PARENT COMPANY >

FINANCIAL STATEMENTS AND EXPLANATORY NOTES

314

| 2012 annual report prysmian group

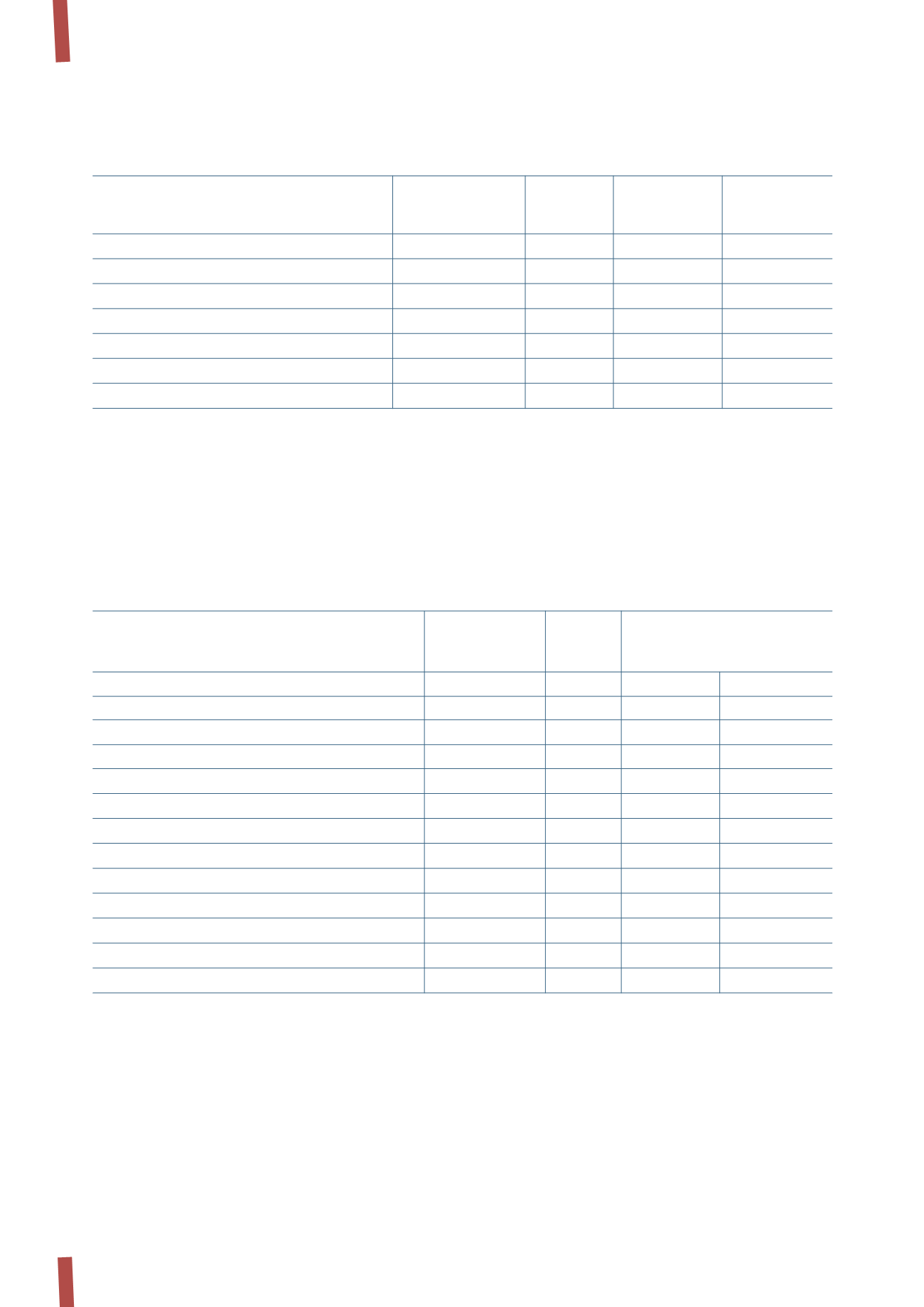

Movements in treasury shares are as follows:

Retained earnings

Retained earnings amount to Euro 138,368 thousand at 31

December 2012, having increased by Euro 54,390 thousand

since 31 December 2011 following the apportionment of net

profit for 2011.

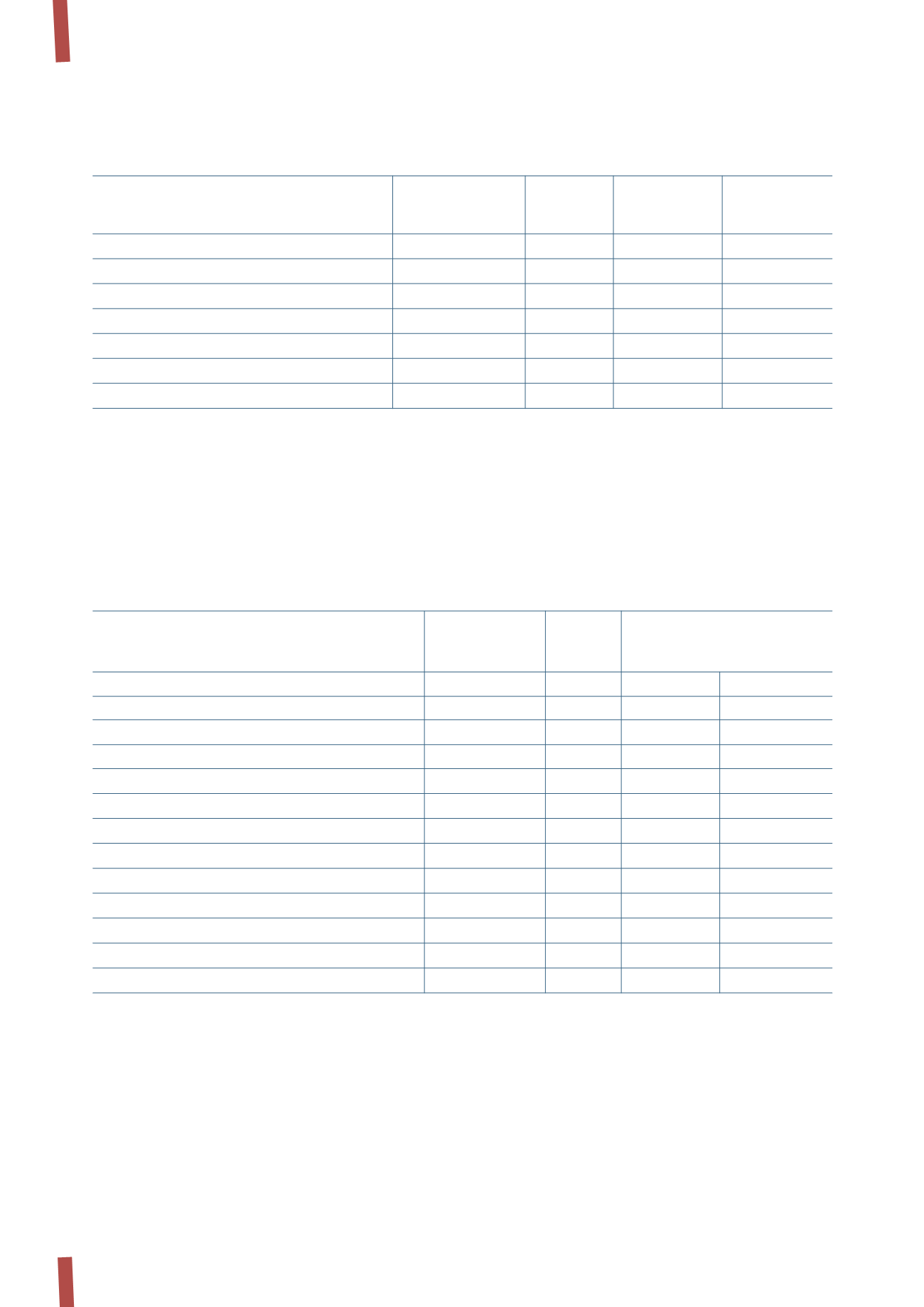

In compliance with art. 2427, no. 7-bis of the Italian Civil

Code, the following table analyses each component of equity,

indicating its origin, permitted use and distribution, as well as

how it has been used in previous years.

Dividend distribution

The shareholders of Prysmian S.p.A. voted on 18 April 2012 to

distribute a gross dividend of Euro 0.21 per share, for a total of

Euro 44 million; this dividend was paid on 26 April 2012, with

the shares going ex-dividend on 23 April 2012.

A proposal to pay a dividend per share of Euro 0.42 for a

total of some Euro 89 million in respect of the year ended 31

December 2012 will be presented to the Shareholders’ Meeting

convened in single call for 16 April 2013.

The present financial statements do not reflect any liability for

the proposed dividend.

Key:

A: to increase capital. B: to cover losses. C: distribution to shareholders.

(*) Entirely available for capital increases and to cover losses. For other uses it is first necessary to adjust the legal reserve to 20% of share capital (including by

transferring amounts from the share premium reserve). At 31 December 2012 such an adjustment would amount to Euro 3 thousand.

Treasury shares

Number of

Total

% of total

Average

Total carrying

ordinary

nominal value share capital

unit value

value

shares

(in Euro)

(in Euro)

(in Euro)

At 31 December 2010

3,028,500

302,850

1.66%

9.965

30,179,003

- Purchases

-

-

-

-

-

- Sales

-

-

-

-

-

At 31 December 2011

3,028,500

302,850

1.41%

9.965

30,179,003

- Purchases

-

-

-

-

-

- Sales

-

-

-

-

-

At 31 December 2012

3,028,500

302,850

1.41%

9.965

30,179,003

(in thousands of Euro)

Amount

Permitted use available for

Nature/description

Amount

(A,B,C)

distribution

Uses in three previous years

to cover losses

other purposes

Share Capital

21,451

Capital reserves:

Capital contribution reserve

6,113

A,B,C (*)

6,113

Share premium reserve

485,496

A,B,C

485,496

Earnings reserves:

Extraordinary reserve

52,688

A,B,C

52,688

IAS/IFRS first-time adoption reserve

30.177

A,B,C

30,177

Legal reserve

4,288

B

Retained earnings

138,368

A,B,C

138,368

25,488

Total

738,581

712,842

25,488

Undistributable amount

3

Distributable amount

712,839