197

F.1

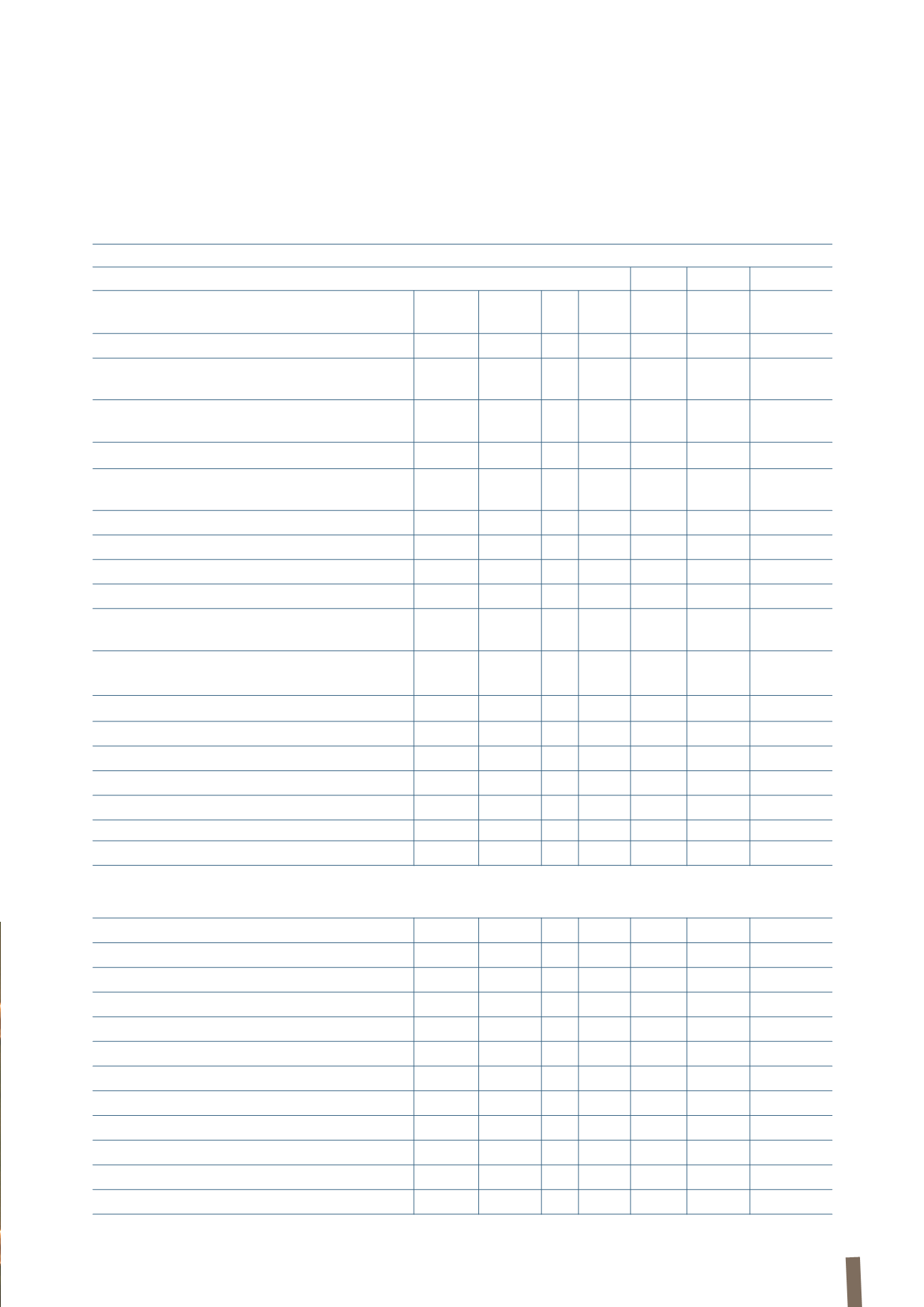

OPERATING SEGMENTS

The following tables present information by operating segment:

(1)

The sales of the operating segments and business areas are reported net of intercompany transactions, consistent with the presentation adopted in the

regularly reviewed reports.

(in millions of Euro)

2012

Energy Telecom Corporate

Group total

Utilities

Trade & Industrial Other

Total

Installers

Sales of goods and services to third parties

(1)

2,287

2,159

1,801

135

6,382

1, 466

-

7,848

Adjusted EBITDA (A)

270

77

139

1

487

160

-

647

% of sales

11.8%

3.6%

7.7% 0.6% 7.6%

10.9%

8.2%

EBITDA (B)

265

37

119

(4)

417

138

(9)

546

% of sales

11.6%

1.7%

6.6%

6.5%

9.4%

7.0%

Amortisation and depreciation (C)

(36)

(28)

(40)

(4)

(108)

(56)

(164)

Adjusted operating income (A+C)

234

49

99

(3)

379

104

483

% of sales

10.2%

2.3%

5.5%

5.9%

7.1%

6.2%

Fair value change in metal derivatives (D)

14

Fair value - stock options (E)

(17)

Impairment of assets (F)

(3)

(5)

(15)

-

(23)

(1)

(24)

Remeasurement of minority put option liability (G)

7

Operating income (B+C+D+E+F+G)

362

% of sales

4.6%

Share of income from investments in associates and dividends

from other companies

15

2

17

Finance costs

(393)

Finance income

258

Taxes

(73)

Net profit/(loss) for the year

171

Attributable to:

Owners of the parent

168

Non-controlling interests

3

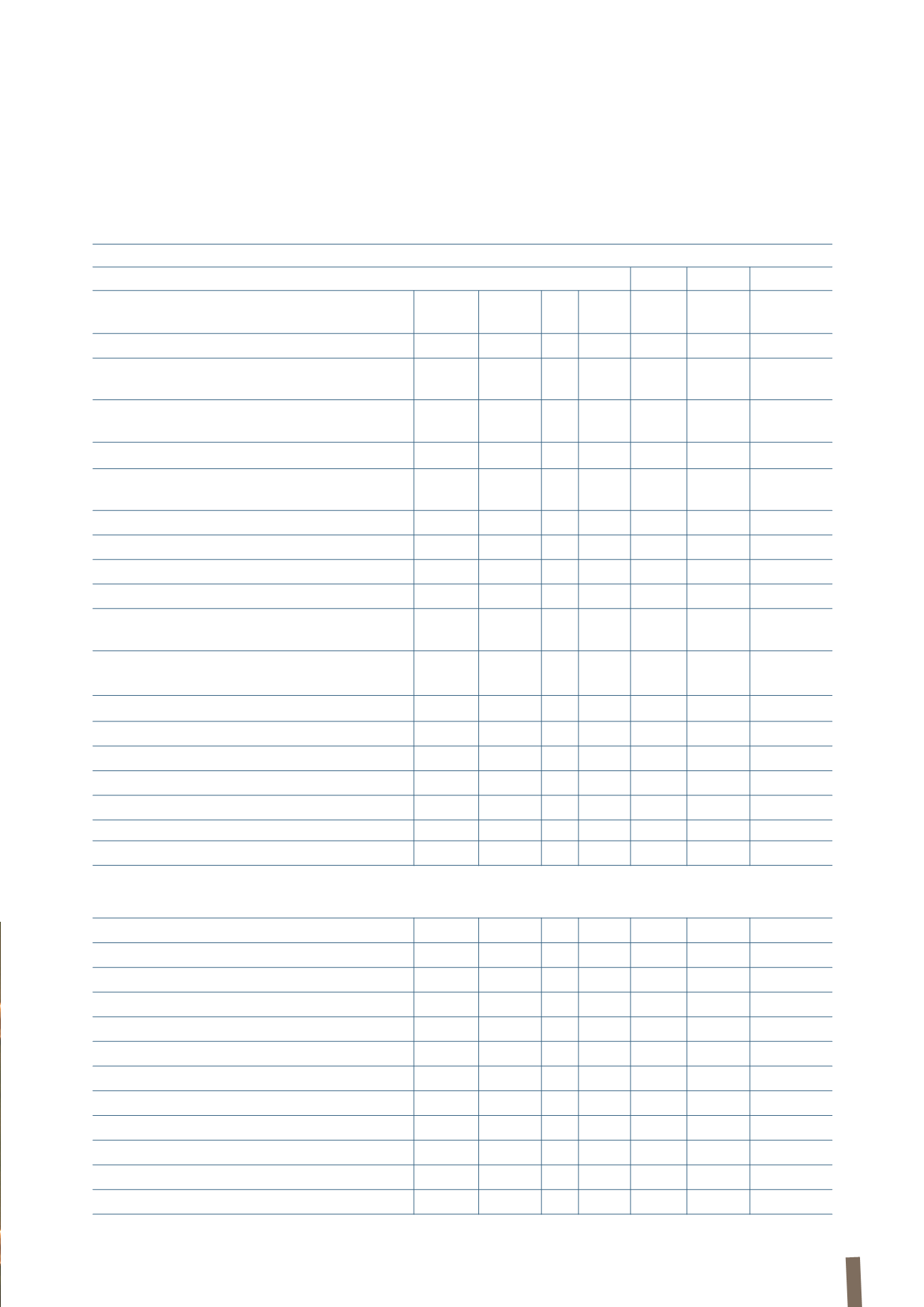

Reconciliation of EBITDA to Adjusted EBITDA

EBITDA (A)

265

37

119

(4)

417

138

(9)

546

NON-RECURRING EXPENSES/(INCOME):

Company reorganisation

3

29

16

5

53

16

5

74

Antitrust

1

-

-

-

1

-

-

1

Draka integration costs

-

2

2

-

4

1

4

9

Tax inspections

-

-

-

1

1

2

-

3

Environmental remediation and other costs

-

1

2

-

3

-

-

3

Italian pensions reform

1

-

-

-

1

-

-

1

Other non-recurring expenses

2

8

-

-

10

3

-

13

Gains on disposal of assets held for sale

(2)

-

-

(1)

(3)

-

-

(3)

Total non-recurring expenses/(income) (B)

5

40

20

5

70

22

9

101

Adjusted EBITDA (A+B)

270

77

139

1

487

160

-

647