231

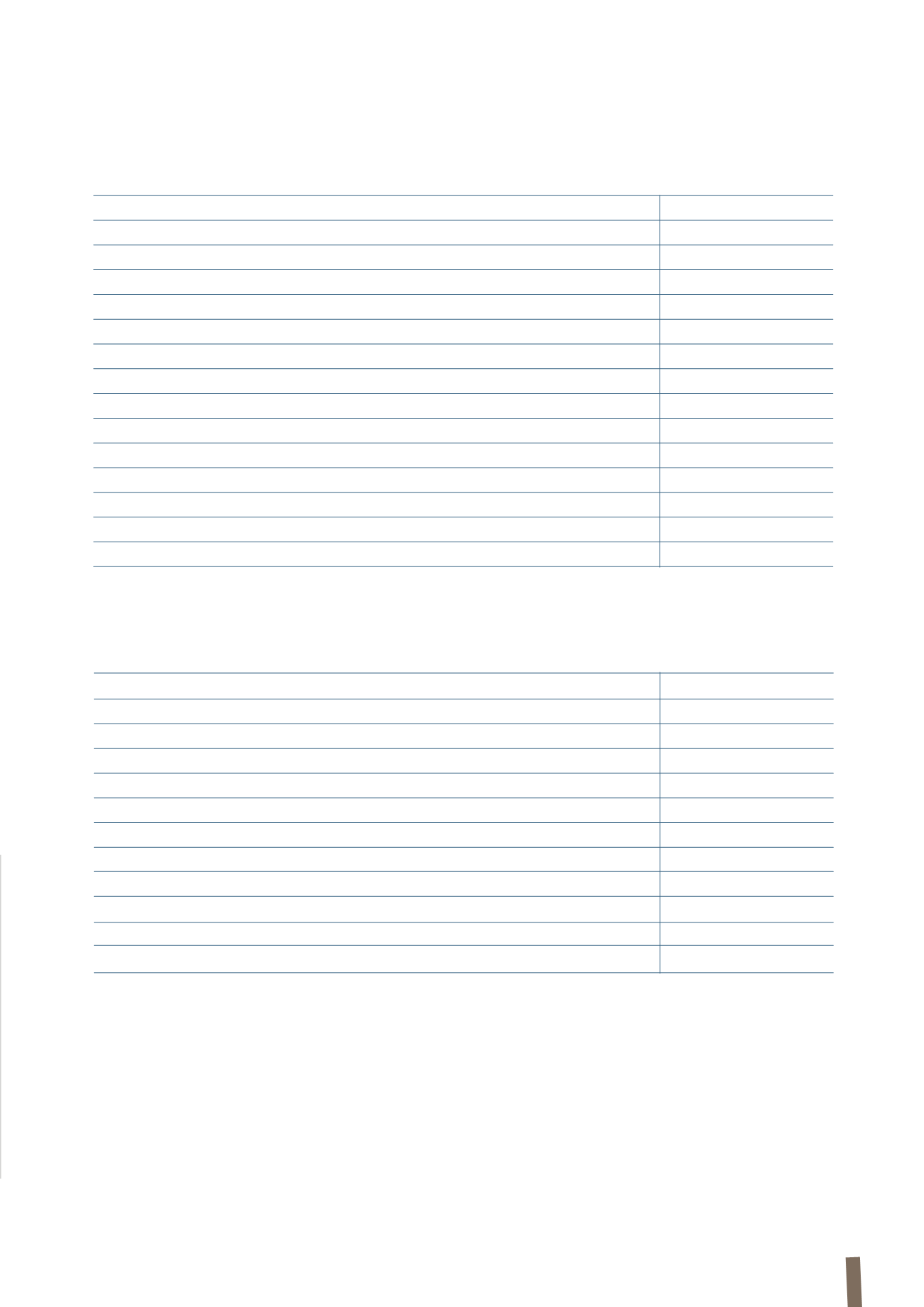

The changes in pension fund obligations are as follows:

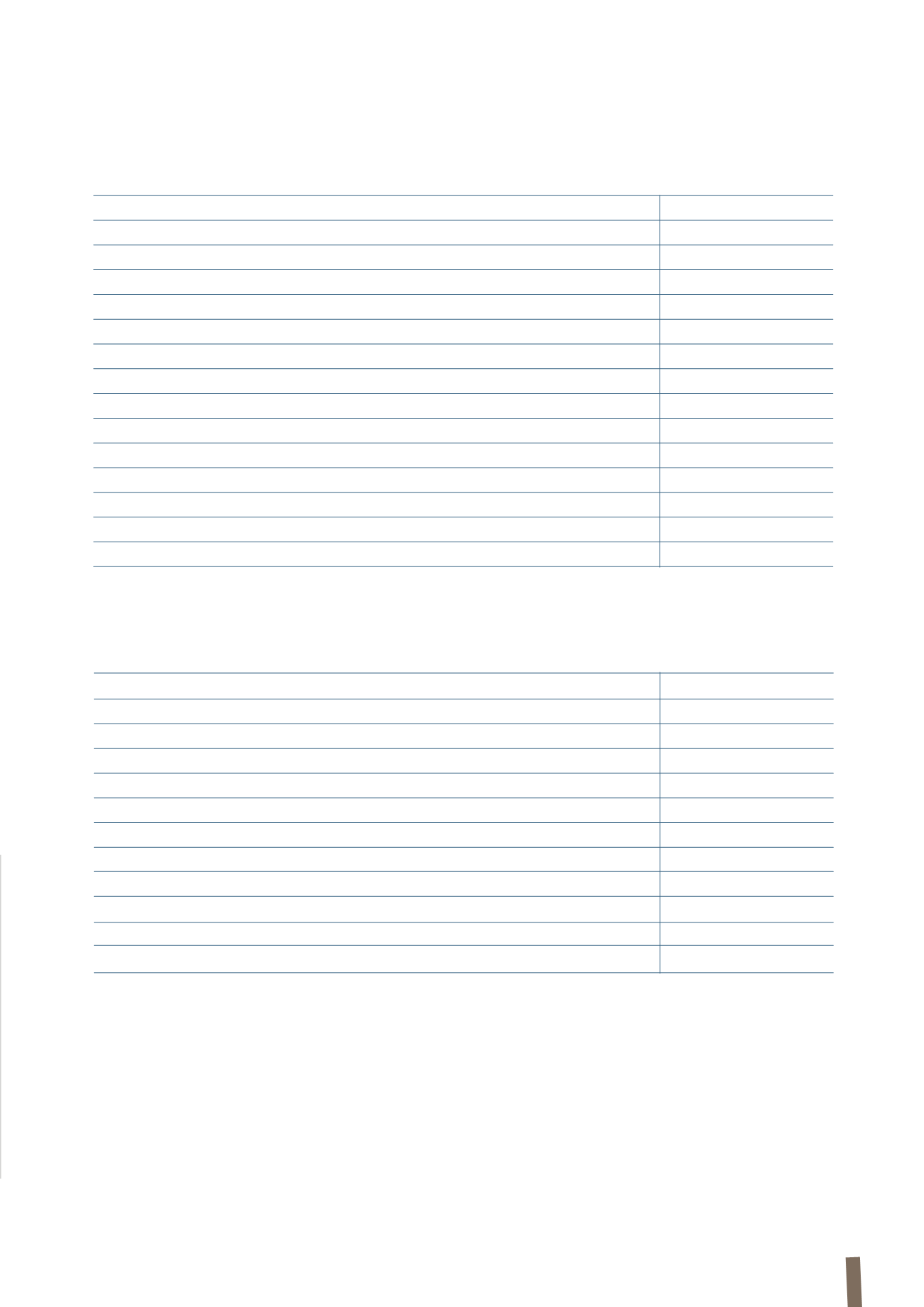

The changes in pension fund assets are as follows:

At 31 December 2012, pension fund assets were made up

of equity funds (46.87%), bonds (48.52%) and other assets

(4.61%). The expected return is basically in line with the

results achieved in the previous year.

At 31 December 2011, pension fund assets were made up

of equity funds (42.13%), bonds (44.71%) and other assets

(13.16%). The expected return was 7.53% for equity funds,

3.78% for bonds and 11.98% for other assets.

(in millions of Euro)

2012

2011

Opening obligations

396

136

Business combinations

-

241

Current service costs

6

4

Interest costs

19

17

Actuarial (gains)/losses recognised in equity

68

13

(Gains)/losses recognised in equity for unrecognised assets

1

2

Currency translation differences

2

2

Contributions paid in by plan participants

1

1

Utilisations for restructuring (curtailment)

(1)

(1)

Plan settlements

-

(3)

Reclassifications

-

-

Utilisations

(23)

(16)

Total movements

73

260

Closing obligations

469

396

(in millions of Euro)

2012

2011

Opening assets

208

45

Business combinations

-

172

Interest income

12

11

Actuarial gains/(losses) recognised in equity

13

(4)

Currency translation differences

2

3

Employer contributions

(21)

(17)

Contributions paid in by plan participants

15

14

Plan settlements

-

(3)

Asset ceilings

(1)

(13)

Total movements

20

163

Closing assets

228

208