217

11. SHARE CAPITAL AND RESERVES

Consolidated equity has increased by Euro 55 million since 31

December 2011, mainly reflecting the net effect of:

• the net profit for the year of Euro 171 million;

• the dividend distribution of Euro 45 million;

• negative currency translation differences of Euro 24

million;

• the change of Euro 17 million in the share-based

compensation reserve linked to the Stock Option Plan;

• the increase of Euro 1 million in share capital and other

reserves due to exercise of the Stock Option Plan 2007-

2012;

• the negative post-tax change of Euro 46 million in actuarial

gains on employee benefits;

• the negative post-tax change of Euro 6 million in the fair

value of derivatives designated as cash flow hedges;

• the negative amount of Euro 22 million for changes in the

scope of consolidation of which: Euro 9 million following

completion of the squeeze-out, under art. 2.359c of the

Dutch Civil Code, to purchase the 478,878 ordinary shares

in Draka Holding N.V. that did not accept the public mixed

exchange and cash offer for all the ordinary shares in

Draka Holding N.V.; Euro 2 million for the purchase of the

remaining 30% of Draktel Optical Fibre S.A.; Euro 1 million

for the purchase of the remaining 25% of Neva Cables Ltd;

Euro 10 million for the deconsolidation of the investments

in Ravin Cables Ltd. and Power Plus Cables LLC.;

• the release of put options reported at 31 December 2011,

relating to the purchase of non-controlling interests in

Draktel Optical Fibre S.A. (Euro 3 million) and to non-

controlling interests in Ravin Cable Ltd. (Euro 6 million).

At 31 December 2012, the share capital of Prysmian S.p.A.

comprises 214,508,781 shares with a total value of Euro

21,450,878.10.

Treasury shares

The treasury shares held at the beginning of the year were

acquired under the shareholders’ resolution dated 15 April

2008, which gave the Board of Directors the authority for

an 18-month maximum period to buy up to 18,000,000

ordinary shares. This period was subsequently extended to

(1)

Capital increases relating to the Draka Group acquisition (31,824,570 shares) and to the exercise of part of the options under the Stock Option Plan 2007-2012

(539,609 shares).

(2)

Capital increases relating to the exercise of part of the options under the Stock Option Plan 2007-2012.

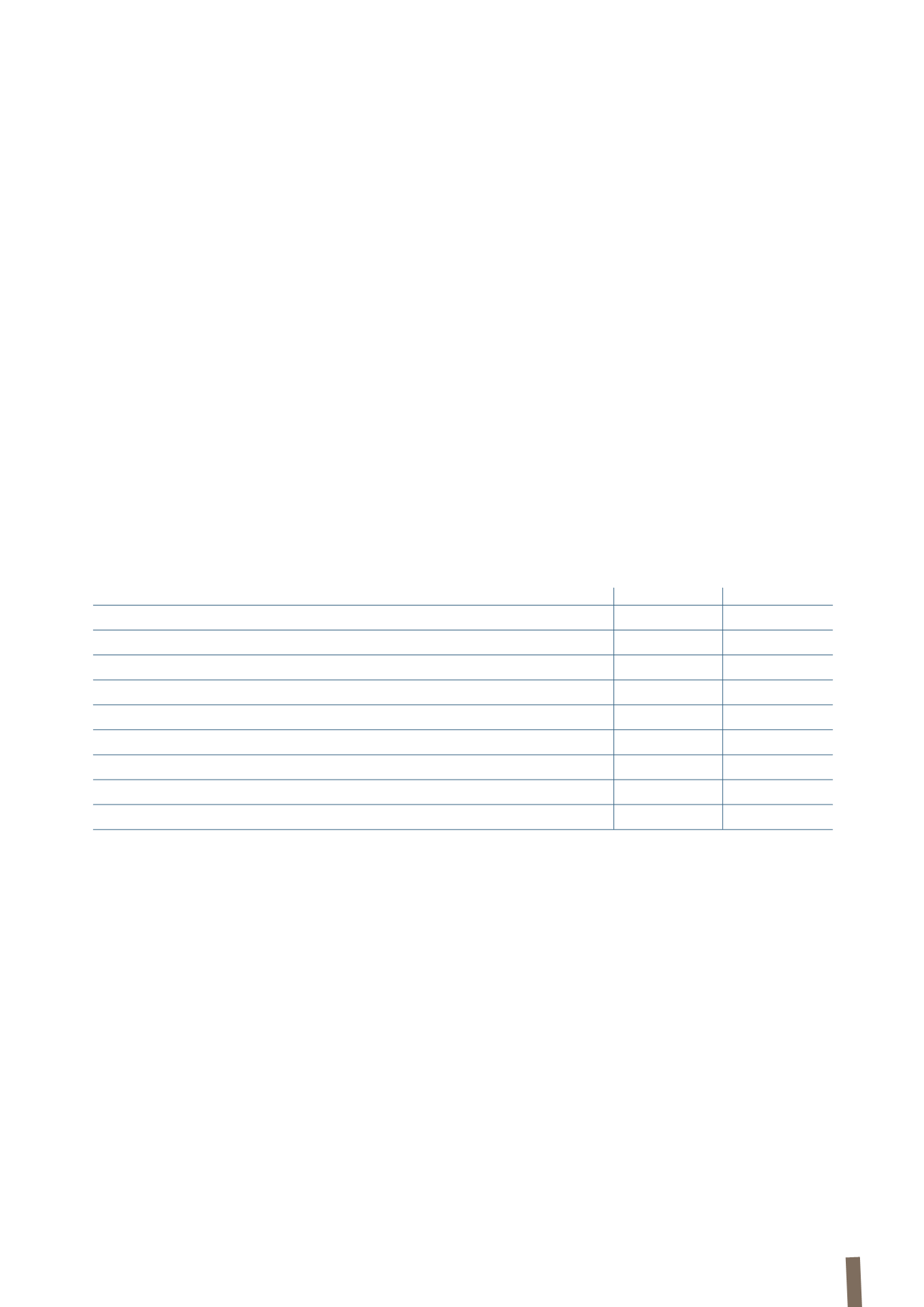

Movements in the ordinary shares and treasury shares of Prysmian S.p.A. are reported in the following table:

October 2010 under a resolution adopted on 9 April 2009.

During 2011 the number of treasury shares increased following

the acquisition of Draka Holding N.V., which holds 10,669

Prysmian S.p.A. shares.

Ordinary shares

Treasury shares

Total

Balance at 31 December 2010

182,029,302

(3,028,500)

179,000,802

Capital increase

(1)

32,364,179

-

32,364,179

Treasury shares

-

(10,669)

(10,669)

Balance at 31 December 2011

214,393,481

(3,039,169)

211,354,312

Ordinary shares

Treasury shares

Total

Balance at 31 December 2011

214,393,481

(3,039,169)

211,354,312

Capital increase

(2)

115,300

-

115,300

Treasury shares

-

-

-

Balance at 31 December 2012

214,508,781

(3,039,169)

211,469,612