Consolidated Financial Statements >

Directors’ Report

86

| 2012 annual report prysmian group

Net cash flow provided by operating activities (before changes

in net working capital) amounted to Euro 545 million at the

end of 2012.

Cash flow also benefited from the reduction of Euro 75 million

in net working capital described earlier. Therefore, after

deducting Euro 74 million in tax payments, net cash flow

from operating activities in the period was a positive Euro 546

million.

Net cash flow used for acquisitions came to Euro 86 million,

of which Euro 9 million for the purchase of the remaining

Draka shares under the squeeze-out procedure, Euro 25 million

for the purchase of shares in both Telcon Fios e Cabos para

Telecomuniçaoes S.A. and Draktel Optical Fibre S.A., Euro 51

million for the purchase of shares in Global Marine Systems

Energy Ltd, and Euro 1 million for the Neva Cables Ltd share

purchase.

Net operating investments in 2012 amounted to Euro 141

million and mainly refer to expansion of production capacity

for high voltage cables in Russia, China and France, for

submarine cables in Italy and Finland, to the investment in the

Telecom segment in Australia in connection with the long-

term project to produce cables using “ribbon” technology and

lastly to the increase in optical fibre production capacity in

Brazil.

Around 58% of total investment expenditure related to

projects to increase production capacity, while some 16% of

the total went on projects to improve industrial efficiency.

About 14% of the total related to structural work on buildings

or entire production lines for compliance with the latest

regulations, while the remaining 12% referred to investments

in information technology.

Dividends paid out in 2012 amounted to Euro 45 million.

(1)

This does not include cash flow relating to “Financial assets held for trading” and non-instrumental “Available-for-sale financial assets”, classified in the net financial

position.

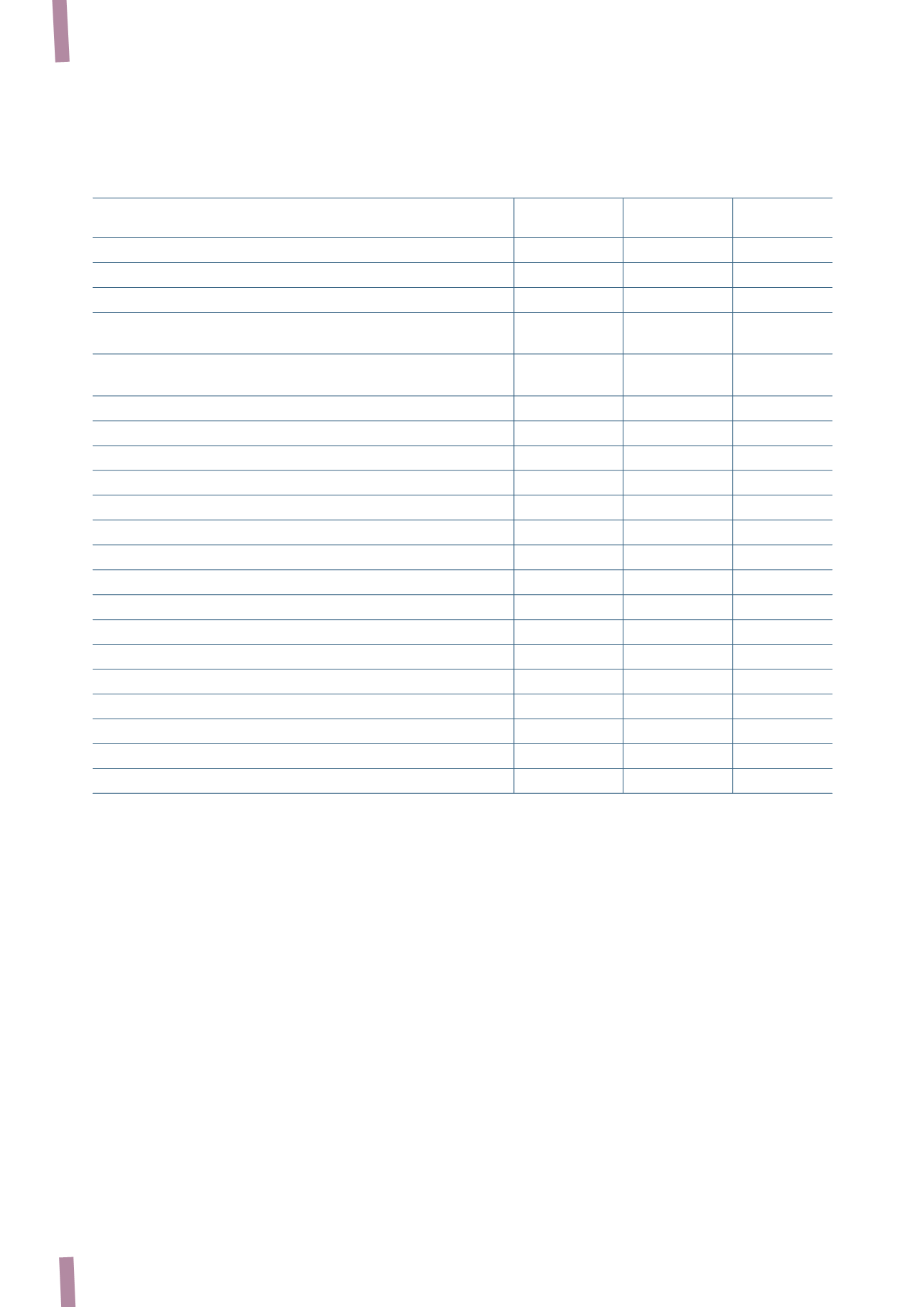

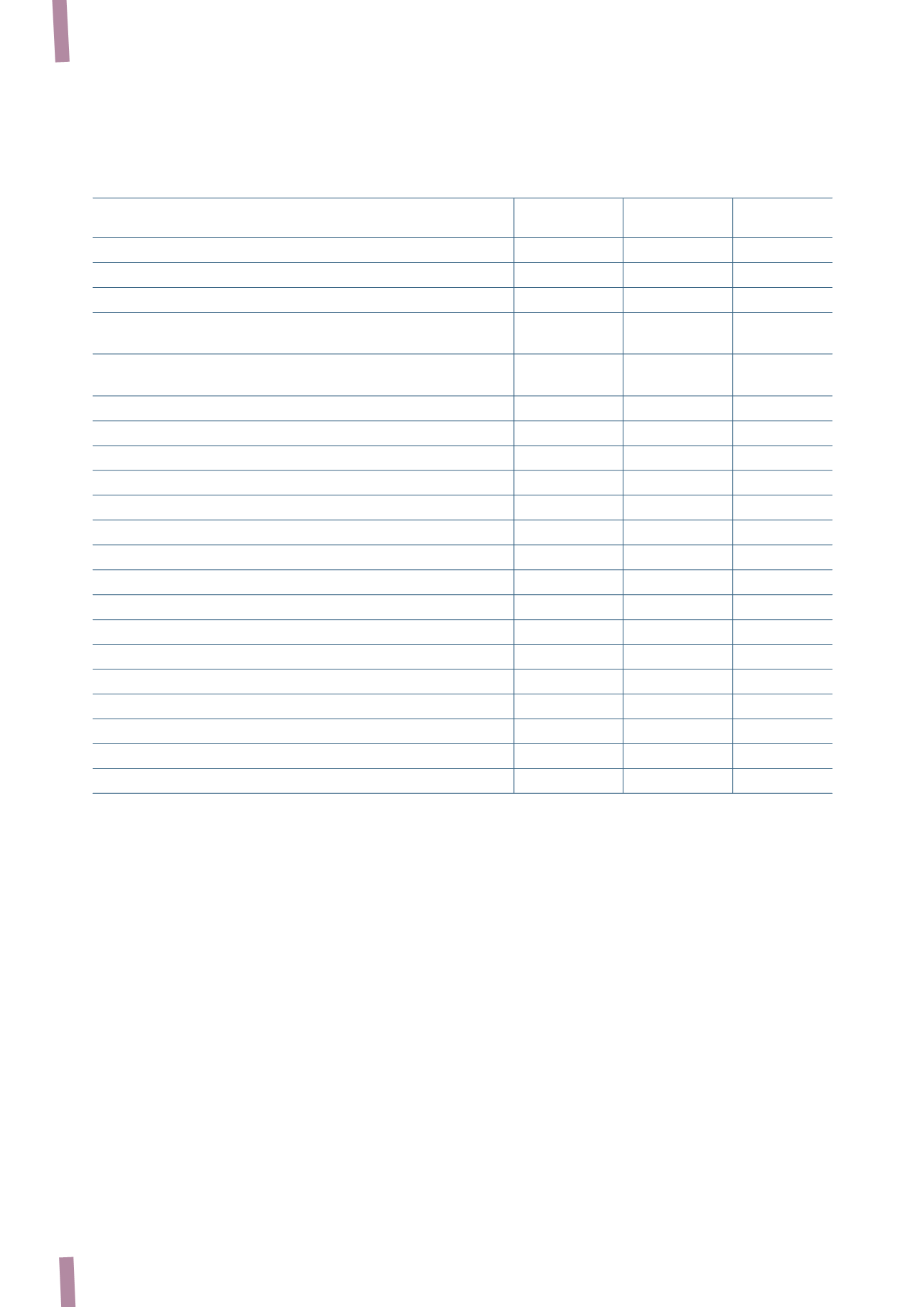

(in millions of Euro)

31 December 2012

31 December 2011

Change 31 December 2010

EBITDA

546

269

277

365

Changes in provisions (including employee benefit obligations)

13

200

(187)

(17)

Inventory step-up

-

14

(14)

-

(Gains)/losses on disposal of property, plant and equipment,

intangible assets and non-current assets

(14)

(2)

(12)

-

Net cash flow provided by operating activities (before

changes in net working capital)

545

481

64

348

Changes in net working capital

75

183

(108)

(6)

Taxes paid

(74)

(97)

23

(59)

Net cash flow provided/(used) by operating activities

546

567

(21)

283

Acquisitions

(86)

(419)

333

(21)

Net cash flow used in operational investing activities

(141)

(145)

4

(95)

Net cash flow provided by financial investing activities

(1)

8

4

4

5

Free cash flow (unlevered)

327

7

320

172

Net finance costs

(129)

(130)

1

(52)

Free cash flow (levered)

198

(123)

321

120

Increases in share capital and other changes in equity

1

1

-

13

Dividend distribution

(45)

(37)

(8)

(75)

Net cash flow provided/(used) in the year

154

(159)

313

58

Opening net financial position

(1,064)

(459)

(605)

(474)

Net cash flow provided/(used) in the year

154

(159)

313

58

Other changes

(8)

(446)

438

(43)

Closing net financial position

(918)

(1,064)

146

(459)

STATEMENT OF CASH FLOWS