199

(1)

The sales of the operating segments and business areas are reported net

of intercompany transactions, consistent with the presentation adopted in

2012.

(2)

Refers to the higher cost of using finished and semi-finished goods and raw

materials measured at the Draka Group’s acquisition-date fair value.

(*)

The figures reported above include the Draka Group’s results for the period

1 March – 31 December 2011.

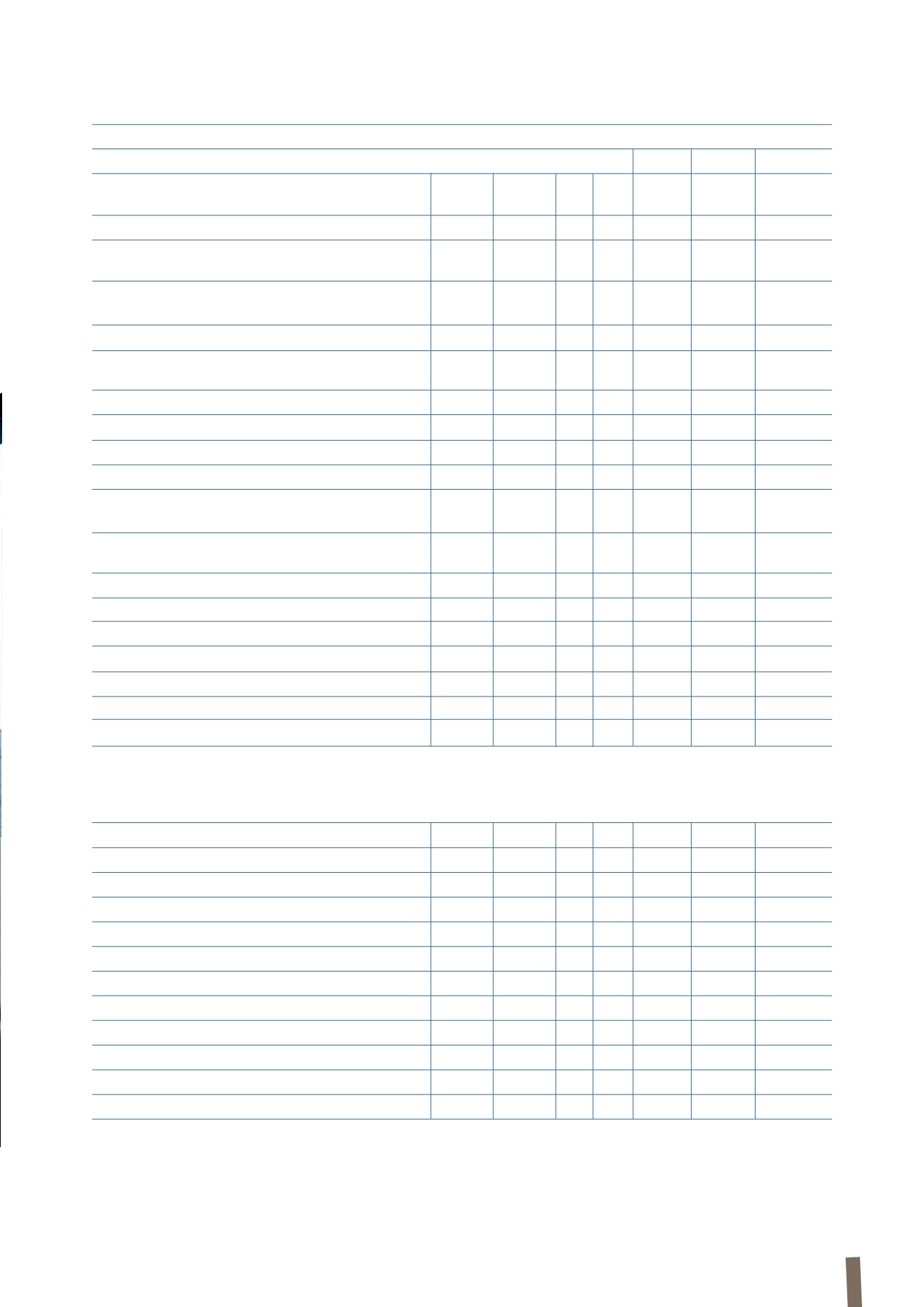

(in millions of Euro)

2011

Energy Telecom Corporate

Group total

Utilities

Trade & Industrial Other Total

Installers

Sales of goods and services to third parties

(1)

2,252

2,281

1,608

127 6,268

1,315

-

7,583

Adjusted EBITDA (A)

267

70

106

4

447

121

-

568

% of sales

11.8%

3.0%

6.6%

7.1%

9.1%

7.5%

EBITDA (B)

55

53

80

(2)

186

103

(20)

269

% of sales

2.4%

2.3%

5.0%

- 2.9%

7.7%

3.4%

Amortisation and depreciation (C)

(25)

(36)

(35)

(3)

(99)

(43)

-

(142)

Adjusted operating income (A+C)

242

34

71

1

348

78

426

% of sales

10.7%

1.5%

4.4%

5.5%

5.8%

5.6%

Fair value change in metal derivatives (D)

(62)

Fair value - stock options (E)

(7)

Remeasurement of minority put option liability (F)

-

-

-

-

-

(1)

(1)

Impairment of assets (G)

(17)

(6)

(8)

-

(31)

(7)

(38)

Operating income (B+C+D+E+F+G)

19

% of sales

0.3%

Share of income from investments in associates and dividends

from other companies

7

2

9

Finance costs

(360)

Finance income

231

Taxes

(44)

Net profit/(loss) for the year

(145)

Attributable to:

Owners of the parent

(136)

Non-controlling interests

(9)

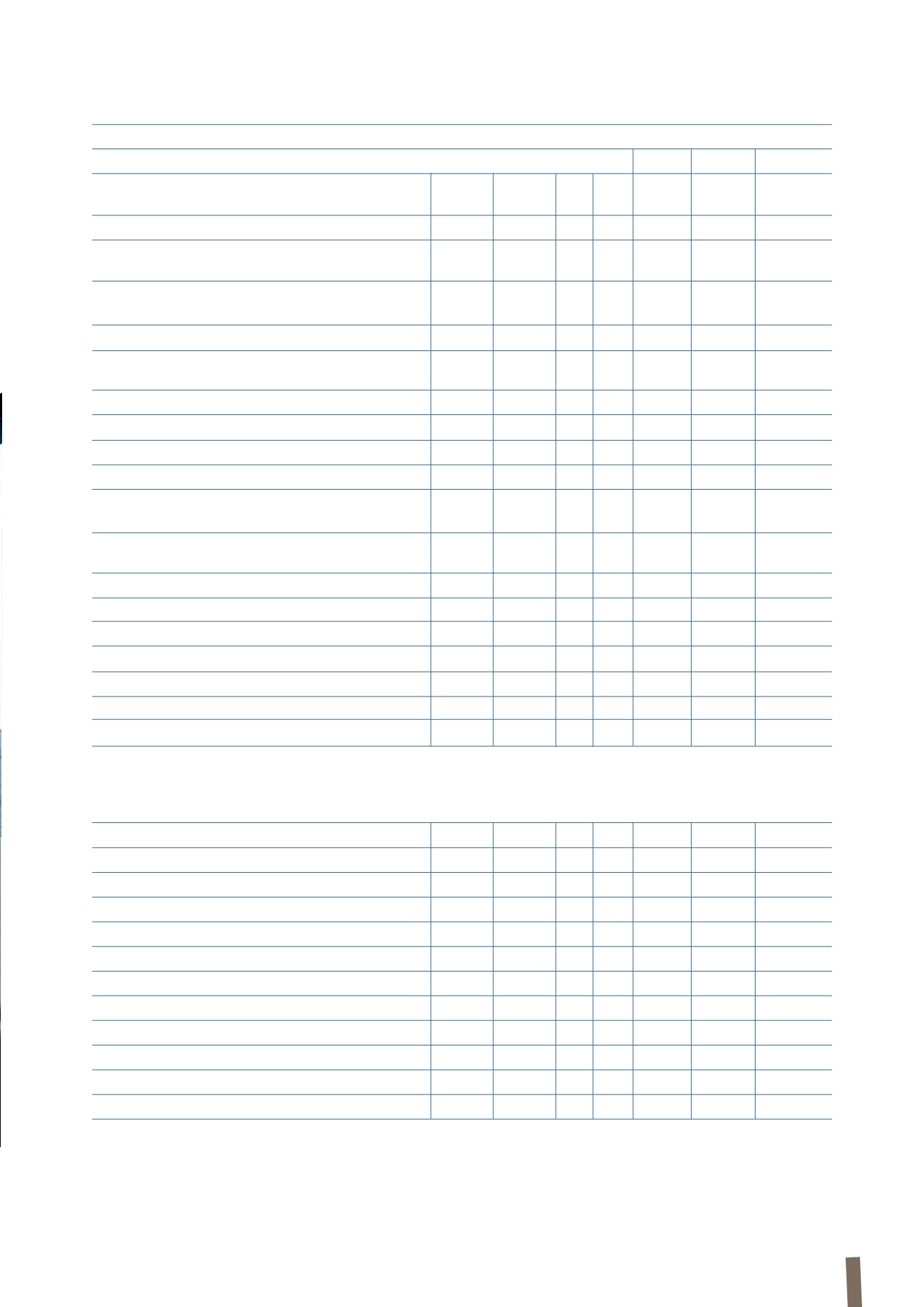

Reconciliation of EBITDA to Adjusted EBITDA

EBITDA (A)

55

53

80

(2)

186

103

(20)

269

NON-RECURRING EXPENSES/(INCOME):

Company reorganisation

5

8

22

7

42

12

2

56

Antitrust

205

-

-

-

205

-

-

205

Draka integration costs

-

2

-

-

2

-

10

12

Draka acquisition costs

-

-

-

-

-

-

6

6

Effects of Draka change of control

-

-

-

-

-

-

2

2

Release of Draka inventory step-up

(2)

-

5

3

-

8

6

-

14

Environmental remediation and other costs

2

2

1

-

5

-

-

5

Gains on disposal of assets held for sale

-

-

-

(1)

(1)

-

-

(1)

Total non-recurring expenses/(income) (B)

212

17

26

6

261

18

20

299

Adjusted EBITDA (A+B)

267

70

106

4

447

121

-

568