327

Personnel costs have increased in 2012 relative to 2011 partly

as a result of higher management bonuses and incentives, as

discussed in Note 23.

Retirement pension costs (Euro 1,658 thousand) refer to the

amount of employee indemnity liability accruing in the year

and paid by the Company into supplementary pension funds or

into the special fund established by INPS (Italy’s social security

agency) following the changes introduced under Law 296/06.

Other personnel costs mostly reflect the recognition of

liabilities for the new long-term incentive plan 2011-2013 which

will be settled in 2014; more details can be found in the later

paragraph on “Long-term incentive plan”.

Share-based payments

At 31 December 2012 and 31 December 2011, Prysmian S.p.A.

had share-based compensation plans in place for managers

of Group companies and members of the Company’s Board of

Directors. These plans are described below.

Stock option plan 2007-2012

On 30 November 2006, the Company’s shareholders approved

a stock option plan which was dependent on the flotation of

the Company’s shares on Italy’s Electronic Equities Market

(Mercato Telematico Azionario - MTA) organised and managed

by Borsa Italiana S.p.A.. The plan was reserved for employees

of companies in the Prysmian Group.

Each option entitles the holder to subscribe to one share at a

price of Euro 4.65.

These are detailed as follows:

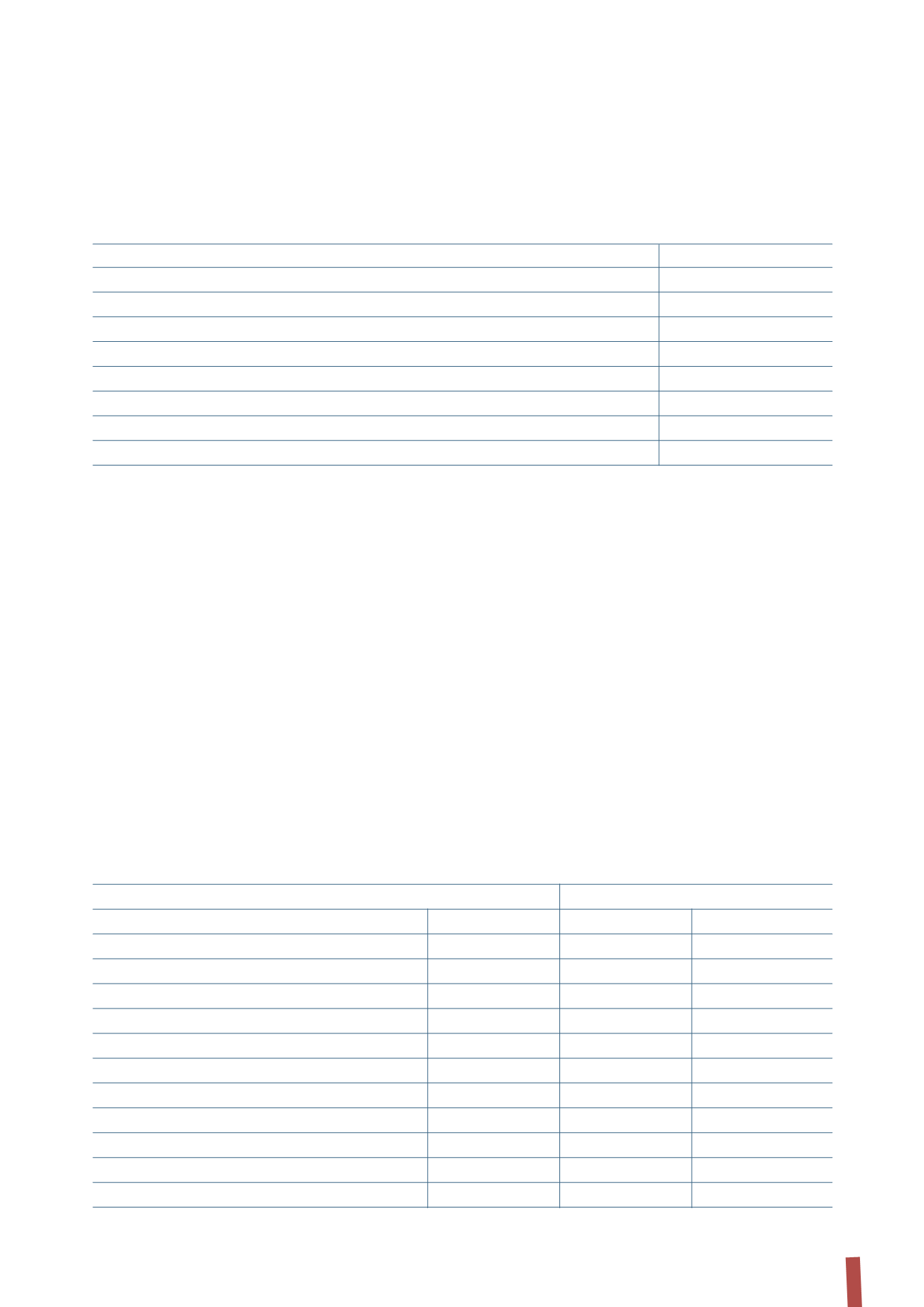

15. PERSONNEL COSTS

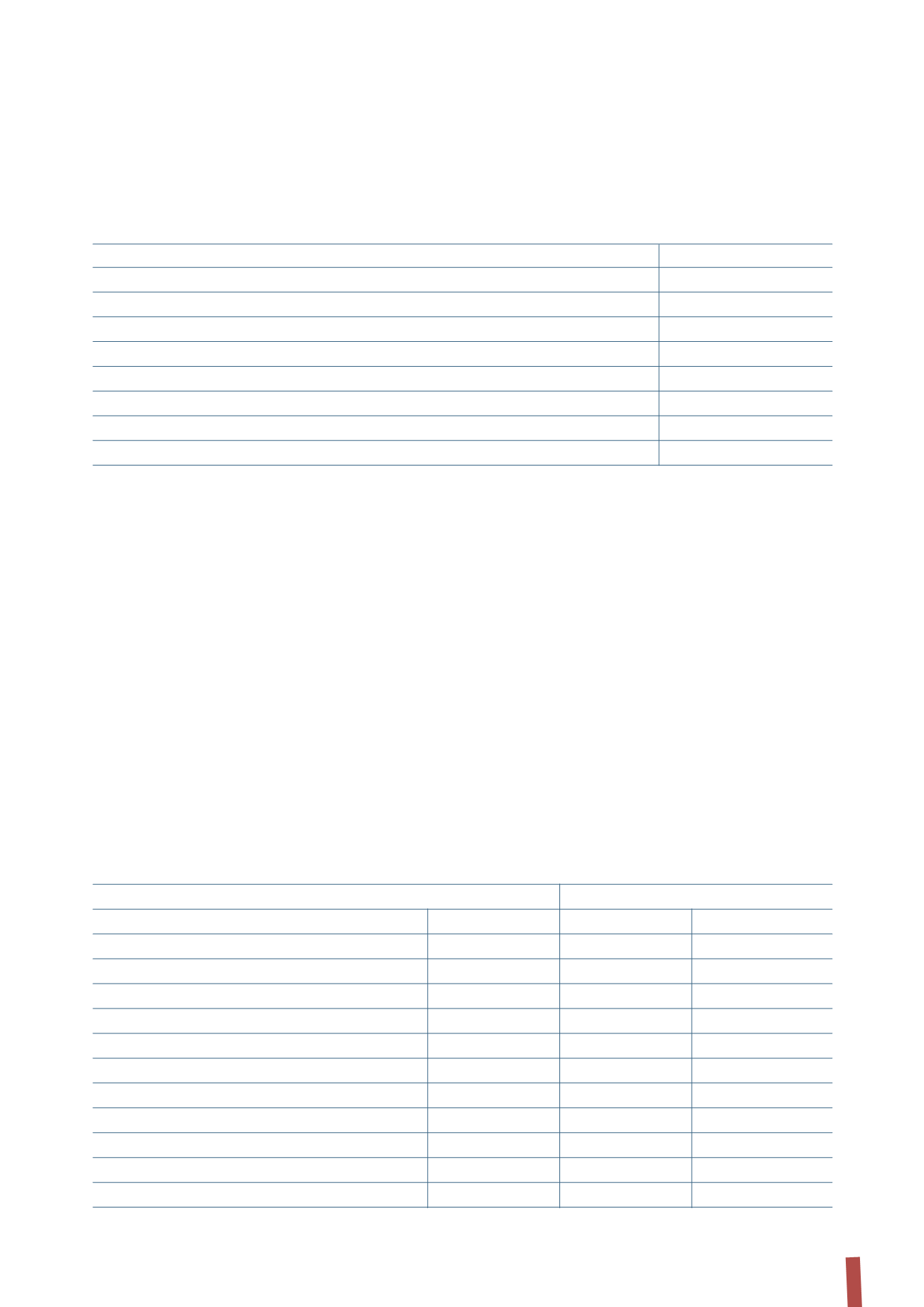

The following table provides further details about the stock option plan:

(1)

Options can be exercised in specified periods only.

(in thousands of Euro)

2012

2011

Wages and salaries

29,720

24,900

Social security

7,152

5,969

Retirement pension costs

1,658

1,546

Non-recurring personnel costs (income):

Company reorganisation

2,979

3,306

Total non-recurring personnel costs (income)

2,979

3,306

Other personnel costs

9,958

5,693

Total

51,467

41,414

(in Euro)

31 December 2012

31 December 2011

Number options

Exercise price

Number options

Exercise price

Options at start of year

198,237

4.65

737,846

4.65

Granted

-

4.65

-

4.65

Cancelled

-

-

-

-

Exercised

(115,300)

4.65

(539,609)

4.65

Options at end of year

82,937

4.65

198,237

4.65

of which Prysmian Spa

65,333

4.65

145,265

4.65

of which vested at end of year

82,937

4.65

198,237

4.65

of which Prysmian Spa

65,333

4.65

145,265

4.65

of which exercisable

(1)

-

-

-

-

of which not vested at end of year

-

4.65

-

4.65

of which Prysmian Spa

-

4.65

-

4.65