Consolidated Financial Statements >

CONSOLIDATED FINANCIAL STATEMENTS AND EXPLANATORY NOTES

204

| 2012 annual report prysmian group

Gross investments in intangible assets amount to Euro 20

million in 2012, and primarily refer to:

• Euro 7 million for development of the SAP Consolidation

project, aimed at standardising the information system

throughout the Group. At 31 December 2012 the new

system had been implemented and was fully operational

in Germany, the Netherlands, Italy, Finland, Hungary,

Romania, Austria, Slovakia, France, Turkey, Spain and

Estonia.

• Euro 8 million for the Brazilian subsidiary’s development of

a prototype destined for flexible pipe production.

During 2012 the Prysmian Group recognised Euro 53 million in

“Goodwill” in connection with the acquisition of the majority

interest in Telcon Fios e Cabos para Telecomuniçaoes S.A. and

of Global Marine Systems Energy Ltd.. Further details can be

found in Section E. Business combinations.

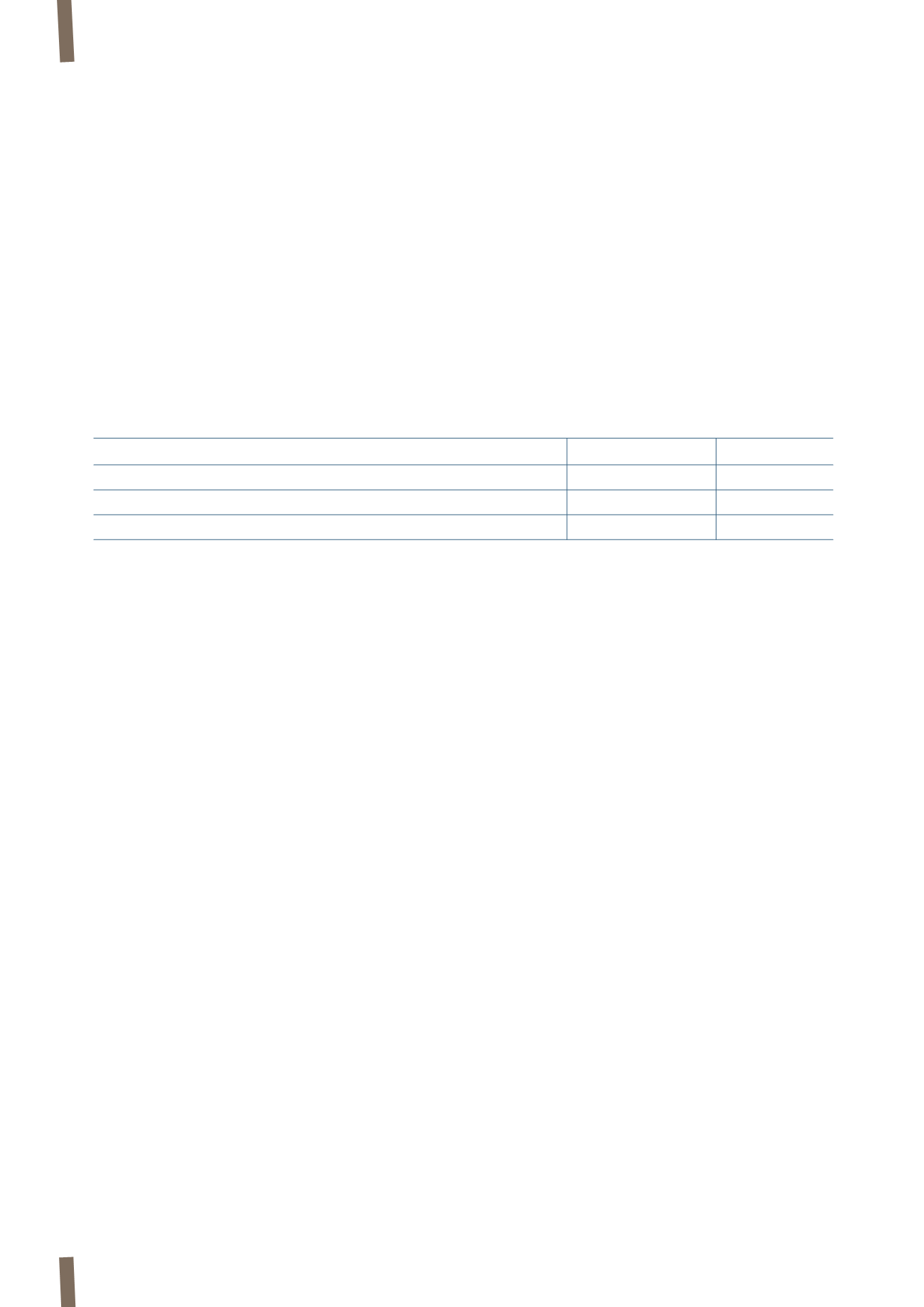

Goodwill impairment test

As reported earlier, the Chief Executive Officer reviews

operating performance by macro type of business (Energy and

Telecom). Goodwill is monitored internally at the Energy and

Telecom operating segment level. The amount of goodwill

allocated to each operating segment is reported in the

following table:

As described earlier, the acquisition of the majority interest in

Telcon Fios e Cabos para Telecomuniçaoes S.A. and of Global

Marine Systems Energy Ltd.. has led to the recognition of Euro

53 million in goodwill during 2012.

In 2011 the acquisition of the Draka Group had led to the

recognition of Euro 352 million in goodwill. This goodwill is

justified by the synergies expected from integrating the two

groups. Based on the predicted realisation of these synergies,

the directors have allocated the goodwill to the two operating

segments.

The amount of goodwill thus allocated (summed with the

remaining portion of the operating segment’s net invested

capital) has been compared with the recoverable amount of

each operating segment, determined on the basis of their value

in use.

Forecast cash flows have been calculated using the post-tax

cash flows expected by management for 2013, prepared on

the basis of results achieved in previous years and the outlook

for the markets concerned. The cash flow forecasts for both

operating segments have been extended to the period 2014-

2015 based on 3% projected growth. A terminal value has been

estimated to reflect CGU value after this period; this value

has been determined assuming a 2% growth rate. The rate

used to discount cash flows has been determined on the basis

of market information about the cost of money and asset-

specific risks (Weighted Average Cost of Capital, WACC). The

test has shown that the recoverable amount of the individual

CGUs is higher than their net invested capital (including the

share of allocated goodwill). In particular, in percentage terms,

recoverable amount exceeds carrying amount by 205% for

the Energy operating segment and by 92% for the Telecom

operating segment. It should be noted that the discount rate

at which recoverable amount is equal to carrying amount is

19% for the Energy operating segment and 14% for the Telecom

operating segment (compared with a WACC of 8.2% used for

both operating segments), while, in order to determine the

same match for growth rates, the growth rate would have to be

negative for both segments.

(in millions of Euro)

31 December 2011

Business combinations 31 December 2012

Energy goodwill

253

49

302

Telecom goodwill

99

4

103

Total goodwill

352

53

405