45

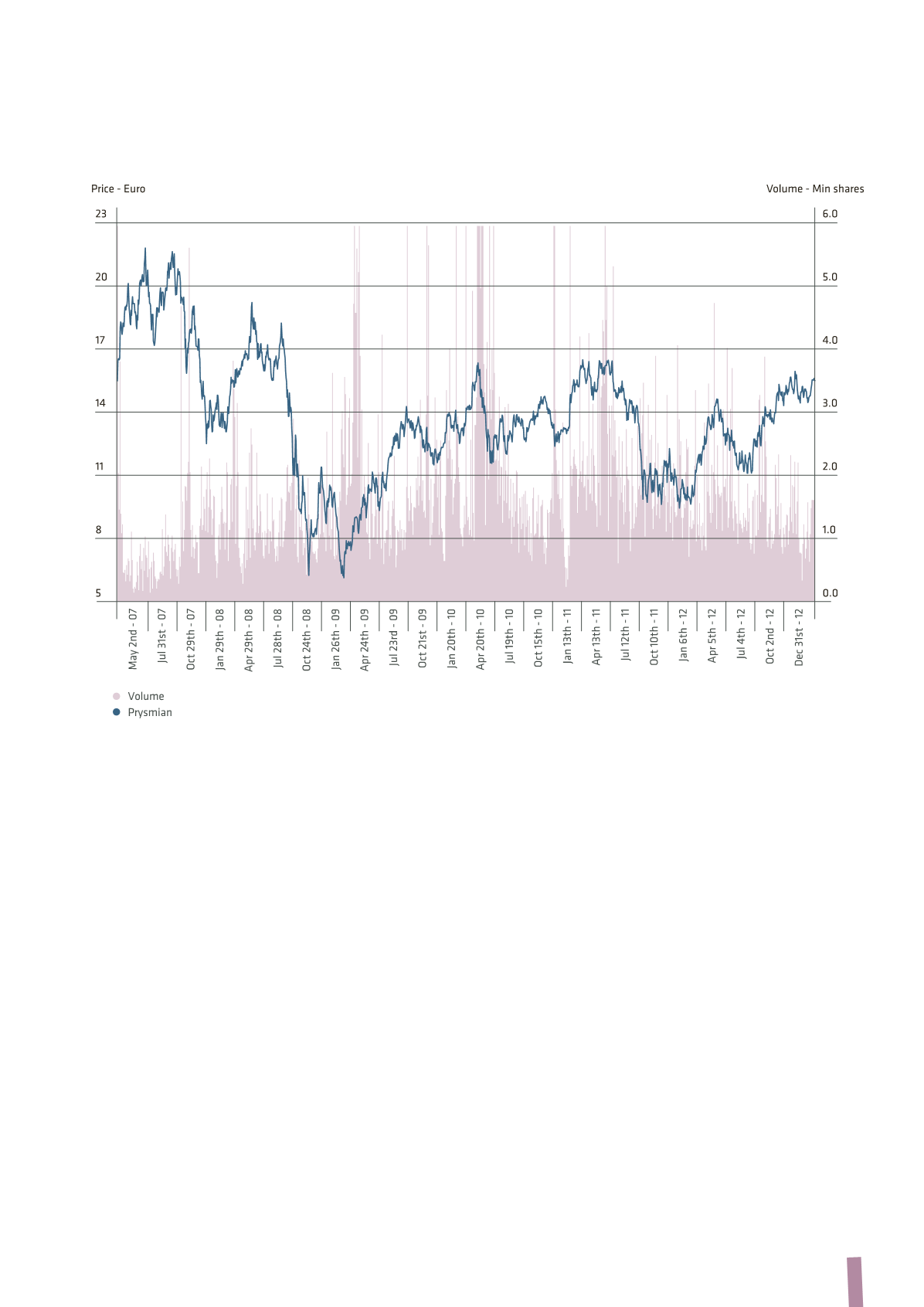

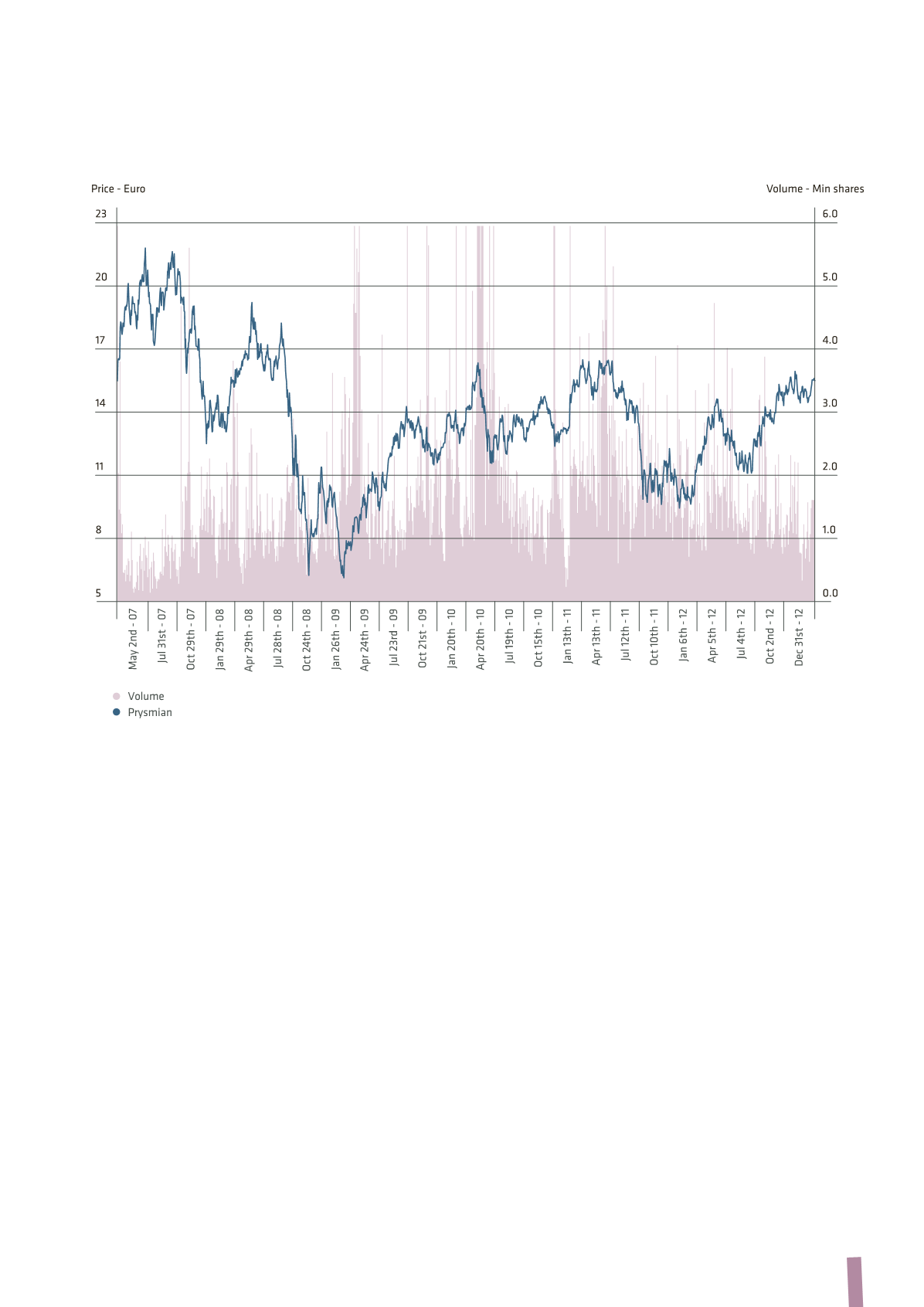

PERFORMANCE OF PRYSMian STOCK SINCE IPO

outperforming its competitors and benchmark indices,

thereby increasing its weight within such indices. The stock’s

performance, including dividend pay-outs (total shareholder

return), was a gain of +59% over the course of 2012 and +11%

since its listing date. The MSCI Europe Capital Goods index

reported a rise of 16% over the year and a fall of -24% since

Prysmian’s listing date, while the FTSE MIB was up 8% from

the start of the year but down -63% since the date of the

Company’s IPO. By way of reference, the principal financial

markets performed as follows in 2012: FTSE MIB: +8%, CAC 40

(France): +15%; IBEX (Spain): -5%; FTSE 100 (UK): +6%; DAX

(Germany): +29%; Dow Jones (US): +7%; S&P 500 (US): +13%;

Nikkei (Japan): +23%; MSCI Europe Capital Goods: +16%.

In particular, during the first quarter of 2012, the Prysmian

stock increased to more than Euro 14, as part of a positive

trend also seen, albeit to a lesser extent, in the major

European indices. In fact, thanks to the actions of the ECB, the

tensions on Eurozone financial markets eased considerably,

leading to a significant reduction in the risk premiums on

European government bonds.

However, from the month of March, there were renewed

concerns over the sustainability of debt levels in some

European countries, particularly Greece, and equity markets

gradually retreated, cancelling all the first-quarter gains by the

end of June. The Prysmian stock was impacted by the bearish

trend, falling to around Euro 11 in June. Thanks to strong

intervention by the ECB, global financial markets stabilised

from July and, in some cases, strengthened, despite the

general slowdown in the global economy and the worsening

outlook for future growth. In this context, the Prysmian

stock entered a positive phase, supported by the growth in

its results and the positive recommendations of financial

analysts, significantly outperforming all the stock indices

and returning to its 2007 listing price of Euro 15, at which

it stabilised in the last few months of the year, eventually

closing the year at Euro 15.01, up 56% from Euro 9.60 at the

end of 2011.

During 2012, the stock’s liquidity recorded an average daily

trading volumes of approximately 1.5 million shares, a

decrease compared with 2011 due to the general reduction

in volumes traded on European stock markets, particularly

in countries like Italy, that were hardest hit by financial

speculation. The average daily value traded amounted to Euro

20 million versus Euro 28 million in 2011.