243

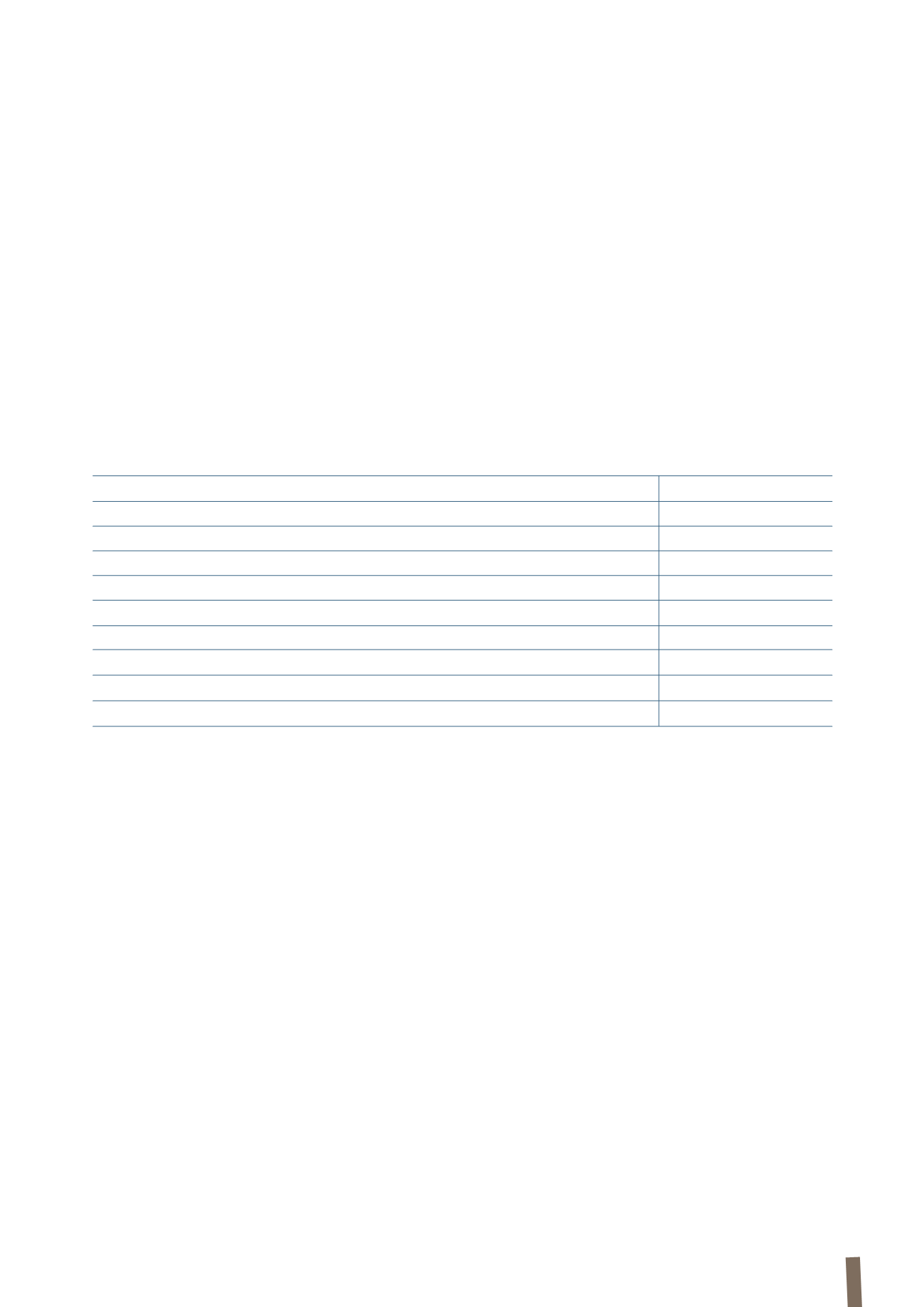

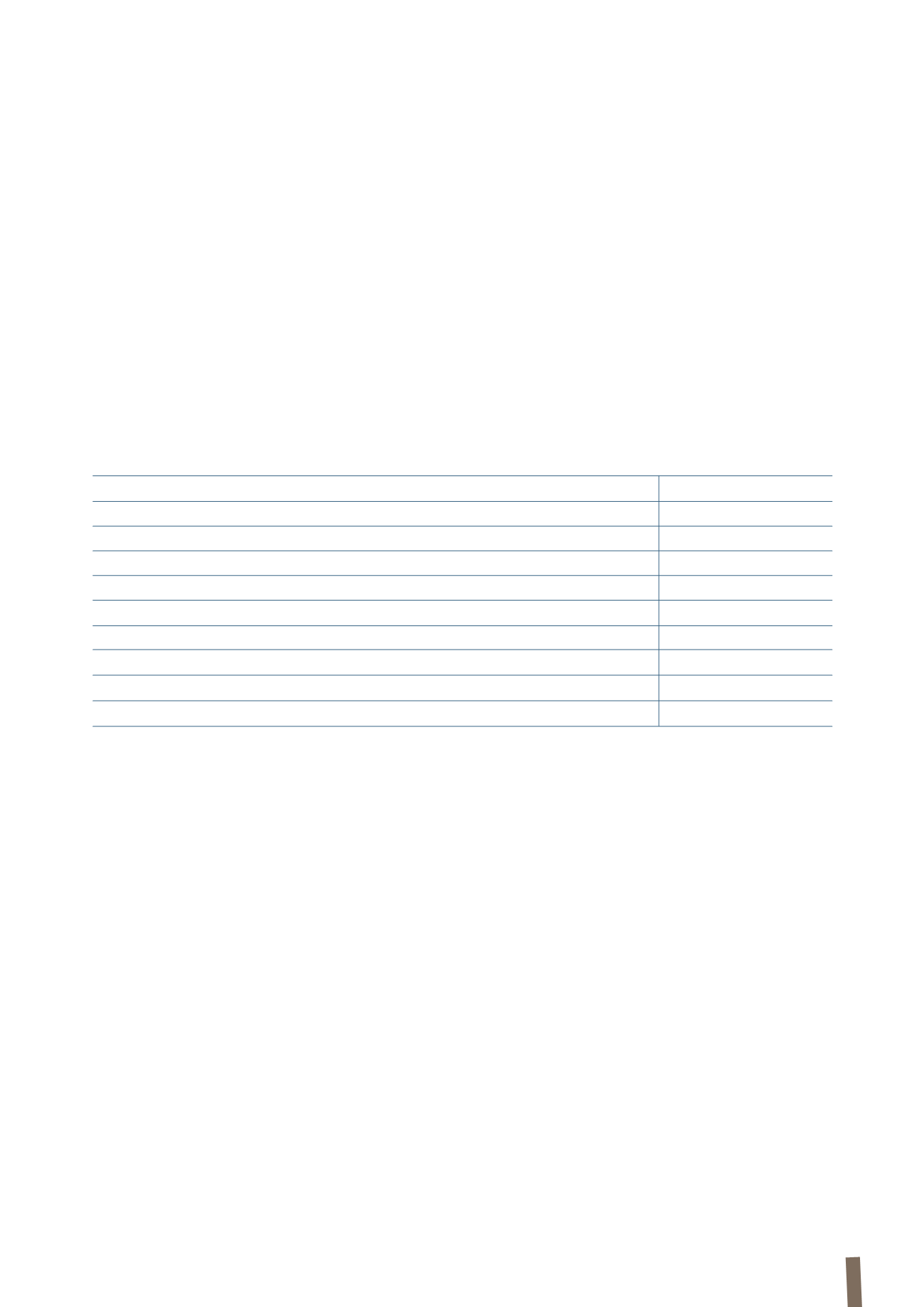

28. EARNINGS/(LOSS) AND DIVIDENDS PER SHARE

Basic earnings/(loss) per share have been determined by

dividing the net result for the period attributable to owners

of the parent by the average number of the Company’s

outstanding shares. With regard to the denominator used

for calculating earnings per share, the average number of

outstanding shares also includes:

a. the shares issued following exercise of options under the

Stock Option Plan, involving the issue of 546,227 shares

in 2008, 688,812 shares in 2009, 794,263 shares in 2010,

539,609 shares in 2011 and 115,300 shares in 2012. The

remaining options are all vested and can be exercised in

just one remaining 30-day period, running from the date

of approving the proposed annual financial statements for

2012;

b. the issue of 31,824,570 shares under the capital increase for

the acquisition of the Draka Group.

Diluted earnings/(loss) per share have been determined

by taking into account, when calculating the number of

outstanding shares, the potential dilutive effect of options

granted under existing Stock Option Plans.

(in millions of Euro)

12 months 2012

12 months 2011

Net profit/(loss) attributable to owners of the parent

168

(136)

Weighted average number of ordinary shares (thousands)

211,416

208,596

Basic earnings/(loss) per share (in Euro)

0.79

(0.65)

Net profit/(loss) attributable to owners of the parent

168

(136)

Weighted average number of ordinary shares (thousands)

211,416

208,596

Adjustments for:

Dilution from incremental shares arising from exercise of stock options (thousands)

88

1,070

Weighted average number of ordinary shares to calculate diluted earnings per share (thousands)

211,504

209,666

Diluted earnings/(loss) per share (in Euro)

0.79

(0.65)

29. CONTINGENT LIABILITIES

As a global operator, the Group is exposed to legal risks

primarily, by way of example, in the areas of product liability

and environmental, antitrust and tax rules and regulations.

Outlays relating to current or future proceedings cannot be

predicted with certainty. It is possible that the outcomes of

these proceedings may give rise to costs that are not covered

or not fully covered by insurance, which would therefore have

a direct effect on the Group’s results.

It is also reported, with reference to the antitrust

investigations in the various jurisdictions involved, that the

only investigation for which Prysmian Group has been unable

to estimate the related risk is the one in Brazil.

The dividend paid in 2012 amounted to Euro 44 million

(Euro 0.21 per share). A dividend of Euro 0.42 per share for

the year ended 31 December 2012 will be proposed at the

annual general meeting to be held on 16 April 2013 in a

single call; based on the number of outstanding shares, the

above dividend per share equates to a total dividend pay-

out of approximately Euro 89 million. The current financial

statements do not reflect any liability for the proposed

dividend.