Consolidated Financial Statements >

CONSOLIDATED FINANCIAL STATEMENTS AND EXPLANATORY NOTES

234

| 2012 annual report prysmian group

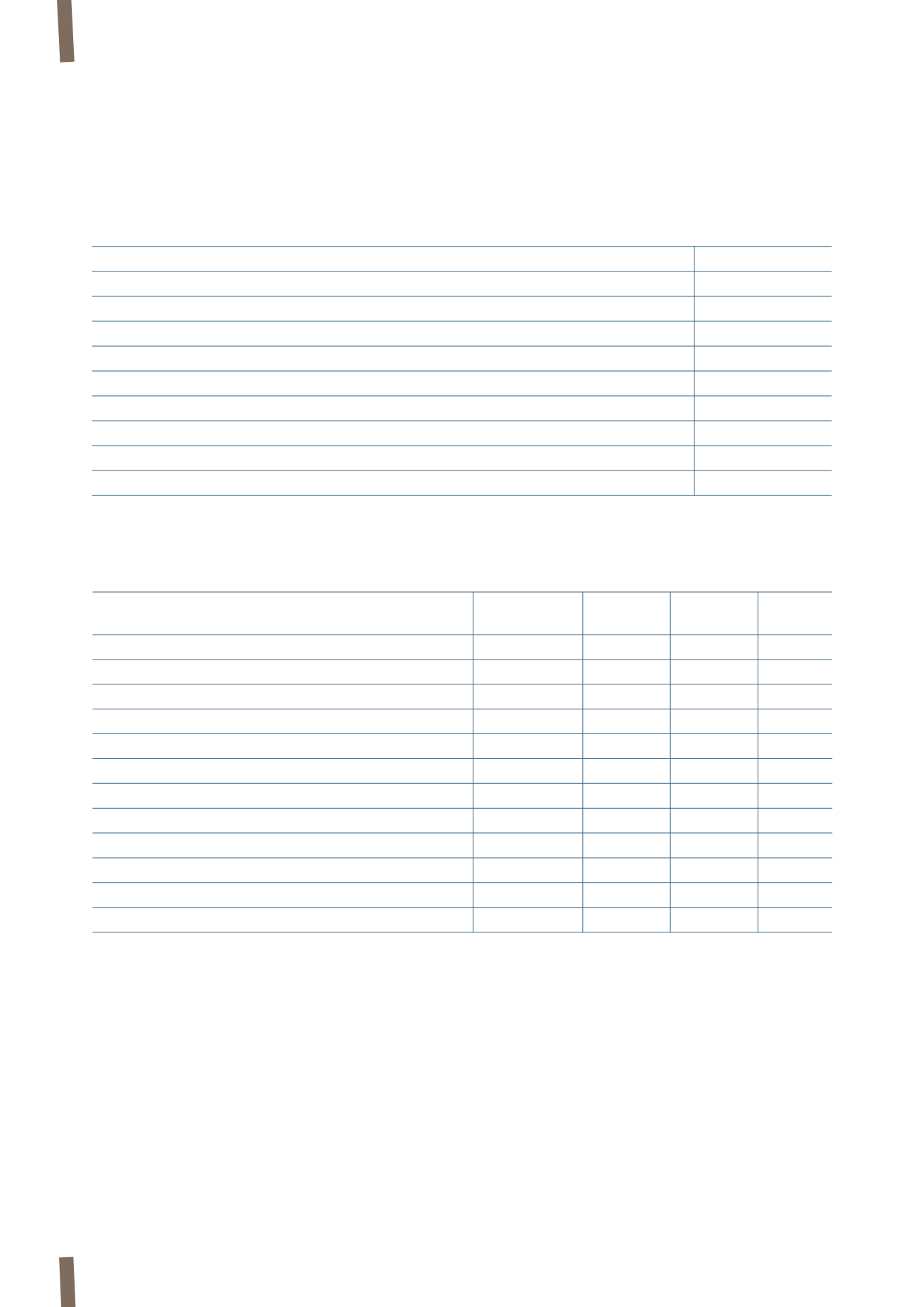

16. DEFERRED TAXES

These are detailed as follows:

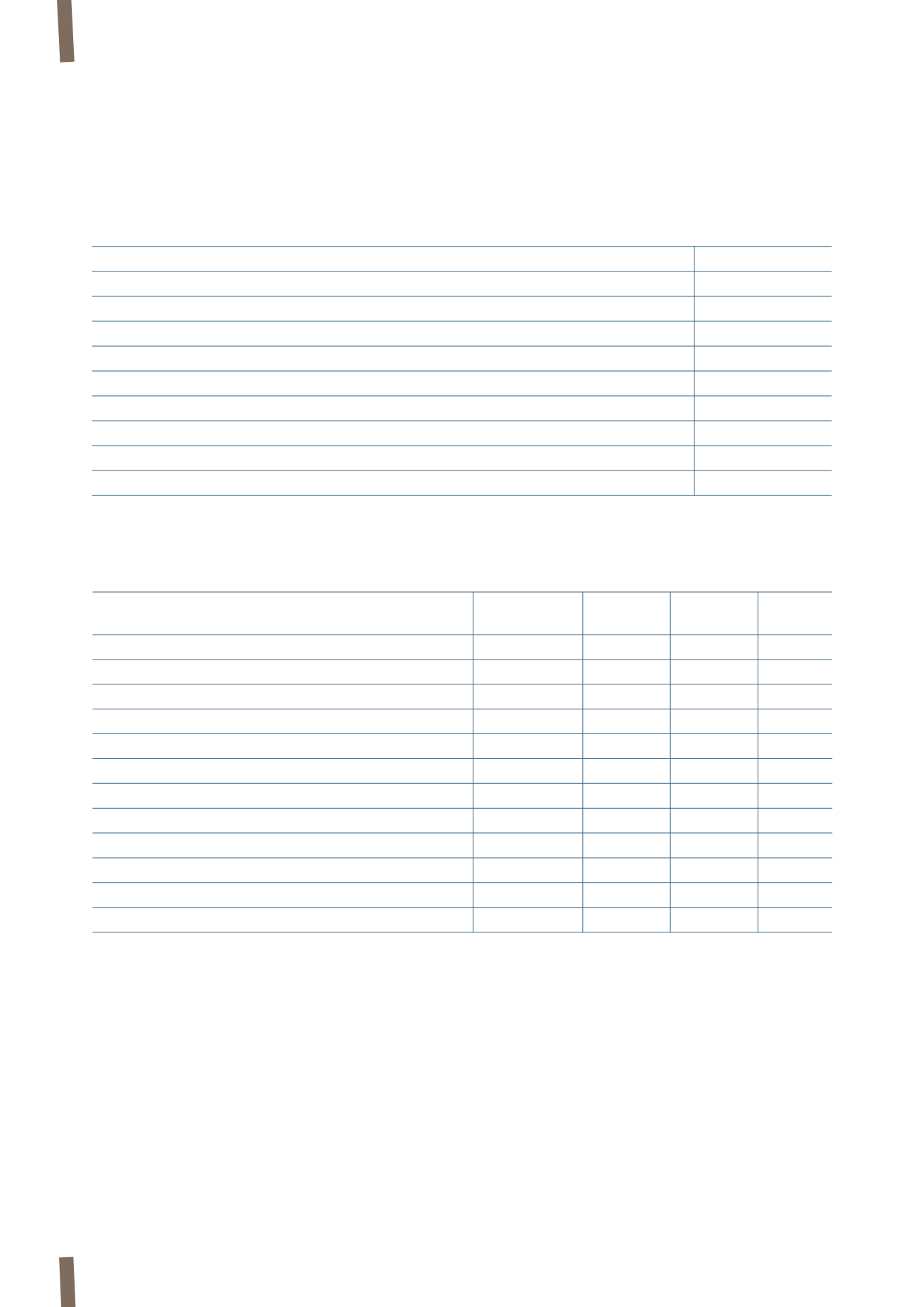

Movements in deferred taxes are detailed as follows:

(in millions of Euro)

31 December 2012

31 December 2011

Deferred tax assets:

- Deferred tax assets recoverable after more than 12 months

108

33

- Deferred tax assets recoverable within 12 months

19

64

Total deferred tax assets

127

97

Deferred tax liabilities:

- Deferred tax liabilities reversing after more than 12 months

(78)

(95)

- Deferred tax liabilities reversing within 12 months

(17)

(11)

Total deferred tax liabilities

(95)

(106)

Total net deferred tax assets (liabilities)

32

(9)

(*) These comprise Provisions for risks and charges (current and non-current) and Employee benefit obligations.

(in millions of Euro)

Accumulated

Provisions (*)

Tax losses

Other

Total

depreciation

Balance at 31 December 2010

(65)

41

9

1

(14)

Business combinations

(100)

5

47

26

(22)

Currency translation differences

-

-

-

(2)

(2)

Impact on income statement

2

2

(7)

27

24

Impact on equity

-

3

-

2

5

Balance at 31 December 2011

(163)

51

49

54

(9)

Business combinations

-

-

-

-

-

Currency translation differences

1

(3)

-

(1)

(3)

Impact on income statement

4

13

22

(7)

32

Impact on equity

-

14

-

3

17

Other and reclassifications

(5)

30

-

(30)

(5)

Balance at 31 December 2012

(163)

105

71

19

32

The Group has not recognised any deferred tax assets for

carryforward tax losses of Euro 675 million at 31 December

2012 (Euro 793 million at 31 December 2011), or for future

deductible temporary differences of Euro 187 million

at 31 December 2012 (Euro 232 million at 31 December

2011). Unrecognised deferred tax assets relating to these

carryforward tax losses and deductible temporary differences

amount to Euro 251 million at 31 December 2012 (Euro 235

million at 31 December 2011).