5

Prysmian Group Insight

QUARTERLY OVERVIEW

€600 million of new submarine projects awarded in H1

Building wires still negative but signs of stabilisation in second quarter

Energy

Sales to third parties amounted

to €2,995 million, compared

with €3,170 million in the

first half of 2012, reporting

an organic decrease of 2.7%.

In the second quarter sales

were broadly in line with the

previous year, despite the

continuing weakness of demand

for building wires and industrial

cables for renewables. Adjusted

EBITDA amounted to €225

million, basically in line with the

€229 million posted in the first

half of 2012.

Utilities

sales to third parties

amounted to

€

1,071 million,

recording a 0.7% organic increase.

The excellent results reported by the

Submarine cables business allowed

adjusted EBITDA to increase to

€

121 million from

€

117 million in

the first half of 2012, while sales

for the High Voltage underground

cables business line were broadly in

line with the corresponding period

of 2012. The order book provides

sales visibility for the whole of 2013,

with signs of recovery particularly

seen in Europe, the Middle East

and a number of Asian countries.

The Group's Submarine cables and

systems business line reported

excellent sales, while the order

book has reached a record figure of

more than

€

2.3 billion, with

€

600

million in new projects awarded in

the period and intense tendering

activities. Profitability improved

sharply with prospects for further

growth in the second half. Sales

by the Power Distribution business

line continued to be affected by

deterioration in demand in the

wider European market, despite

signs of recovery in North America.

Trade & Installers

sales to third

parties amounted to

€

974 million

with an organic decrease of 8.5%

on the first half of 2012, basically

attributable to the construction

industry crisis, while positive

performance was confirmed in South

America. Adjusted EBITDA came in

at

€

37 million, compared with

€

42

million in the corresponding period

of 2012.

Industrial

sales to third

parties amounted to

€

896 million,

delivering organic growth of 0.6%

(+6.2% in the second quarter).

Elevator cables continued to report

an excellent trend. Adjusted EBITDA

amounted to

€

63 million.

Telecom

Decline in optical cable sales in

North and South America, stable

optical volumes in Europe,

growing demand in China for

FTTH. Profitability expected to

improve in second half. Sales to

third parties amounted to €627

million.

The timing of any renewal or

effective activation of incentives

in the Americas is still uncertain,

notably in the US, while in Europe

optical sales volumes were stable.

In Asia Pacific there was growing

demand in China for Fibre to the

Home cabling solutions, while

sales performed well in Australia

thanks to the National Broadband

Network Project. The Multimedia

Solutions business line continued

its commercial expansion in South

America and Australia. OPGW

performed well in Southern Europe,

Middle East and Africa, with growing

exposure also in North America

and Russia. Adjusted EBITDA

declined from

€

79 million in the

first half 2012 to

€

57 million; this

profitability shrinkage was fully

attributable to incentives suspended

in US and Brazil.

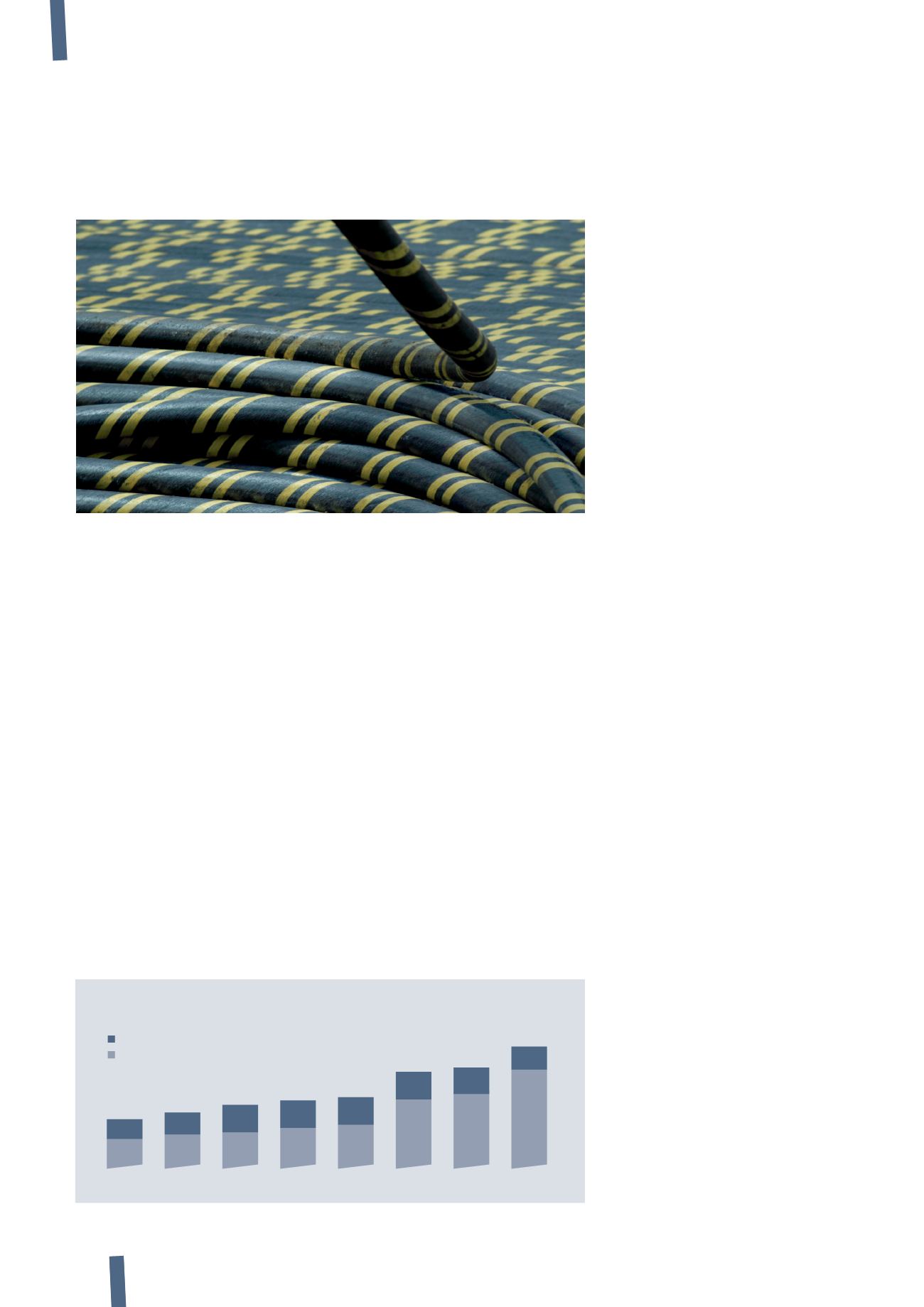

Utilities Orders Backlog evolution

E

million

Jun '13

Dec '12

~550

~500

Jun '12

~650

Dec '11

~650

Jun '11

~650

Dec '10

~650

Jun '10

~300

Dec '09

~250

~1,000

~900

~800

~650

~2,300

~1,900

~1,700

~1,050

HV

Submarine