309

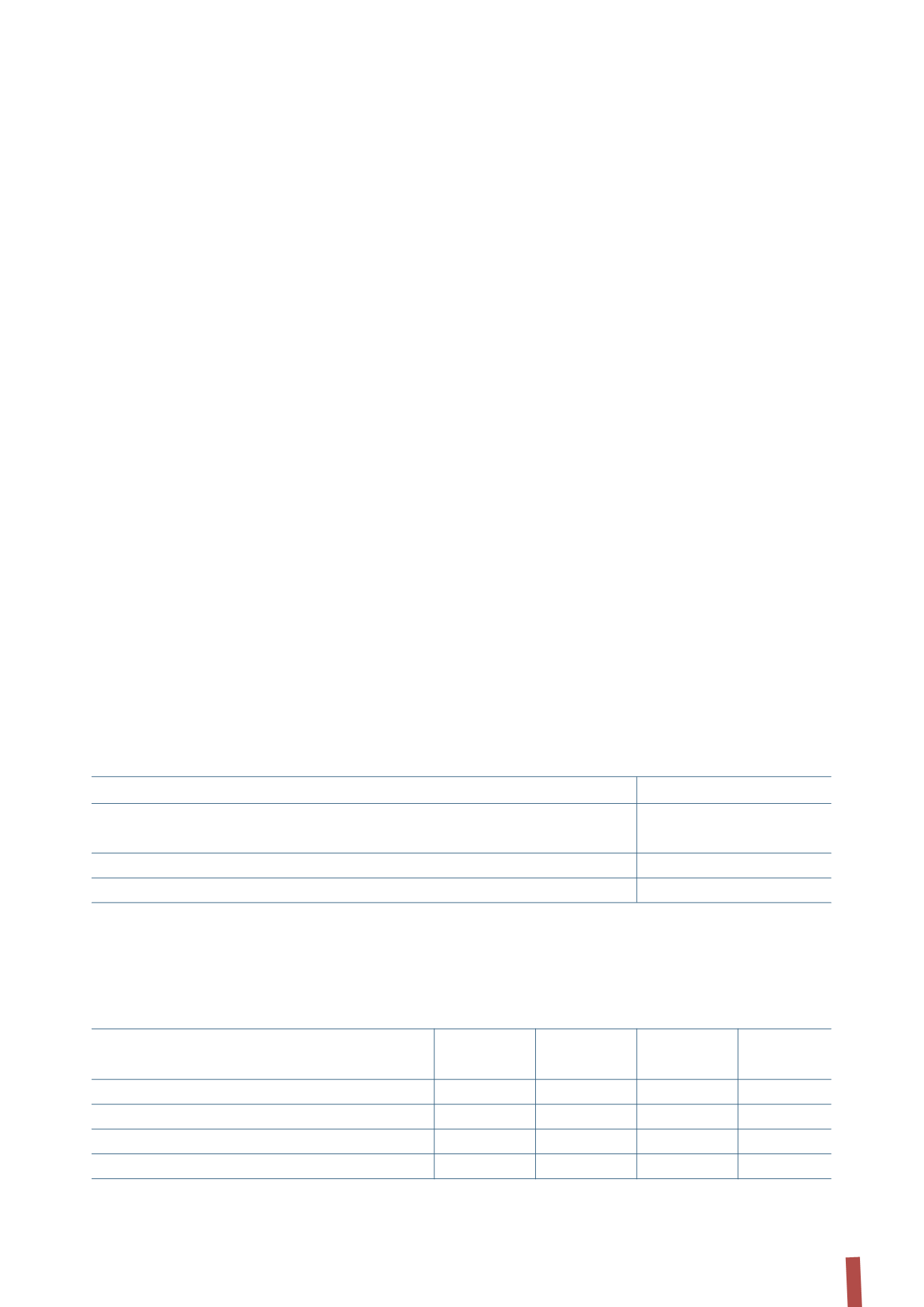

These are detailed as follows:

Movements in deferred tax assets are detailed as follows:

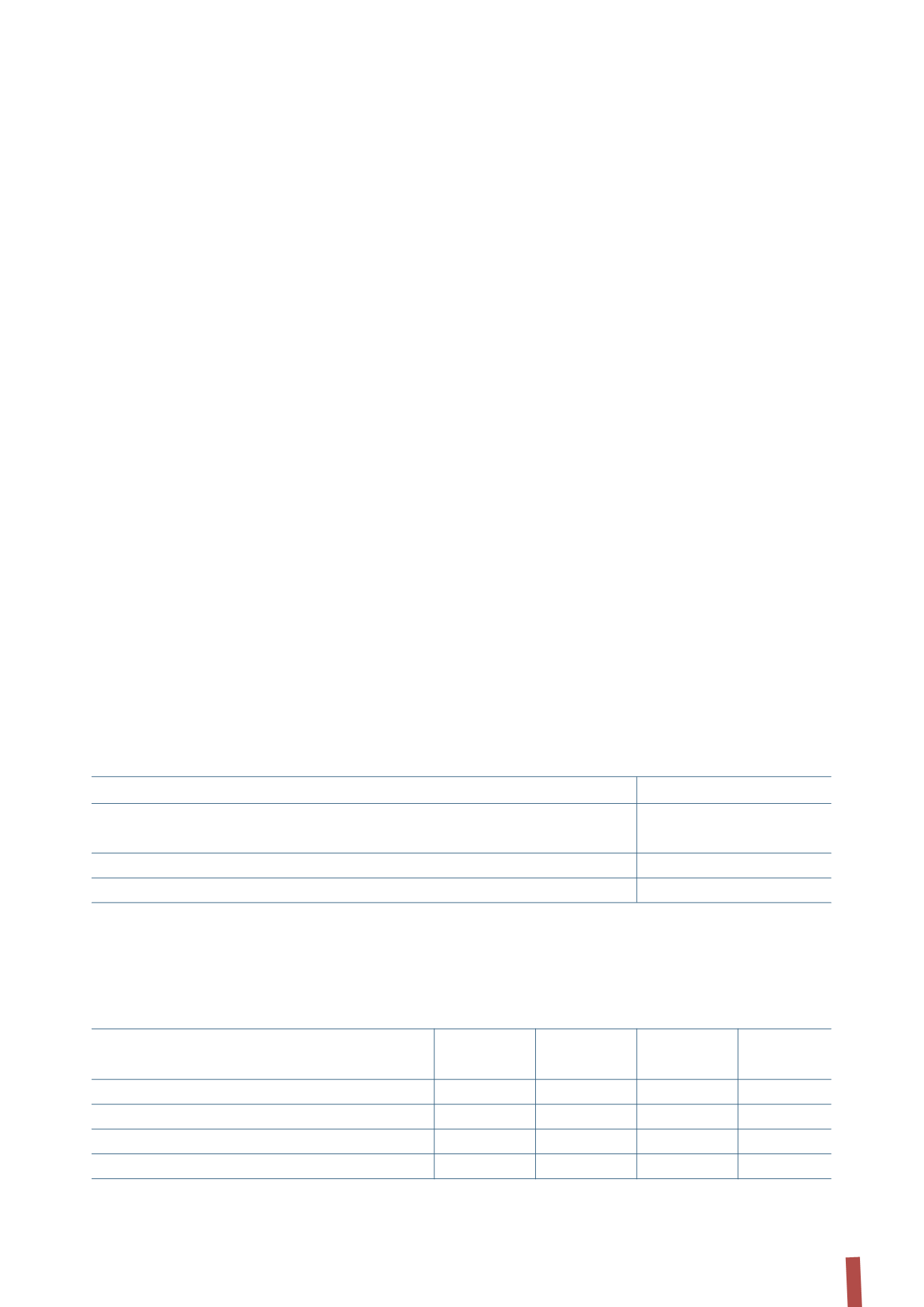

4. DEFERRED TAX ASSETS

(in thousands of Euro)

31 December 2012

31 December 2011

Deferred tax assets:

Deferred tax assets recoverable beyond 12 months

3,809

2,300

Deferred tax assets recoverable within 12 months

2,192

2,614

Total deferred tax assets

6,001

4,914

(in thousands of Euro)

Employee benefit

Provisions for Capital increase

Other

Total

obligations

risks

costs

Balance at 31 December 2011

980

1,281

1,049

1,604

4,914

Impact on income statement

1,747

457

-

(998)

1,206

Impact on equity

143

-

(262)

-

(119)

Balance at 31 December 2012

2,870

1,738

787

606

6,001

- on 5 March 2012, Prysmian Cavi e Sistemi S.r.l and Prysmian

S.p.A. respectively acquired 99.99% and 0.01% of the shares

in Jaguar Communication Consultancy Services Private Ltd,

an Indian company formed on 31 January 2012;

- on 1 June 2012, the Company acquired a 0.01% interest in

Prysmian Surflex Umbilicais e Tubos Flexiveis do Brasil Ltda

from its subsidiary Prysmian Cavi e Sistemi S.r.l;

- on 30 November 2012, the Company made capital

contributions to the subsidiary Draka Holding N.V. for Euro

230,000 thousand, to the subsidiary Prysmian Treasury S.r.l.

for Euro 12,000 thousand and to the subsidiary Fibre Ottiche

Sud – F.O.S. S.r.l. for Euro 12,000 thousand;

- increases totalling Euro 935 thousand for the compensation-

related component of stock options over Prysmian

S.p.A. shares held by managers employed by other Group

companies, as explained in Note 15. Personnel costs. This

component has been treated like a capital contribution to the

subsidiaries and so reported as an increase in the value of

the investments in the subsidiaries in which these managers

are directly or indirectly employees. These increases are

matched by a corresponding movement in the specific equity

reserve. Further information can be found in Note 7. Share

capital and reserves.

Demerger:

With effect from 1 October 2012 Prysmian S.p.A. received

through demerger:

- from the subsidiary Prysmian Cavi e Sistemi S.r.l., the

interests in Prysmian Cavi e Sistemi Italia S.r.l. (100%),

Prysmian PowerLink S.r.l. (84.8%), Prysmian Treasury S.r.l.

(100%) and Fibre Ottiche Sud – F.O.S. S.r.l. (100%);

- from the subsidiary Prysmian Cavi e Sistemi Italia S.r.l., a

minority interest in Prysmian PowerLink S.r.l. (15.2%).

For completeness of disclosure, it is reported that the demerger

took the form of a business combination involving entities or

business under common control, and so was outside the scope

of IFRS 3.

The financial statements for the year ended 31 December 2012

have therefore been prepared by applying the principle of

continuity in values for the beneficiary. The values at which the

Company has recognised the investments acquired with the

demerger have been determined on the basis of net assets (of

each demerged company), with a consequent proportionate

reduction in the value of the investment in the subsidiary

Prysmian Cavi e Sistemi S.r.l..