PARENT COMPANY >

FINANCIAL STATEMENTS AND EXPLANATORY NOTES

306

| 2012 annual report prysmian group

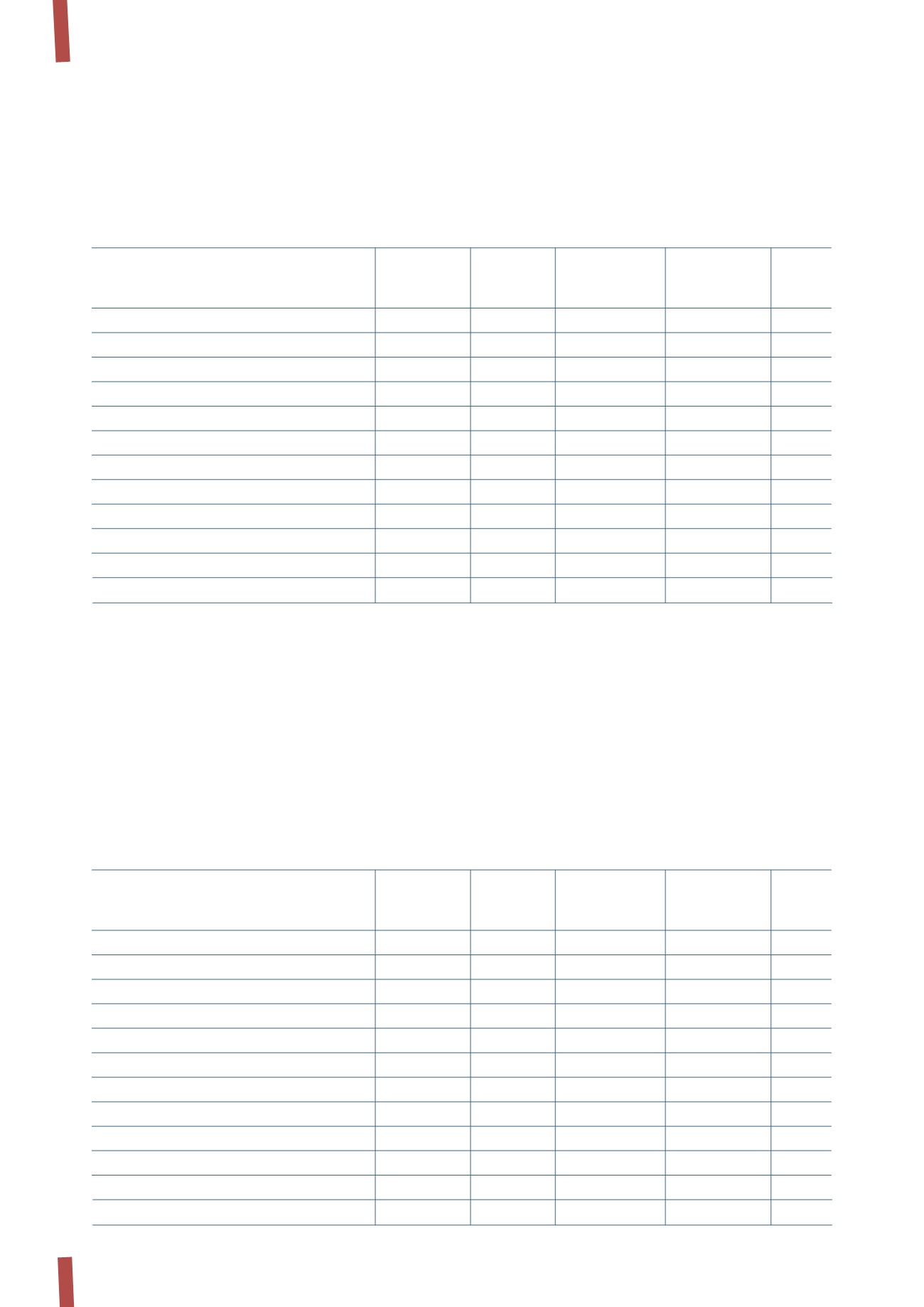

The following table presents the movements in property, plant and equipment over the course of 2012:

The amount of Euro 148 thousand for “Buildings” refers to

expenditure on properties taken under lease.

“Plant and machinery” (Euro 1,064 thousand) and “Equipment”

(Euro 325 thousand) mostly refer to instrumentation used for

Research and Development activities.

“Other assets” (Euro 1,463 thousand) comprise Euro 1,299

thousand in office furniture and equipment and Euro 164

thousand in motor and other vehicles.

1.

PROPERTY, PLANT AND EQUIPMENT

“Assets under construction and advances” (Euro 1,242

thousand) mostly refer to plant and machinery that will be

used for Research and Development and which are expected to

become available for use in the next year.

No borrowing costs were capitalised during the year.

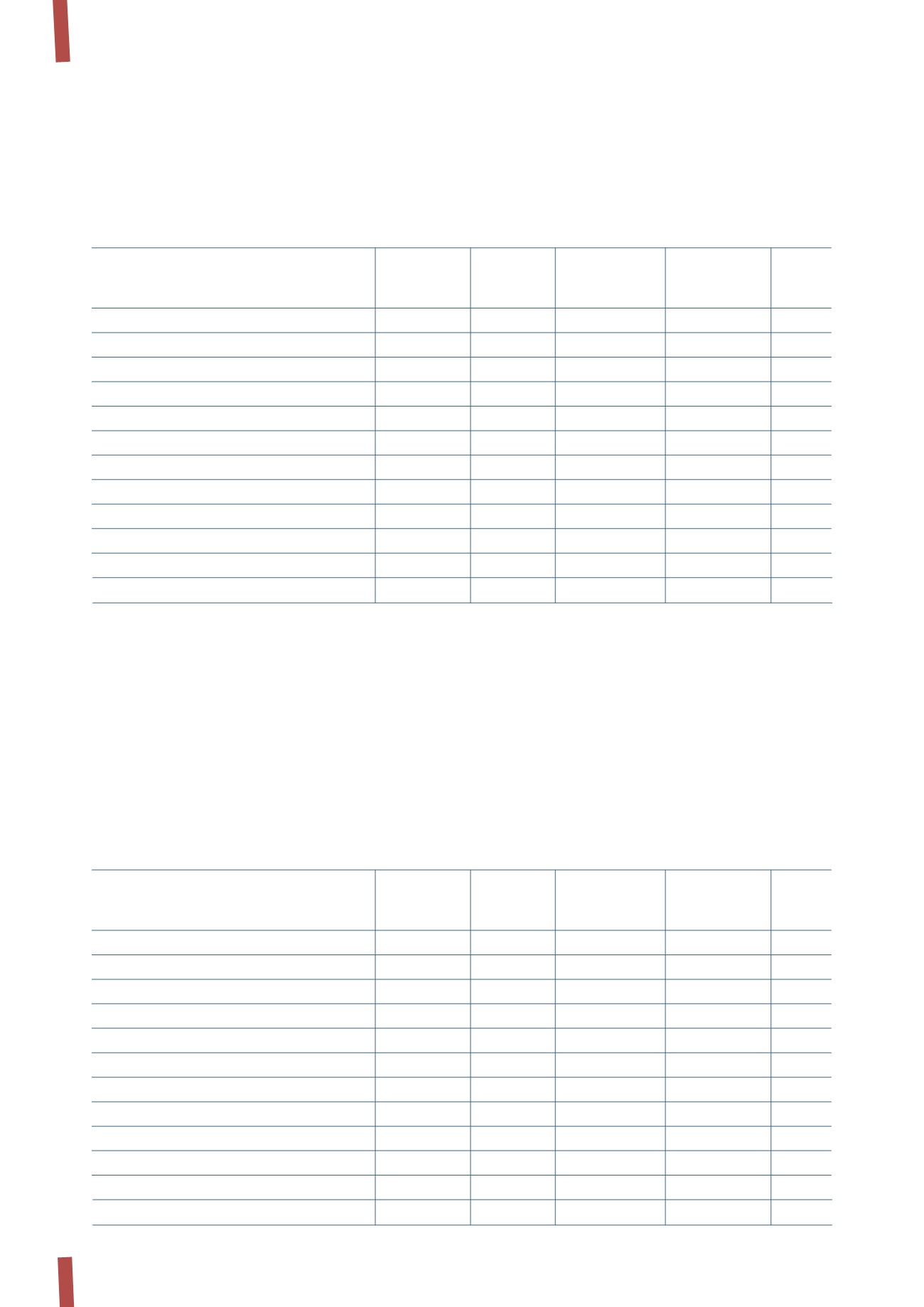

Movements in property, plant and equipment in 2011 were as

follows:

(in thousands of Euro)

Buildings

Plant and

Equipment

Other

Assets under

Total

machinery

assets

construction

and advances

Balance at 31 December 2010

249

1,436

587

623

437

3,332

Movements in 2011:

- Investments

-

110

24

149

576

859

- Disposals

-

-

-

-

-

-

- Reclassifications

-

-

-

223

(223)

-

- Depreciation

(51)

(248)

(206)

(189)

-

(694)

Total movements

(51)

(138)

(182)

183

353

165

Balance at 31 December 2011

198

1,298

405

806

790

3,497

Of which:

- Historical cost

420

5,259

1,125

2.158

790

9,752

- Accumulated depreciation and impairment (222)

(3,961)

(720)

(1,352)

-

(6,255)

Net book value

198

1,298

405

806

790

3,497

(in thousands of Euro)

Buildings

Plant and

Equipment

Other

Assets under

Total

machinery

assets

construction

and advances

Balance at 31 December 2011

198

1,298

405

806

790

3,497

Movements in 2012:

- Investments

-

411

208

356

908

1,883

- Disposals

-

(461)

(162)

-

-

(623)

- Reclassifications

-

134

124

552

(456)

354

- Depreciation

(50)

(318)

(250)

(251)

-

(869)

Total movements

(50)

(234)

(80)

657

452

745

Balance at 31 December 2012

148

1,064

325

1,463

1,242

4,242

Of which:

- Historical cost

420

5,272

1.270

3,086

1,242

11,290

- Accumulated depreciation and impairment (272)

(4,208)

(945)

(1,623)

-

(7,048)

Net book value

148

1,064

325

1,463

1,242

4,242