PARENT COMPANY >

FINANCIAL STATEMENTS AND EXPLANATORY NOTES

330

| 2012 annual report prysmian group

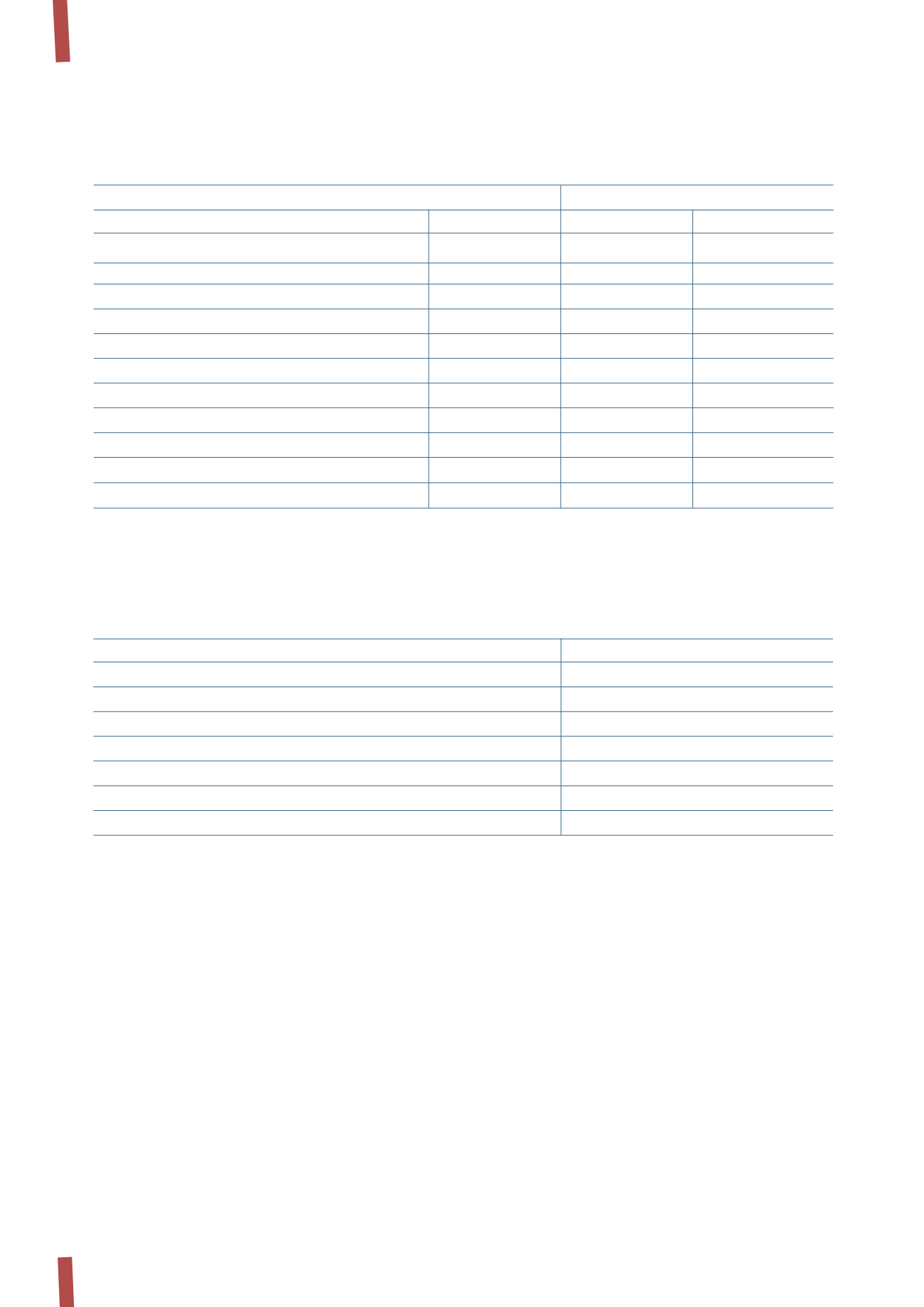

The fair value of the options has been determined using the Cox-Ross-Rubistein binomial pricing model, based on the following

assumptions:

At 31 December 2012, the options have an average remaining

life of 1 year.

At 31 December 2012, the overall cost recognised in the income

statement under “Personnel costs” in relation to the fair

value of the options granted has been estimated at Euro 5,557

thousand.

The information memorandum, prepared under art. 114-bis

of Legislative Decree 58/98 and describing the characteristics

of the above incentive plan, is publicly available on the

Company’s website at

/, from

its registered offices and from Borsa Italiana S.p.A..

As at 31 December 2012, there are no loans or guarantees by

the Parent Company or its subsidiaries to any of the directors,

senior managers or statutory auditors.

(*) The number of options shown has been determined assuming that the objective achieved is a mean between the Target and the Adjusted EBITDA upper limit.

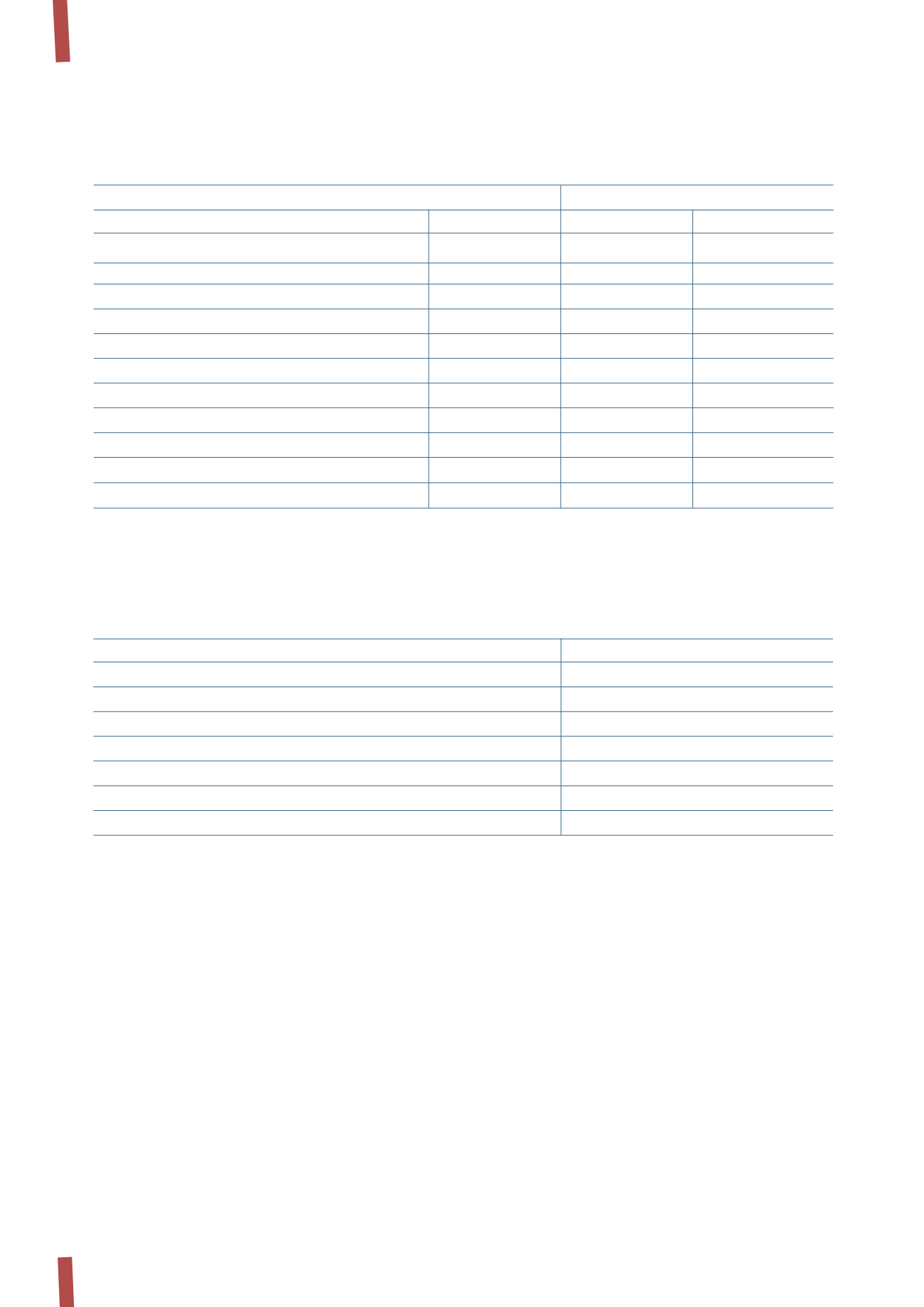

The following table provides further details about the plan:

(in Euro)

For consideration

For no consideration

Number options (*)

Exercise price Number options (*)

Exercise price

Options at start of year

2,131,500

0.10

2,017,223

-

Granted

-

0.10

5,772

-

Cancelled

-

-

(132,120)

-

Exercised

-

0.10

-

-

Options at end of year

2,131,500

0.10

1,890,875

-

of which Prysmian Spa

645,396

0.10

669,132

-

of which vested at end of year

-

0.10

-

-

of which Prysmian Spa

-

0.10

-

-

of which exercisable

-

-

-

-

of which not vested at end of year

2,131,500

0.10

1,890,875

-

of which Prysmian Spa

645,396

0.10

669,132

-

Options for consideration

Options for no consideration

Grant date

2 September 2011

2 September 2011

Remaining life at grant date (in years)

2.33

2.33

Exercise price (Euro)

0.10

-

Expected volatility

45.17%

45.17%

Risk-free interest rate

1.56%

1.56%

Expected interest rate

3.96%

3.96%

Option fair value at grant date (Euro)

10.53

10.63