PARENT COMPANY >

FINANCIAL STATEMENTS AND EXPLANATORY NOTES

316

| 2012 annual report prysmian group

Credit Agreement 2010 and Credit Agreement 2011

The evolution of the Credit Agreements 2010 and 2011, signed

at Group level, is summarised below, along with their impact

on the Company’s financial statements.

On 3 May 2012, the Group repaid the credit agreement signed

on 18 April 2007 (Credit Agreement) under which Prysmian

S.p.A. and some of its subsidiaries had been granted an initial

total of Euro 1,700 million in loans and credit facilities (of

which Euro 100 million provided to Prysmian S.p.A.).

The Group repaid the remaining balance on the Term Loan

Facility for Euro 670 million (of which Euro 67 million repaid by

Prysmian S.p.A.) and Euro 5 million in amounts drawn down

against the Revolving Credit Facility for Euro 400 million. The

Bonding Facility for Euro 300 million had been cancelled on 10

May 2011 in advance of its natural maturity.

On 3 May 2012, this credit agreement was replaced with the

activation of the Forward Start Credit Agreement (now termed

Credit Agreement 2010) previously signed by the Group on 21

January 2010 with a pool of major national and international

banks. This is a long-term agreement for Euro 1,070 million

(maturing on 31 December 2014), negotiated in advance of its

period of use, under which the lenders have made available to

Prysmian S.p.A. and some of its subsidiaries loans and credit

facilities totalling Euro 1,070 million (of which Euro 320 million

provided to Prysmian S.p.A.).

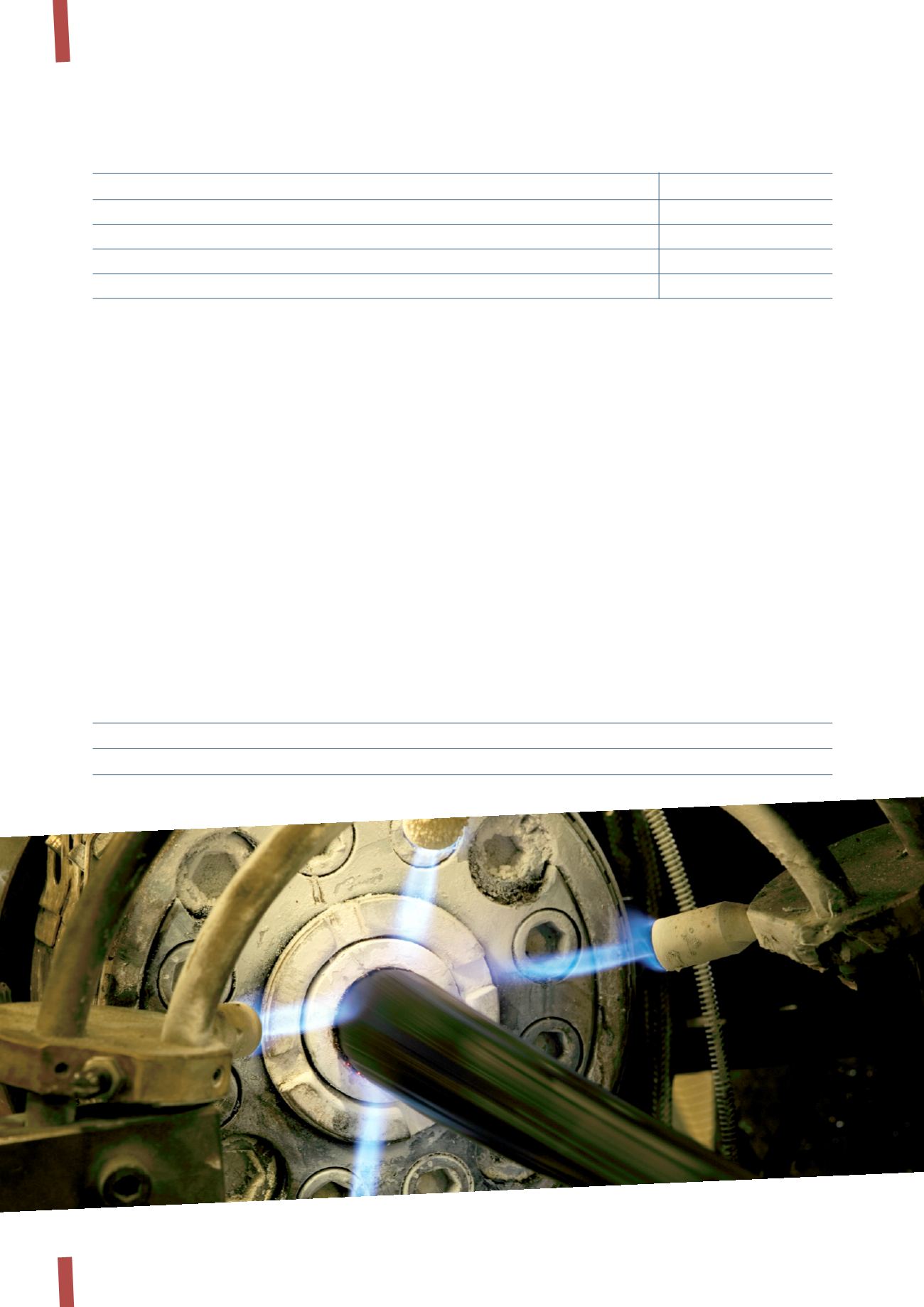

This credit agreement is split at a Group level as follows:

(in thousands of Euro)

Term Loan Facility 2010

670,000

Revolving Credit Facility 2010

400,000

(1)

Credit Agreements refer to the following lines: Term Loan Facility 2010 and Term Loan Facility 2011.

(in thousands of Euro)

31 December 2012

31 December 2011

Credit Agreement

(1)

713,033

462,117

Bond

412,819

411,817

Other borrowings

722

2,001

Total

1,126,574

875,935

Borrowings from banks and other financial institutions and the bond are analysed as follows: