QUARTERLY OVERVIEW

4

Prysmian Group Insight

Ongoing recovery in volumes, transmission

order book reaches record €3 bn

The results of the first half of 2014

of Prysmian approved by the Board

of Directors included the financial

impact of the problems encountered

in the execution of the Western Link

project and the effects of exchange

rate trends. Excluding these two

major factors, the recovery in

volumes continued along with a

slight improvement in profitability

since the start of the year, albeit less

visible than in the first quarter. With

regard to the Western Link project,

CEO Valerio Battista reported that

the extensive and rigorous testing

performed to ensure the perfect

execution of such an important

project has been successfully

completed on the submarine

cables and now allows to have a

realistic view of the overall impact

on the project profitability. The

power transmission business has

continued to grow and, thanks to

intensive tendering and continuous

customer confidence, the Group’s

order book has reached a record

€

3 billion. Group Sales amounted

to

€

3,287 million compared with

€

3,504 million in the first half of

2013, posting organic growth of

+1.3%, assuming the same group

perimeter and excluding metal price

and exchange rate effects. Without

the negative impact of the Western

Link project, organic growth would

have been +3.4%, confirming the

slight uptrend in volumes already

seen in the first quarter after several

quarters of organic decline. Adjusted

EBITDA amounted to

€

204 million

(

€

282 million in the first half of

2013). Excluding the adverse impact

of the Western Link contract of

€

74

million in the first half of 2014,

as well as

€

14 million in negative

exchange rate effects, Adjusted

EBITDA would have been

€

292

million (+3.5% on the first half of

2013). With the aim of preserving

its levels of profitability, the Group

has continued to pursue the policy

of containing costs and rationalising

its manufacturing footprint.

Adjusted EBIT amounted to

€

133

million, or

€

207 million excluding

WL effect (

€

208 million in the first

half of 2013). Net financial charges

reported a negative balance of

€

74

million, down from

€

82 million in

the first half of 2013, thanks to the

improvement in financial structure

and in the cost of Group debt.

Adjusted net profit amounted to

€

59 million. Excluding the negative

impact of the Western Link project,

adjusted net profit would have been

€

111 million, slightly down from

€

115 million in the first half of 2013.

have

been impacted by a

€

74

million negative impact on

the Adj. EBITDA related to

Western Link project execution

problems. Sales posted a 1.3%

organic growth on H1 2013,

and 3.4% excluding Western

Link. Adjusted net profit came

in at

€

59 million or

€

111

million excluding Western Link

impact. Profitability improved

slightly excluding Western Link

and exchange rates.

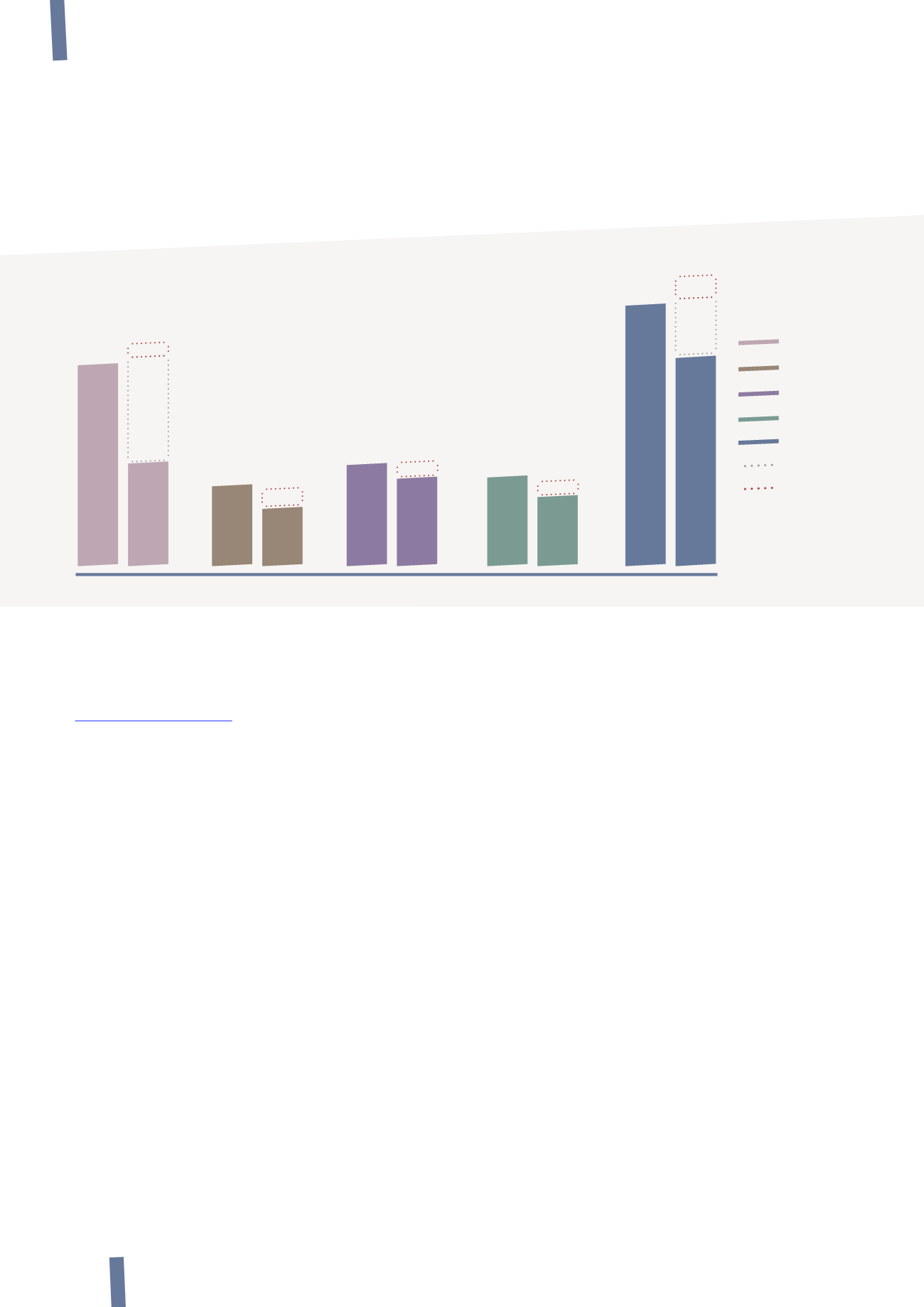

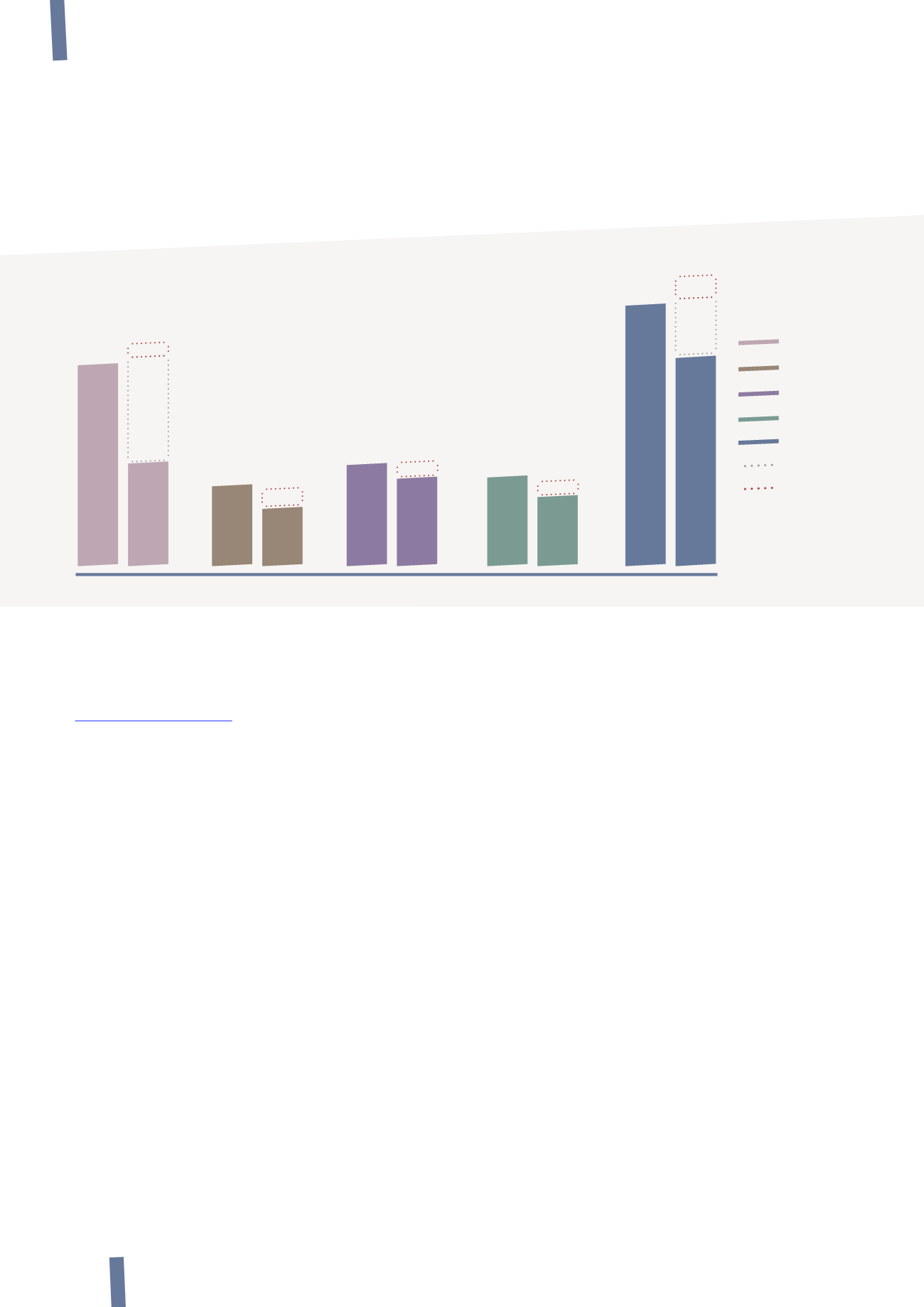

H1 2014: Sales €3,287 million, Adj. EBITDA €204 million

(€278 million excluding WL)

H1 profitability slightly above previous year excl. Forex and WL

Adj. EBITDA evolution (Euro million)

Utilities

Telecom

H1’13

H1’13

H1’13

H1’13

H1’13

H1’14

H1’14

H1’14

H1’14

H1’14

T&I

Total

Western Link

FX

Industrial

124

41

63 63

58

34

43

50

282

140

38

46

292

204

64

74

74

2

3

4

5

Total includes Other Energy

Business (€4 million in H1 2013,

€5 million in H1 2014)

14