229

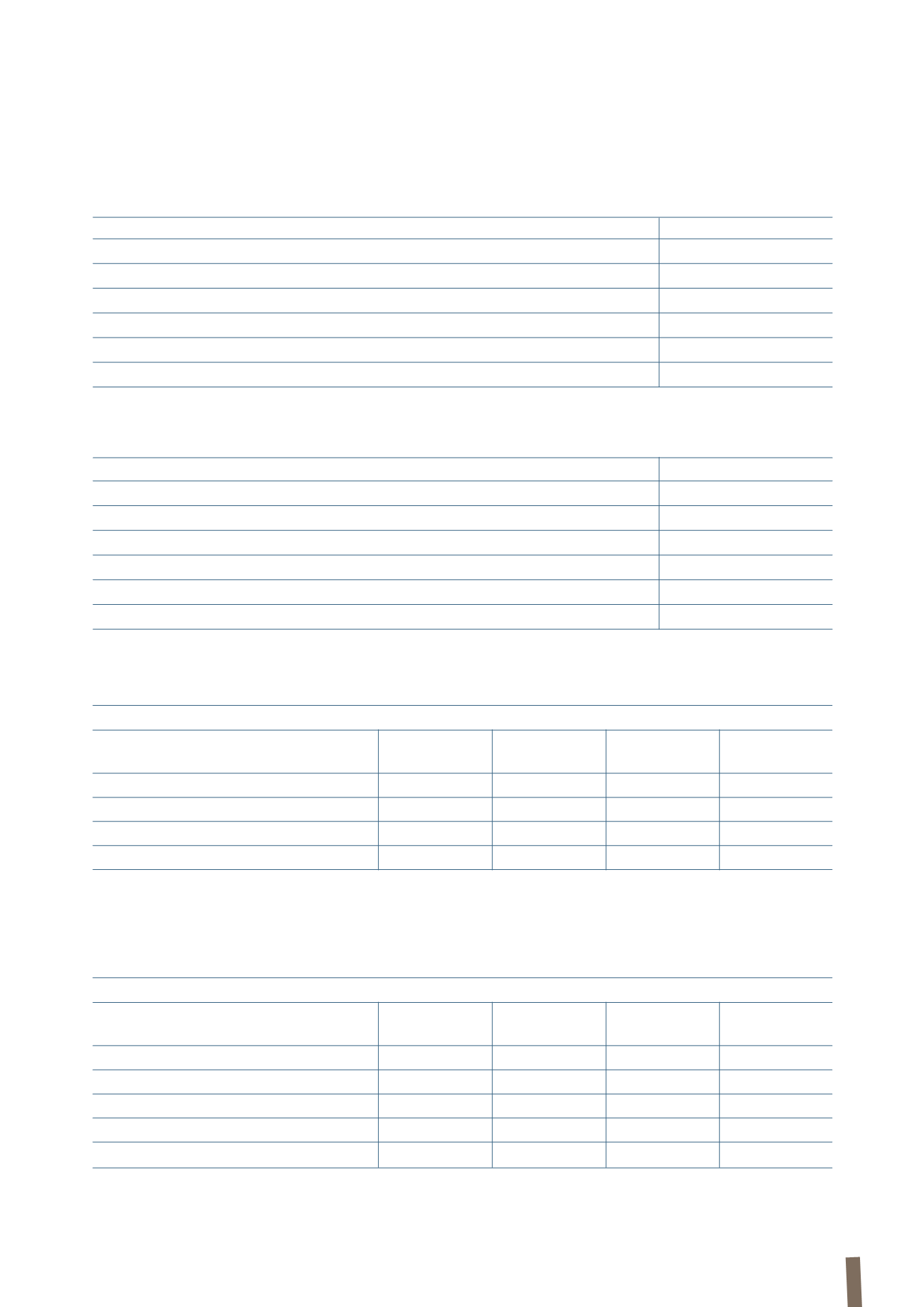

15. EMPLOYEE BENEFIT OBLIGATIONS

These are detailed as follows:

The impact of employee benefit obligations on the income statement is as follows:

(in millions of Euro)

31 December 2012

31 December 2011

Pension funds

241

188

Employee indemnity liability (Italian TFR)

25

22

Medical benefit plans

28

26

Termination and other benefits

29

26

Incentive plans

21

6

Total

344

268

(in millions of Euro)

31 December 2012

31 December 2011

Pension funds

13

12

Employee indemnity liability (Italian TFR)

1

1

Medical benefit plans

2

2

Termination and other benefits

7

5

Incentive plans

15

6

Total

38

26

(*) Expected returns on plan assets are classified in Finance costs.

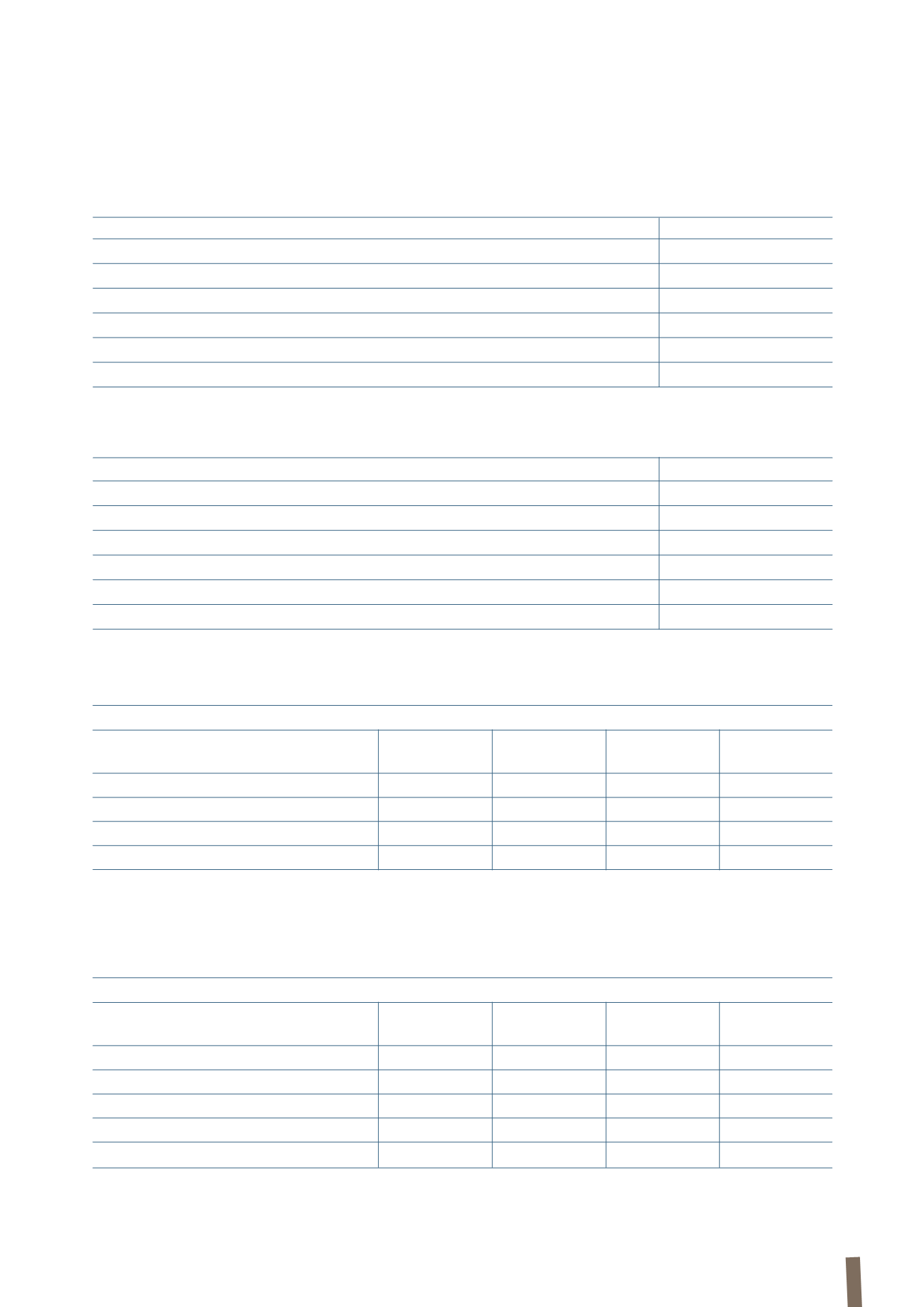

The income and expenses relating to employee benefit obligations are as follows:

(*) Expected returns on plan assets are classified in Finance costs.

(in millions of Euro)

2012

Pension funds

Employee

Medical benefit

Termination

Incentive

indemnity liability

plans and other benefits

plans

Current service costs

6

-

1

6

15

Interest costs

19

1

1

1

-

Expected returns on plan assets (*)

(12)

-

-

-

-

Total

13

1

2

7

15

(in millions of Euro)

2011

Pension funds

Employee

Medical benefit

Termination

Incentive

indemnity liability

plans and other benefits

plans

Current service costs

4

-

1

4

6

Interest costs

17

1

1

1

-

Expected returns on plan assets (*)

(11)

-

-

-

-

Losses/(gains) on curtailments and settlements

2

-

-

-

-

Total

12

1

2

5

6