215

Considering the market level of interest rates, the Group

entered new interest rate swaps in March 2012 with a notional

value of Euro 100 million as a partial hedge against future

variable interest rate payments in the period 2012-2016,

taking the nominal value of hedges covering this period to

Euro 200 million.

Interest rate swaps on loans totalling Euro 500 million expired

in May 2012. New hedges with a total nominal value of Euro

480 million, covering the period 2012-2014, came into effect

on the same date.

Interest rate swaps have a notional value of Euro 680 million

at 31 December 2012 and are hedging derivatives that qualify

as cash flow hedges (Euro 655 million at 31 December 2011).

Such financial instruments convert the variable component of

The ineffective portion of cash flow hedges had a negligible negative post-tax impact, compared with Euro 1 million in 2011,

reported in the income statement under “Finance costs”.

interest rates on loans received into a fixed rate of between

1.1% and 3.7%.

Forward currency contracts have a notional value of Euro

1,971 million at 31 December 2012 (Euro 1,758 million at 31

December 2011); total notional value at 31 December 2012

includes Euro 728 million in derivatives designated as cash

flow hedges (Euro 779 million at 31 December 2011).

At 31 December 2012, like at 31 December 2011, almost all the

derivative contracts had been entered with major financial

institutions.

Metal derivatives have a notional value of Euro 614 million at

31 December 2012 (Euro 548 million at 31 December 2011).

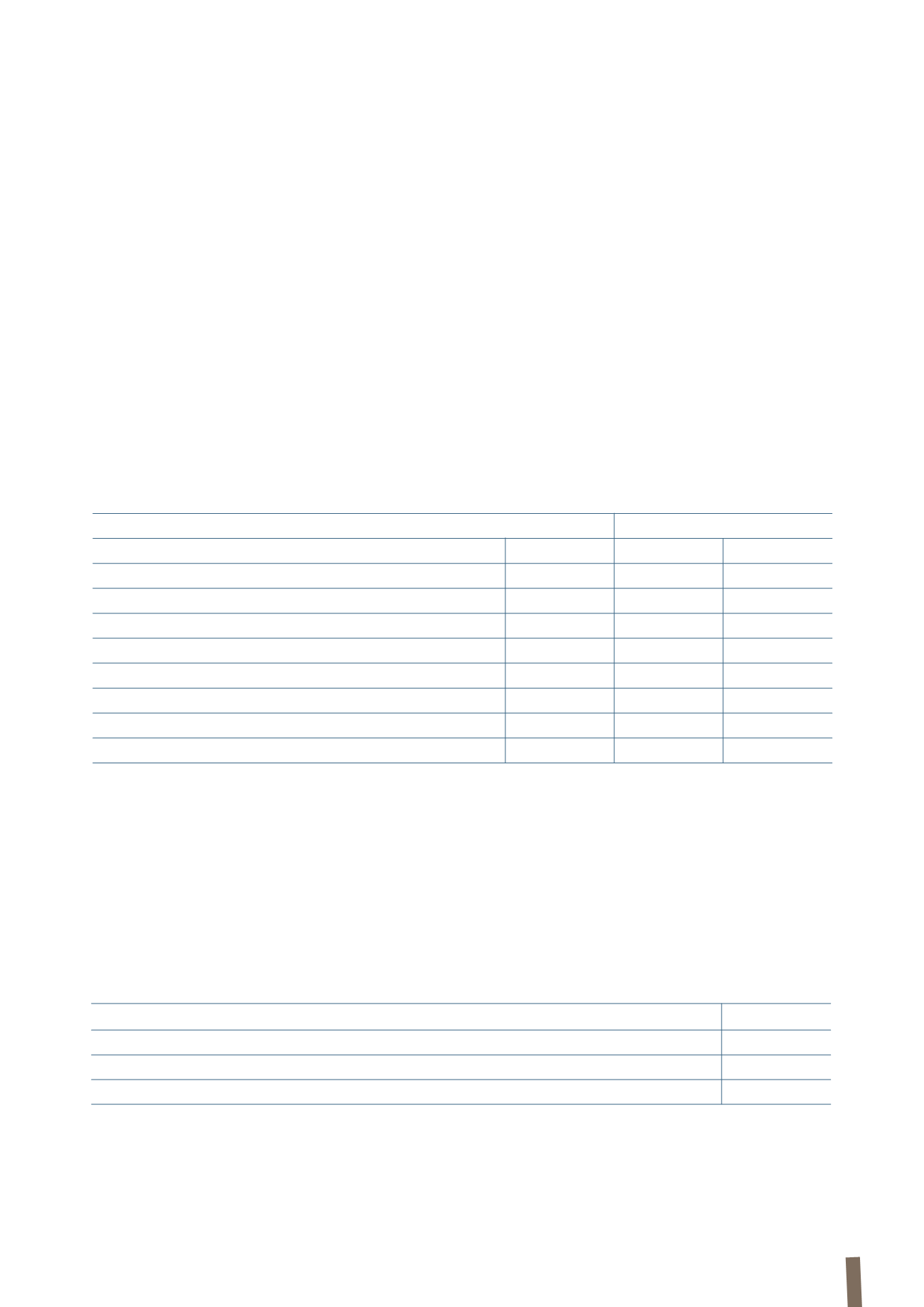

9. CASH AND CASH EQUIVALENTS

These are detailed as follows:

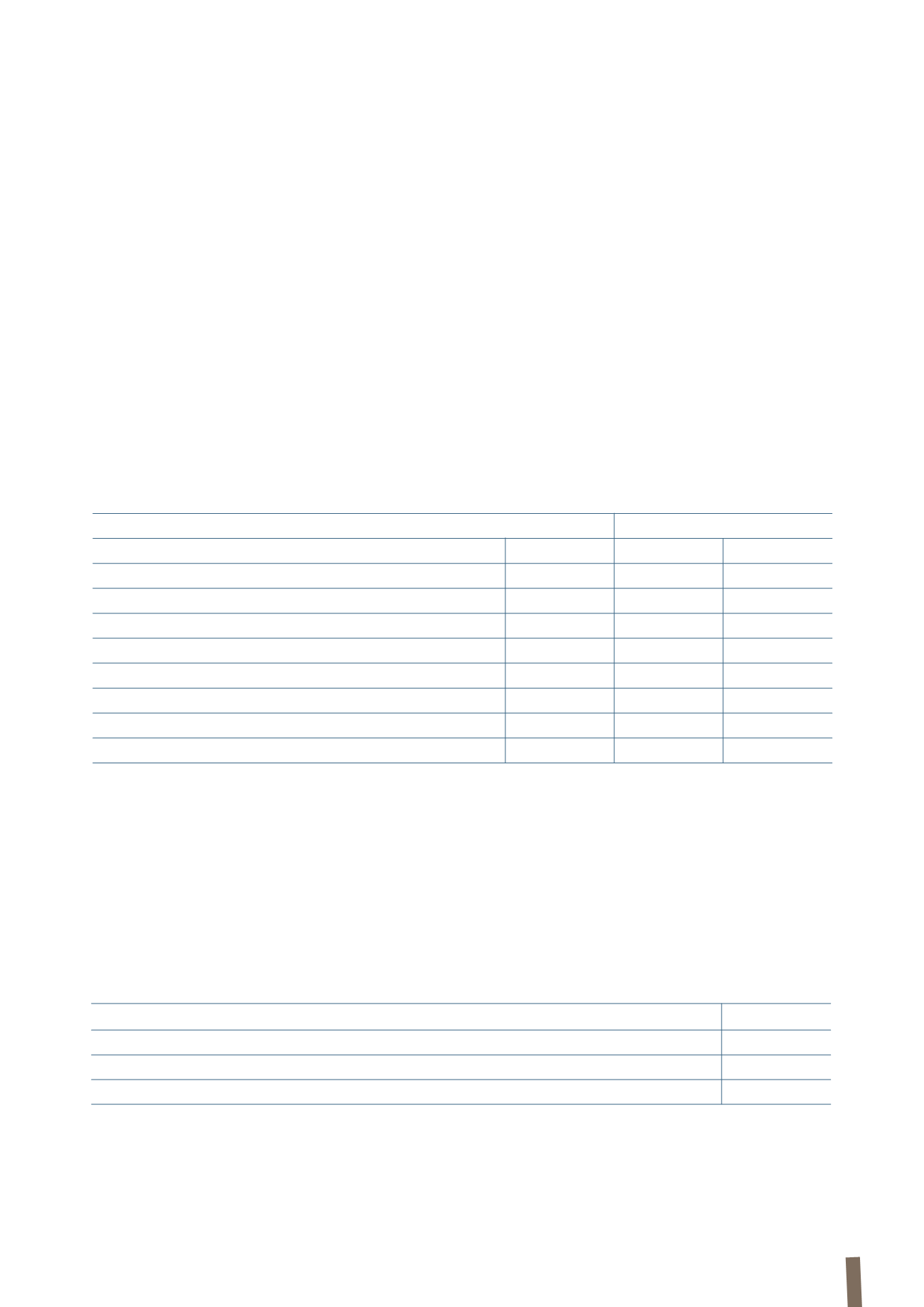

The following table shows movements in both reporting periods in the cash flow hedge reserve for designated hedging derivatives:

Cash and cash equivalents, deposited with major financial

institutions, are managed centrally by Group treasury

companies or by subsidiaries under the supervision of the

Prysmian S.p.A. Finance Department.

Cash and cash equivalents managed by Group treasury

companies amount to Euro 354 million at 31 December 2012

compared with Euro 353 million at 31 December 2011.

For additional details about the change in cash and cash

equivalents, please refer to Note 37. Statement of cash flows.

(in millions of Euro)

2012

2011

Gross reserve

Tax effect

Gross reserve

Tax effect

Opening balance

(25)

8

(19)

6

Changes in fair value

(15)

5

(14)

4

Release to other finance income/(costs)

11

(3)

5

(1)

Release to exchange gains/(losses)

(1)

-

(4)

1

Reclassification to other reserves

-

-

-

-

Release to finance costs/(income)

-

-

2

(1)

Release to construction contract costs/(revenues)

(4)

1

5

(1)

Closing balance

(34)

11

(25)

8

(in millions of Euro)

31 December 2012

31 December 2011

Cash and cheques

7

10

Bank and postal deposits

805

717

Total

812

727