83

EQUITY

The net financial position of Euro 918 million at 31 December

2012 has decreased by Euro 146 million since 31 December 2011

(Euro 1,064 million), mainly reflecting the following factors:

• positive cash flows from operating activities (before changes

in net working capital) of Euro 545 million;

• positive impact of Euro 75 million from changes in working

capital;

• payment of Euro 74 million in taxes;

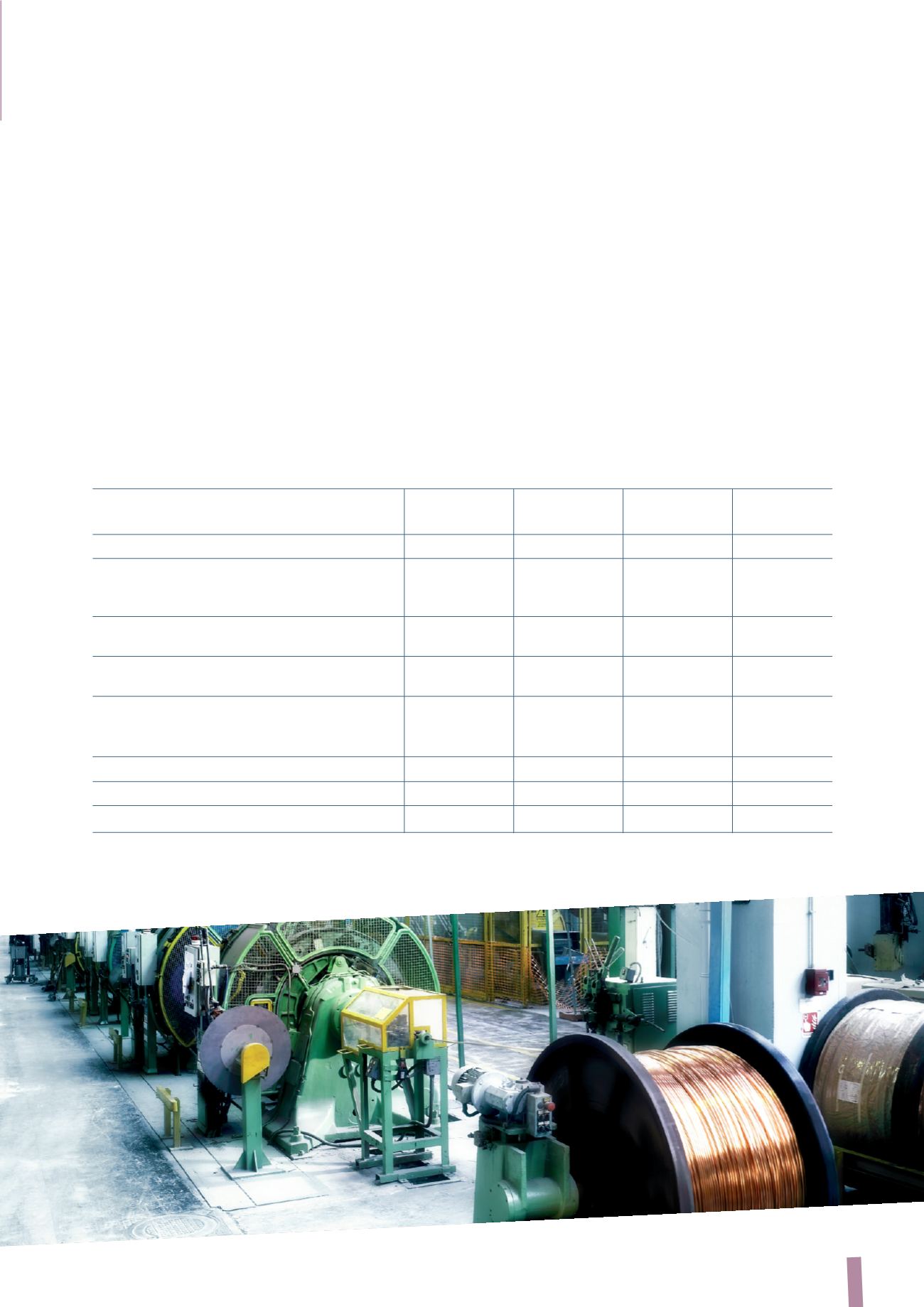

The following table reconciles the Group’s equity at 31 December 2012 and net profit/(loss) for 2012 with the corresponding

figures reported by Prysmian S.p.A., the Parent Company:

• net operating investments of Euro 141 million;

• receipt of Euro 6 million in dividends;

• purchase of the remaining Draka shares under the squeeze-

out procedure for Euro 9 million;

• cash outlays of Euro 77 million for acquisitions, of which

Euro 51 million for the acquisition of GME;

• payment of Euro 129 million in net finance costs;

• distribution of Euro 45 million in dividends.

(in millions of Euro)

Equity Net profit/(loss)

Equity Net profit/(loss)

31 December 2012

for 2012 31 December 2011

for 2011

Parent Company Financial Statements

872

112

786

99

Recognition of equity and net profit/(loss) of

consolidated companies, net of their carrying

amount

309

210

396

(54)

Elimination of dividends received from consolidated

companies

-

(150)

-

(173)

Deferred taxes on net profit/(loss) and distributable

reserves from consolidated companies

(18)

(4)

(14)

-

Elimination of intercompany profits and losses

included in inventories and other consolidation

adjustments

(35)

1

(36)

(1)

Non-controlling interests

31

2

(28)

(16)

Other consolidation adjustments

(47)

(3)

(62)

9

Consolidated Financial Statements

1,112

168

1,042

(136)