Consolidated Financial Statements >

CONSOLIDATED FINANCIAL STATEMENTS AND EXPLANATORY NOTES

220

| 2012 annual report prysmian group

The “Credit Agreements” line also includes the Credit

Agreement 2011, entered into by Prysmian on 7 March 2011

with a pool of major banks for Euro 800 million with a five-year

maturity. This agreement comprises a loan for Euro 400 million

(Term Loan Facility 2011) and a revolving facility for Euro 400

million (Revolving Credit Facility 2011). The entire amount of

the Term Loan Facility 2011 is scheduled for repayment on 7

March 2016.

At 31 December 2012, the fair values of the Credit Agreements

2010 and 2011 approximate the related carrying amounts.

This financing agreement is split as follows:

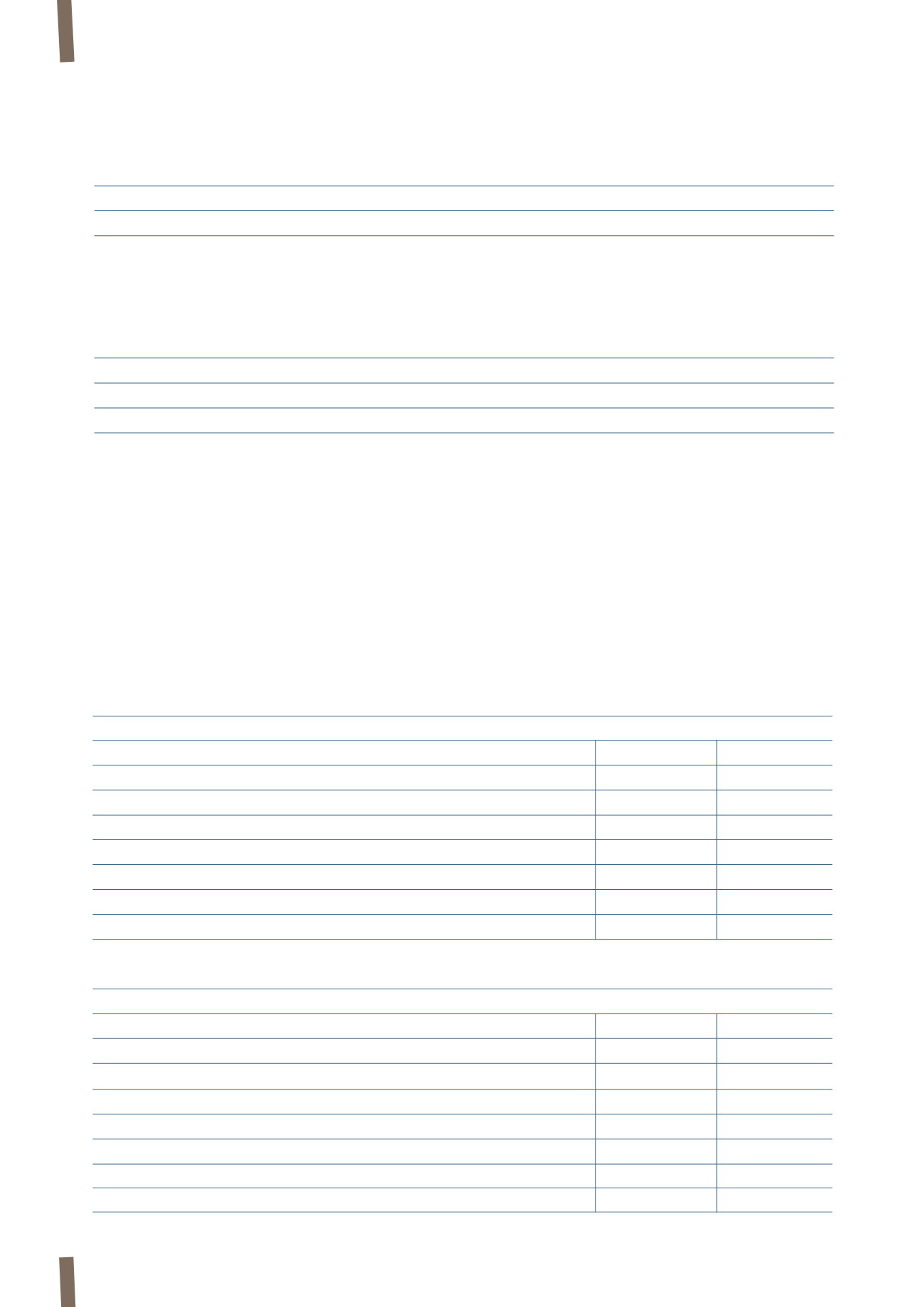

The repayment schedule of the Term Loan Credit Agreement 2010 is structured as follows:

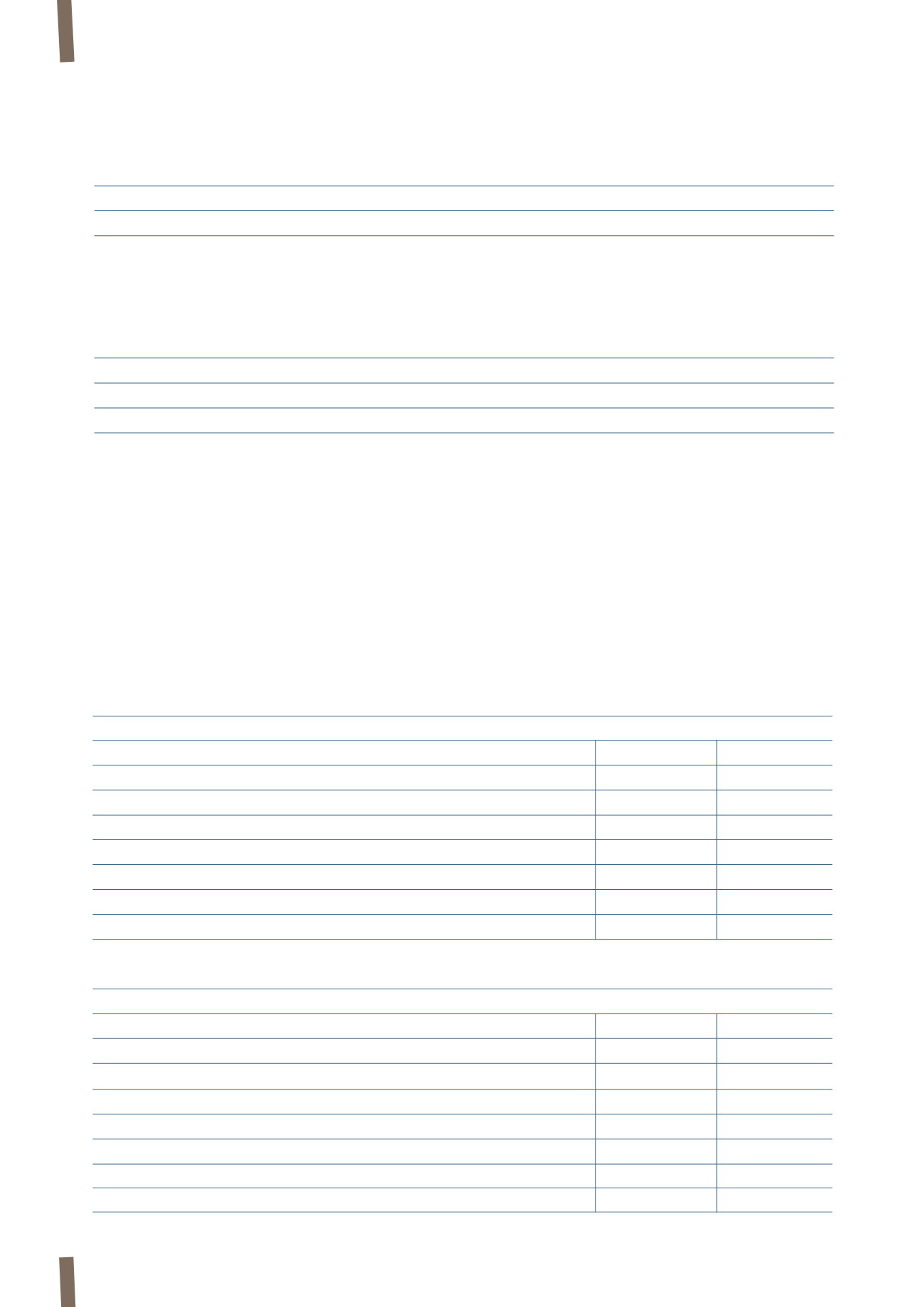

The following tables summarise the committed lines available to the Group at 31 December 2012 and 31 December 2011:

(in thousands of Euro)

Term Loan Facility 2010

670,000

Revolving Credit Facility 2010

400,000

31 May 2013

9.25%

30 November 2013

9.25%

31 May 2014

9.25%

31 December 2014

72.25%

(in millions of Euro)

31 December 2012

Total lines

Used

Unused

Term Loan Facility 2010

670

(670)

-

Term Loan Facility 2011

400

(400)

-

Revolving Credit Facility 2010

400

(4)

396

Revolving Credit Facility 2011

400

-

400

Total Credit Agreements

1,870

(1,074)

796

Securitization

150

(75)

75

Total

2,020

(1,149)

871

(in millions of Euro)

31 dicembre 2011

Total lines

Used

Unused

Term Loan Facility

670

(670)

-

Term Loan Facility 2011

400

(400)

-

Revolving Credit Facility

400

(6)

394

Revolving Credit Facility 2011

400

-

400

Total Credit Agreements

1,870

(1,076)

794

Securitization

350

(111)

239

Total

2,220

(1,187)

1,033