317

The following tables summarise the committed lines available to the Company at 31 December 2012 and 31 December 2011.

At the Group level there is also another Euro 950 million in

committed lines as follows:

• Revolving Credit Facility 2010 (Euro 400 million);

• Revolving Credit Facility 2011 (Euro 400 million);

• Securitization (Euro 150 million).

These lines are available to a certain number of Group

companies, including Prysmian S.p.A..

As at 31 December 2012 and 31 December 2011, the Company

had not drawndown any of Group credit facilities shown above.

More details about the nature and drawdown of the Group-

level facilities shown above can be found in the Explanatory

Notes to the Consolidated Financial Statements (Note 12.

Borrowings from banks and other lenders).

Bond

Further to the resolution adopted by the Board of Directors on

3 March 2010, Prysmian S.p.A. completed the placement of

an unrated bond with institutional investors on the Eurobond

market on 30 March 2010 for a total nominal amount of Euro

400 million. The bond, with an issue price of Euro 99.674, has a

5-year term and pays a fixed annual coupon of 5.25%. The bond

settlement date was 9 April 2010. The bond has been admitted

to the Luxembourg Stock Exchange’s official list and is traded

on the related regulated market. The fair value of the bond at

31 December 2012 was Euro 420,000 thousand (Euro 395,200

thousand at 31 December 2011).

The “Credit Agreements” line also includes the Credit

Agreement 2011, entered into by Prysmian S.p.A. on 7 March

2011 with a pool of major banks for Euro 800 million with a five-

year maturity. This agreement comprises a loan for Euro 400

million (Term Loan Facility 2011), all of which is recorded among

the Company’s liabilities and repayable in full on 7 March 2016,

and a revolving facility for Euro 400 million (Revolving Credit

Facility 2011).

At 31 December 2012, the fair values of the Credit Agreements

2010 and 2011 approximate the related carrying amounts.

The repayment schedule of the Term Loan under the Credit Agreement 2010 is structured as follows:

31 May 2013

9.25%

30 November 2013

9.25%

31 May 2014

9.25%

31 December 2014

72.25%

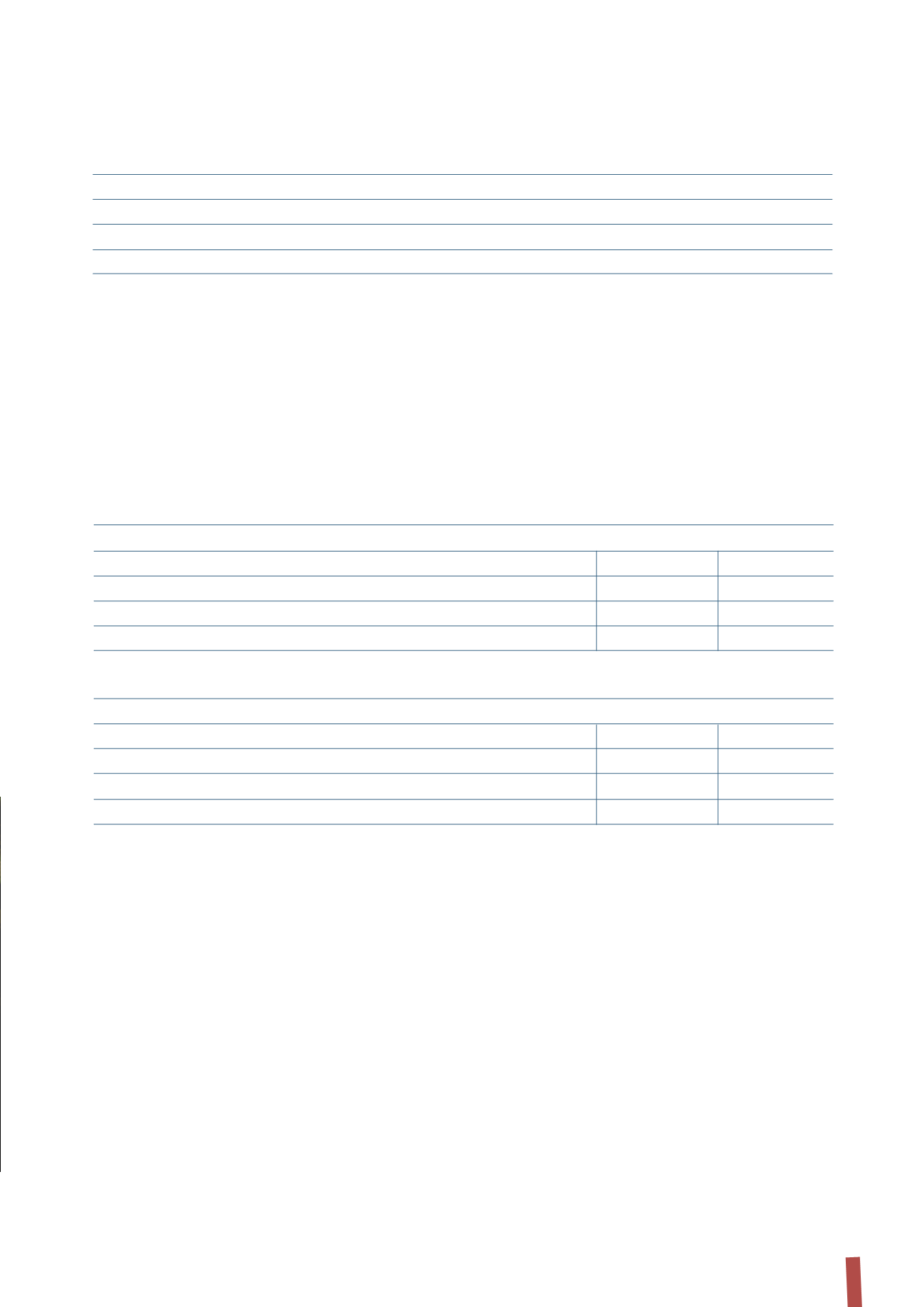

(in thousands of Euro)

31 December 2012

Total lines

Used

Unused

Term Loan Facility 2010

320,000

(320,000)

-

Term Loan Facility 2011

400,000

(400,000)

-

Totale Credit Agreement

720,000

(720,000)

-

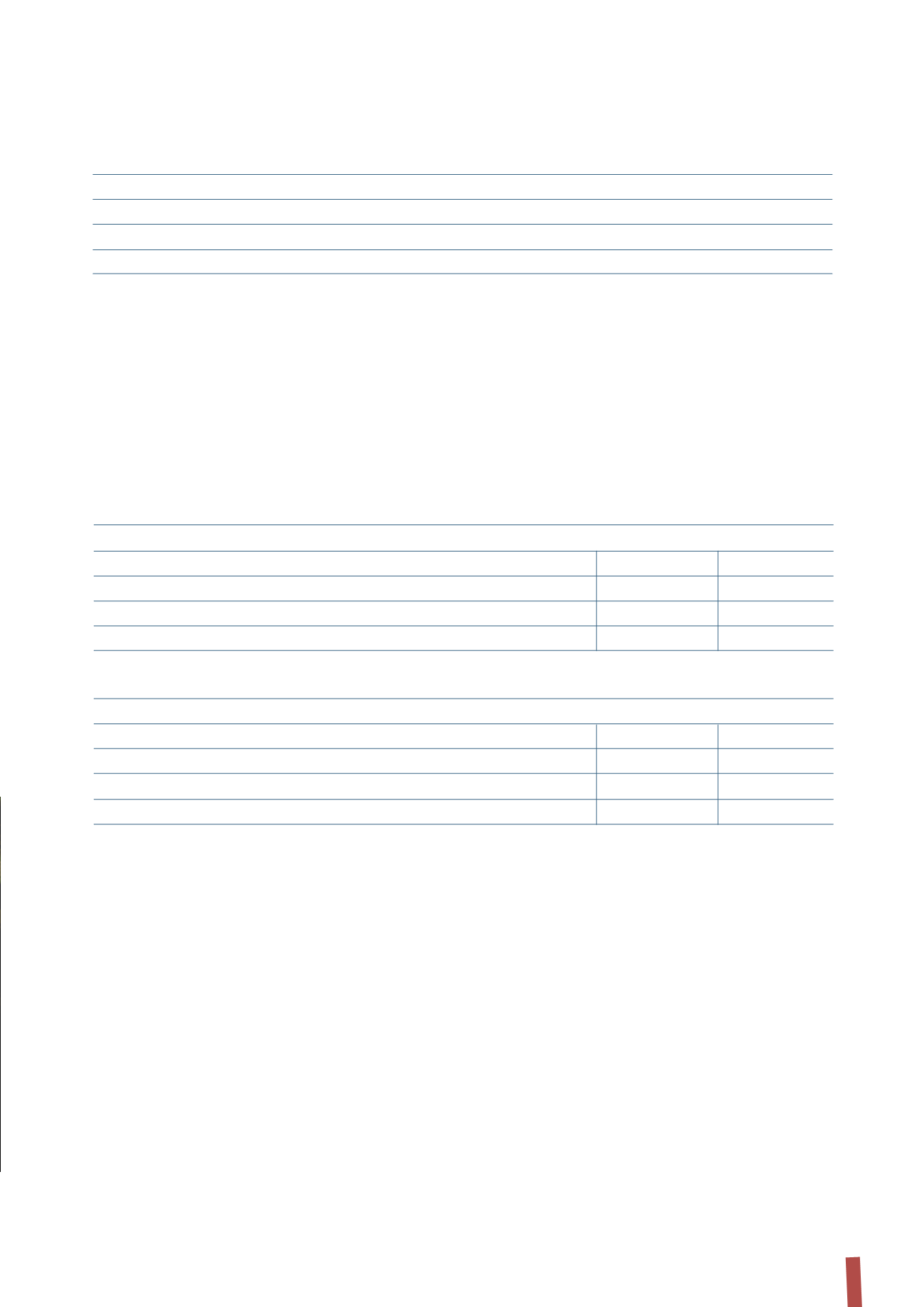

(in thousands of Euro)

31 December 2011

Total lines

Used

Unused

Term Loan Facility

100,000

(100,000)

-

Term Loan Facility 2011

400,000

(400,000)

-

Totale Credit Agreement

500,000

(500,000)

-