Consolidated Financial Statements >

CONSOLIDATED FINANCIAL STATEMENTS AND EXPLANATORY NOTES

190

| 2012 annual report prysmian group

C.2

FAIR VALUE

The fair value of financial instruments listed on an active

market is based on market price at the reporting date. The

market price used for derivatives is the bid price, while for

financial liabilities the ask price is used. The fair value of

instruments not listed on an active market is determined

using valuation techniques based on a series of methods and

assumptions linked to market conditions at the reporting date.

Other techniques, such as that of estimating discounted cash

flows, are used for the purposes of determining the fair value

of other financial instruments.

The fair value of interest rate swaps is calculated on the basis

of the present value of forecast future cash flows. The fair

value of currency futures is determined using the forward

exchange rate at the reporting date. The fair value of metal

derivative contracts is determined using the prices of such

metals at the reporting date.

Financial instruments are classified according to the following

fair value hierarchy:

Level 1:

fair value is determined with reference to quoted

(unadjusted) prices in active markets for identical financial

instruments;

Level 2

: fair value is determined using valuation techniques

where the input is based on observable market data;

Level 3

: fair value is determined using valuation techniques

where the input is not based on observable market data.

Financial assets classified in fair value level 3 reported no

significant movements in either 2012 or 2011.

Given the short-term nature of trade receivables and payables,

their book values, net of any allowance for doubtful accounts,

are treated as a good approximation of fair value.

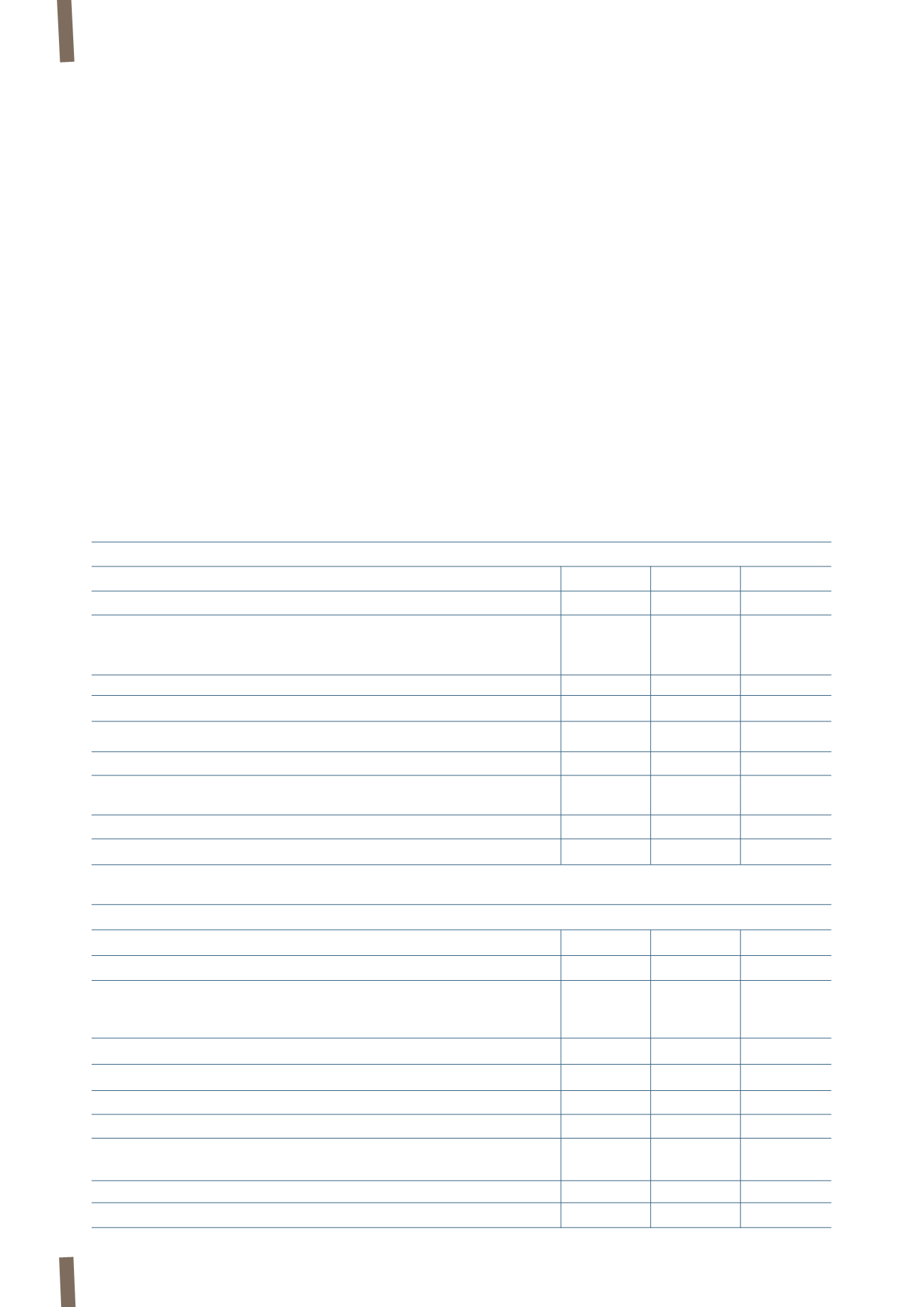

(in millions of Euro)

31 December 2012

Level 1

Level 2

Level 3

Total

ASSETS

Financial assets at fair value through profit or loss:

Derivatives

-

10

-

10

Financial assets held for trading

74

4

-

78

Hedging derivatives

-

9

-

9

Available-for-sale financial assets

-

-

14

14

Total assets

74

23

14

111

LIABILITIES

Financial liabilities at fair value through profit or loss:

Derivatives

-

16

-

16

Hedging derivatives

-

49

-

49

Total liabilities

-

65

-

65

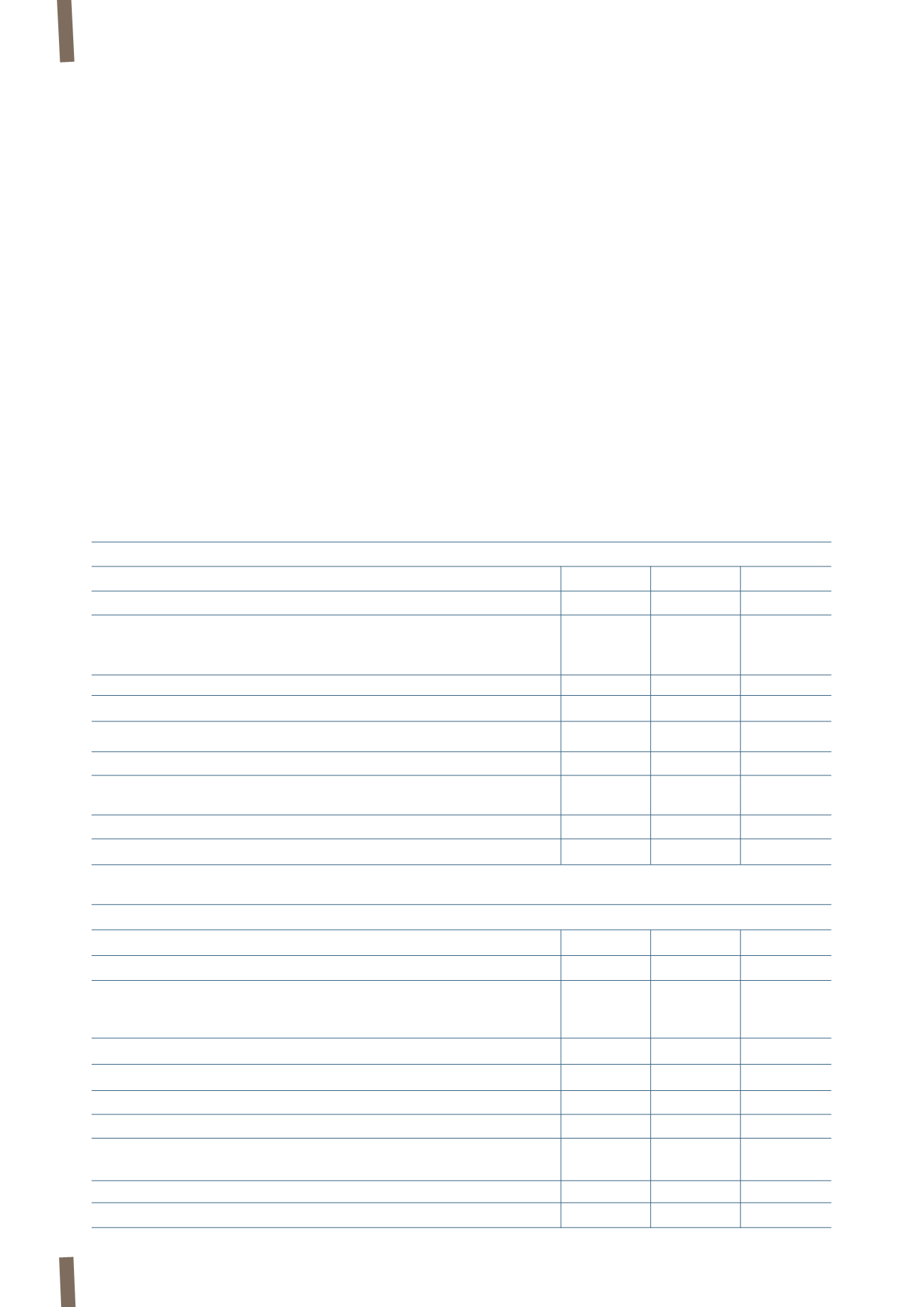

(in millions of Euro)

31 December 2011

Level 1

Level 2

Level 3

Total

ASSETS

Financial assets at fair value through profit or loss:

Derivatives

-

12

-

12

Financial assets held for trading

61

19

-

80

Hedging derivatives

-

18

-

18

Available-for-sale financial assets

-

-

6

6

Total assets

61

49

6

116

LIABILITIES

Financial liabilities at fair value through profit or loss:

Derivatives

-

50

-

50

Hedging derivatives

-

57

-

57

Total liabilities

-

107

-

107