Consolidated Financial Statements >

CONSOLIDATED FINANCIAL STATEMENTS AND EXPLANATORY NOTES

242

| 2012 annual report prysmian group

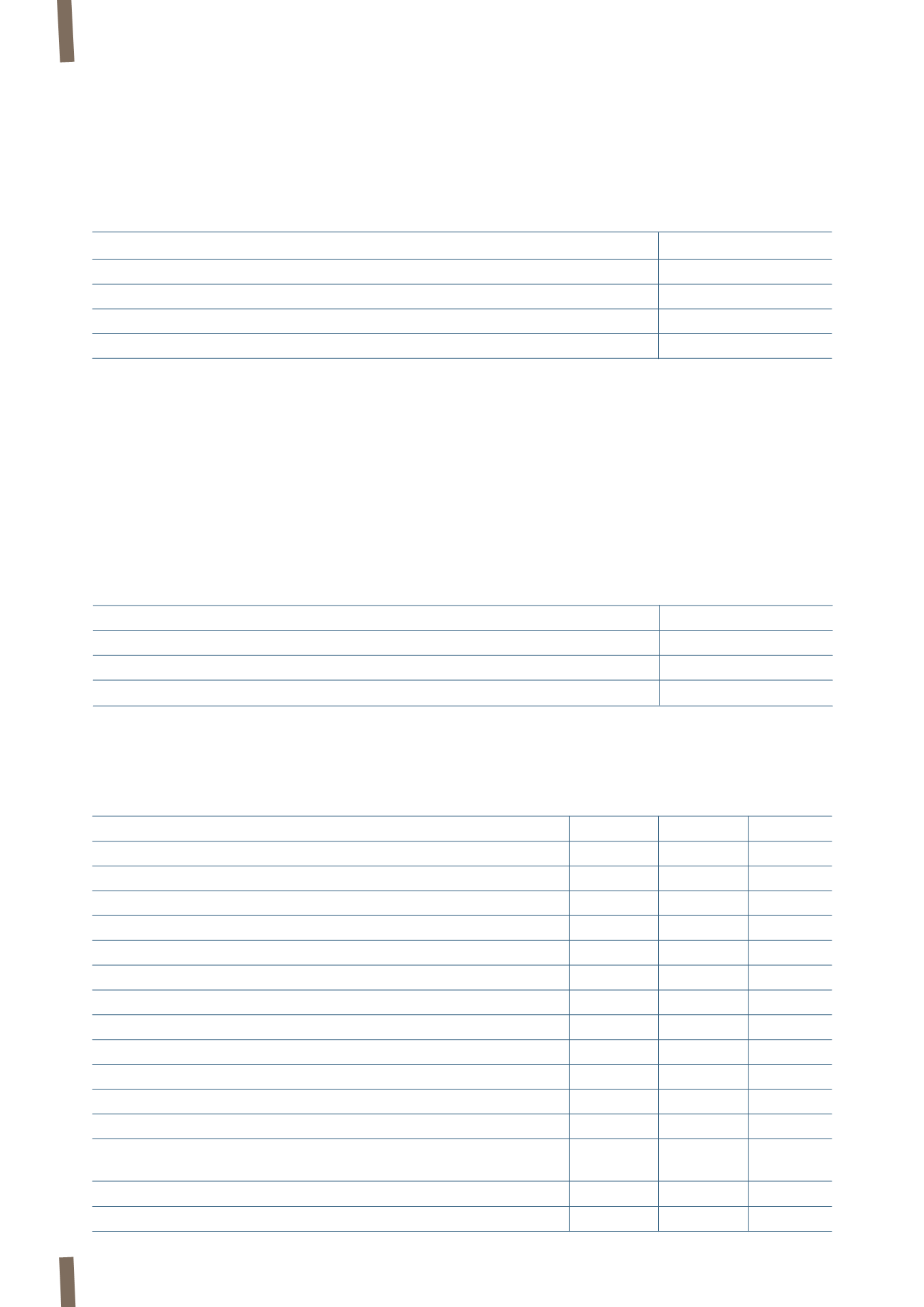

26. SHARE OF INCOME FROM INVESTMENTS IN ASSOCIATES AND DIVIDENDS FROM

OTHER COMPANIES

This is detailed as follows:

“Other companies” refer to the results of minor equity investments totalling Euro 5 million, of which Euro 2 million relates

to the interest in ELKAT Ltd., Euro 2 million to the interest in Tianjin YOFC XMKJ Optical Communications Co. Ltd and Euro 1

million to the interest in Eksa Sp. Zo.o..

(in millions of Euro)

2012

2011

Kabeltrommel Gmbh & Co.K.G.

3

2

Oman Cables Industry SAOG

9

4

Other companies

5

3

Total

17

9

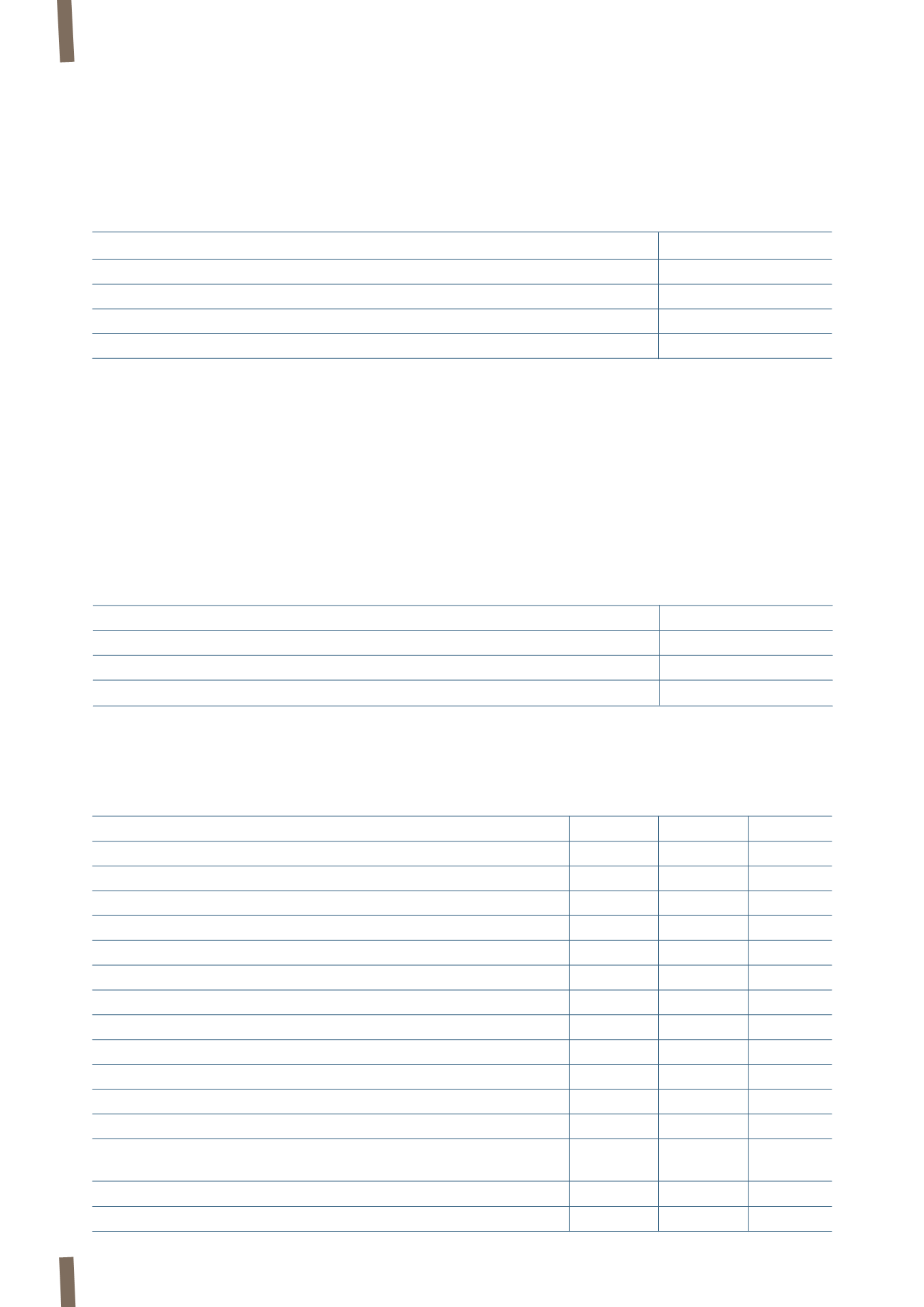

27. TAXES

These are detailed as follows:

The following table reconciles the effective tax rate with the Parent Company’s theoretical tax rate:

(in millions of Euro)

2012

2011

Current income taxes

105

68

Deferred income taxes

(32)

(24)

Total

73

44

(in millions of Euro)

2012

Tax rate

2011

Tax rate

Profit/(loss) before taxes

244

(101)

Theoretical tax expense at Parent Company’s nominal tax rate

67

27.5%

(28)

(27.5%)

Differences in tax rates of foreign subsidiaries

4

1.7%

(4)

(4.3%)

Differences in tax rate of companies in profit/loss

-

-

8

8.0%

Utilisation of unrecognised carryforward tax losses

(45)

(18.5%)

(7)

(7.0%)

Unrecognised deferred tax assets

30

12.5%

21

20.9%

Net increase (release) of provision for tax disputes

(3)

(1.2%)

(1)

(1.0%)

IRAP (Italian regional business tax)

13

5.4%

10

9.9%

Taxes on distributable reserves

4

1.7%

-

-

Utilisation of prior year credit for taxes paid abroad

-

-

(25)

(24.9%)

Antitrust

-

-

56

55.7%

Asset impairment

3

1.2%

6

6.0%

Deferred tax assets from prior years recognised and utilised

in current year

(2)

(1.2%)

(2)

(2.0%)

Non-deductible costs/ (non-taxable income) and other

2

0.9%

10

9.8%

Effective income taxes

73

30.0%

44

43.6%