221

The Revolving Credit Facility 2010 and the Revolving Credit

Facility 2011 are both intended to finance ordinary working

capital requirements, while only the Revolving Credit Facility

2010 can also be used for the issue of guarantees.

On 26 July 2012, the securitization programme, due to end

on 31 July 2012, was extended for another 12 months and the

amount of the related credit facility was reduced to Euro

150 million, consistent with the amount of trade receivables

eligible for securitization under the agreed contractual terms

(amounting to approximately Euro 117 million at 31 December

2012 and approximately Euro 134 million at 31 December 2011).

Bond

Further to the resolution adopted by the Board of Directors on

3 March 2010, Prysmian S.p.A. completed the placement of

an unrated bond with institutional investors on the Eurobond

market on 30 March 2010 for a total nominal amount of Euro

400 million. The bond, with an issue price of Euro 99.674, has

a 5-year term and pays a fixed annual coupon of 5.25%. The

bond settlement date was 9 April 2010. The bond has been

admitted to the Luxembourg Stock Exchange’s official list

and is traded on the related regulated market.

The fair value of the bond at 31 December 2012 was Euro 420

million (Euro 395 million at 31 December 2011).

Other borrowings from banks and financial institutions and

Finance lease obligations

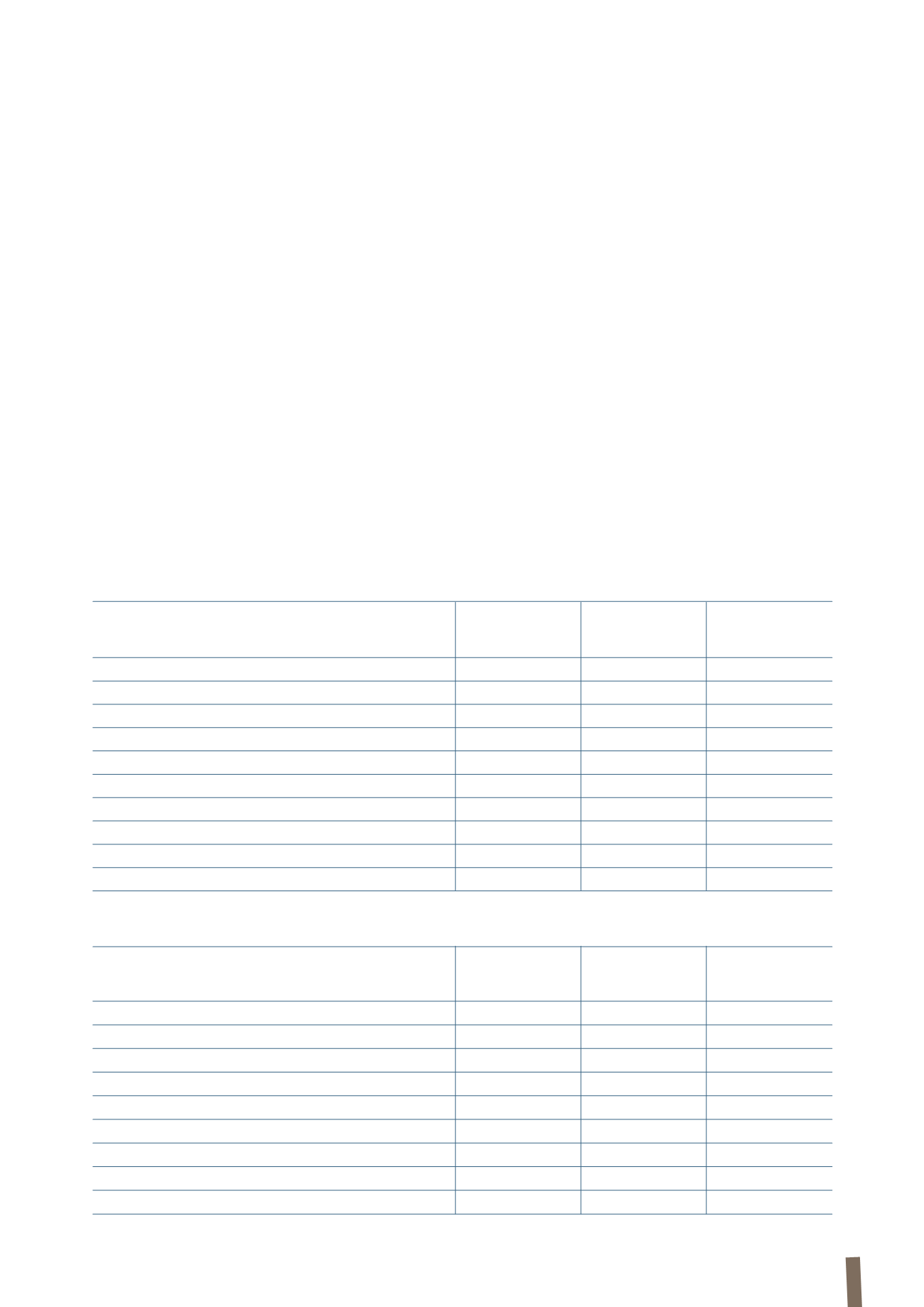

These have reported the following changes during 2012:

- the drawdown of Euro 134 million, primarily relating to

the securitization facility (Euro 45 million) and other debt

raised by subsidiaries in Brazil, Russia and China;

- the repayment of Euro 181 million, primarily against the

securitization facility (Euro 81 million) and other debt raised

mainly by subsidiaries in Brazil, Russia and China.

(1)

“Drawdowns” are stated net of Euro 10 million in bank fees relating to the Term Loan Facility 2010.

(in millions of Euro)

Credit

Bond Other borrowings/

Total

Agreements

Finance lease

obligations

Balance at 31 December 2011

1,070

412

380

1,862

Business combinations

-

-

15

15

Effects of deconsolidation

-

-

(16)

(16)

Currency translation differences

(4)

-

(11)

(15)

Drawdowns

(1)

660

-

134

794

Repayments

(670)

-

(181)

(851)

Amortisation of bank and financial fees and other expenses

4

1

-

5

Interest and other movements

-

-

-

-

Total movements

(10)

1

(59)

(68)

Balance at 31 December 2012

1,060

413

321

1,794

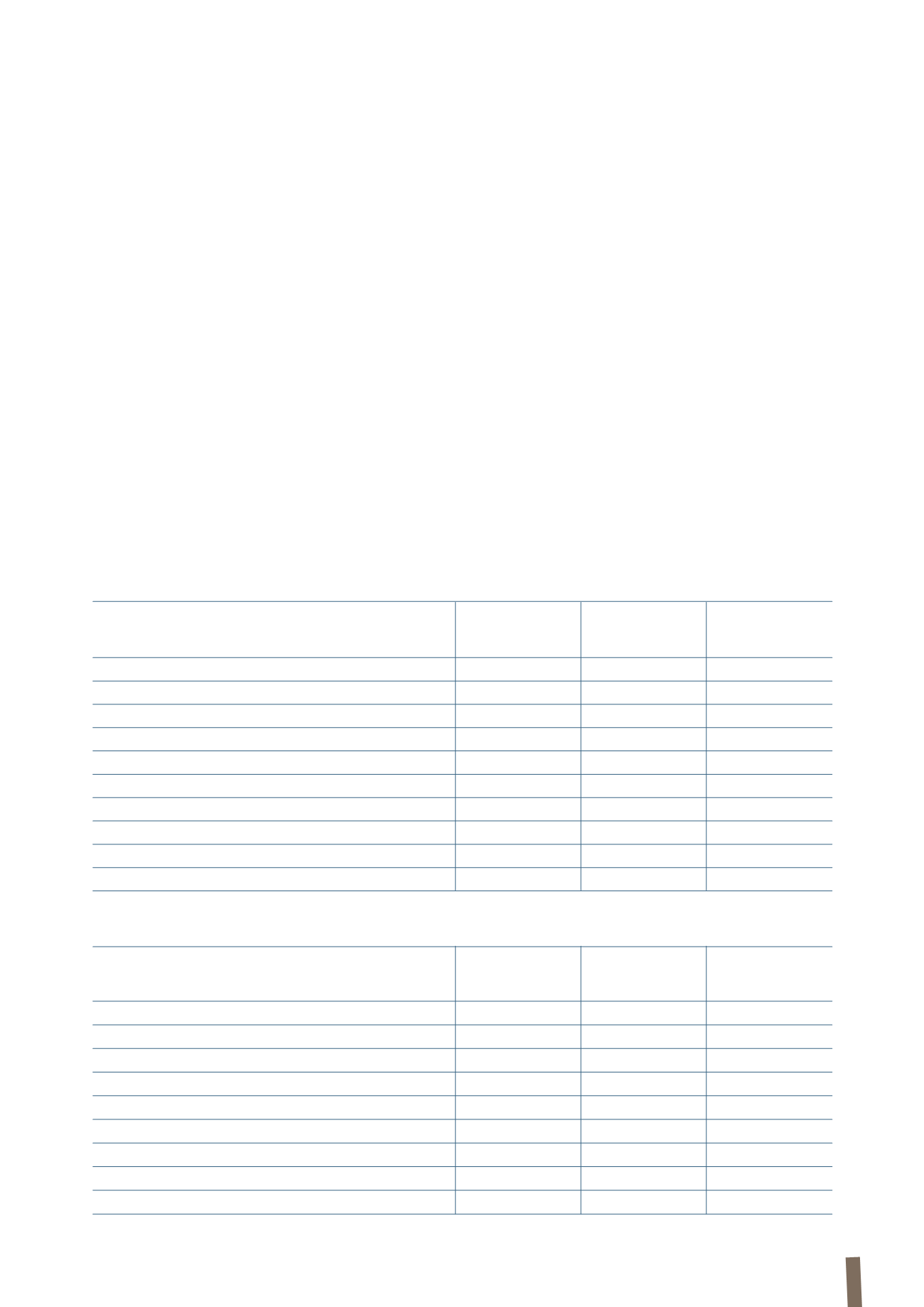

(in millions of Euro)

Credit

Bond Other borrowings/

Total

Agreements

Finance lease

obligations

Balance at 31 December 2010

770

411

131

1,312

Business combinations

-

-

443

443

Currency translation differences

2

-

3

5

Drawdowns

394

-

210

604

Repayments

(100)

-

(419)

(519)

Amortisation of bank and financial fees and other expenses

2

1

-

3

Interest and other movements

2

-

12

14

Total movements

300

1

249

550

Balance at 31 December 2011

1,070

412

380

1,862

The following tables report movements in borrowings from banks and other lenders: