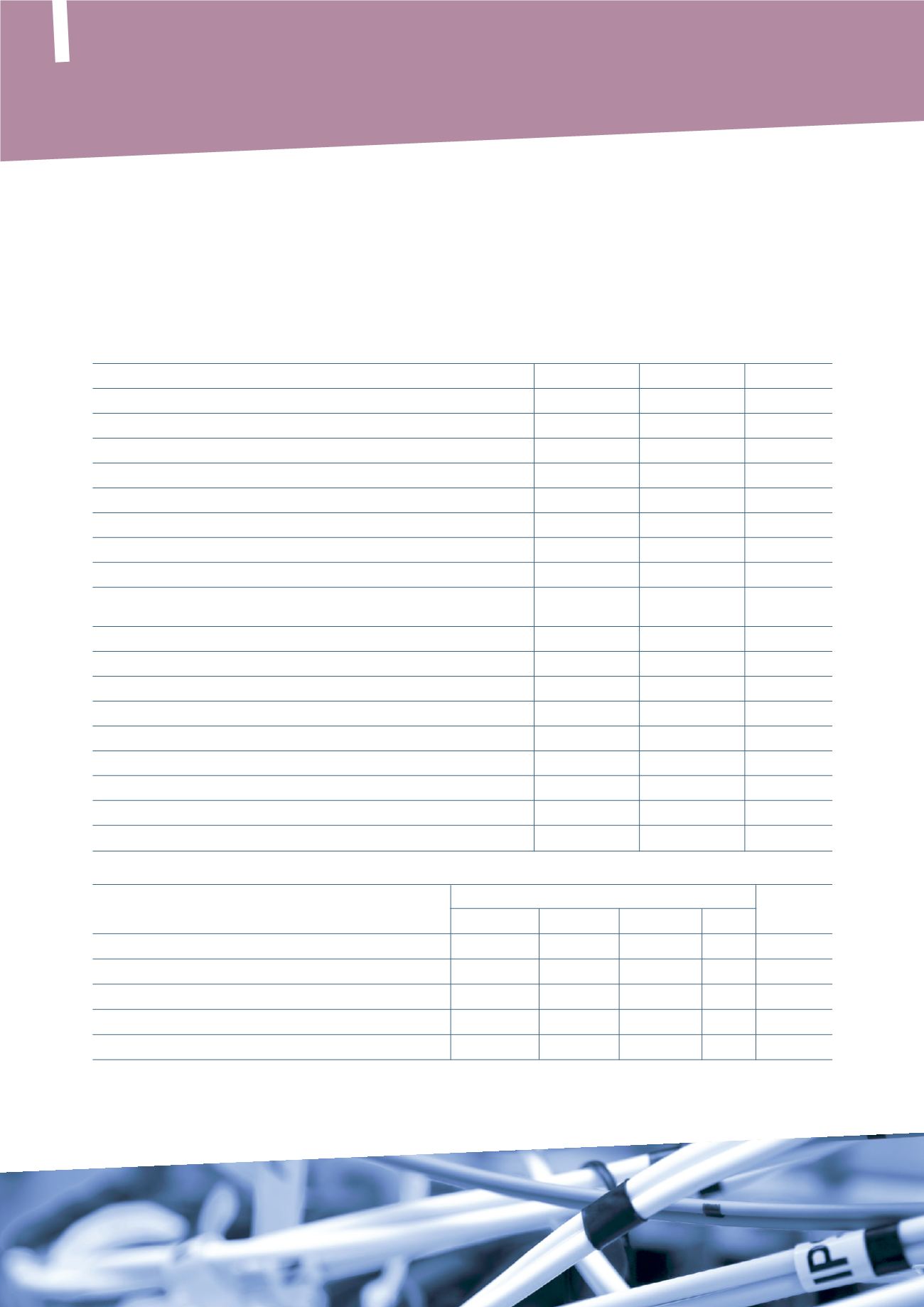

(in milions of Euro)

2012

2011(**) Pro-forma

% Change

Prysmian

Drak Adjustments

Total

Sales to third parties

1,466

534

911

(14)

1,431

2.4%

Adjusted EBITDA

160

46

82

-

128

24.9%

% of sales

10.9%

8.5%

8.8%

8.8%

Adjusted operating income

104

38

55

(12)

81

28.9%

% of sales

7.1%

7.0%

4.6%

5.6%

TELECOM BUSINESS

(*) Includes the Draka Group’s results for the period 1 March – 31 December 2011.

(**) The pro-forma figures are calculated by aggregating the Draka Group’s results for the two-month pre-acquisition period (January-February) with the

consolidated figures.

Consolidated Financial Statements >

Directors’ Report

In the key fibre sector, the Group is in the unique position of being able to use all existing

manufacturing processes within its own plants.