Consolidated Financial Statements >

CONSOLIDATED FINANCIAL STATEMENTS AND EXPLANATORY NOTES

186

| 2012 annual report prysmian group

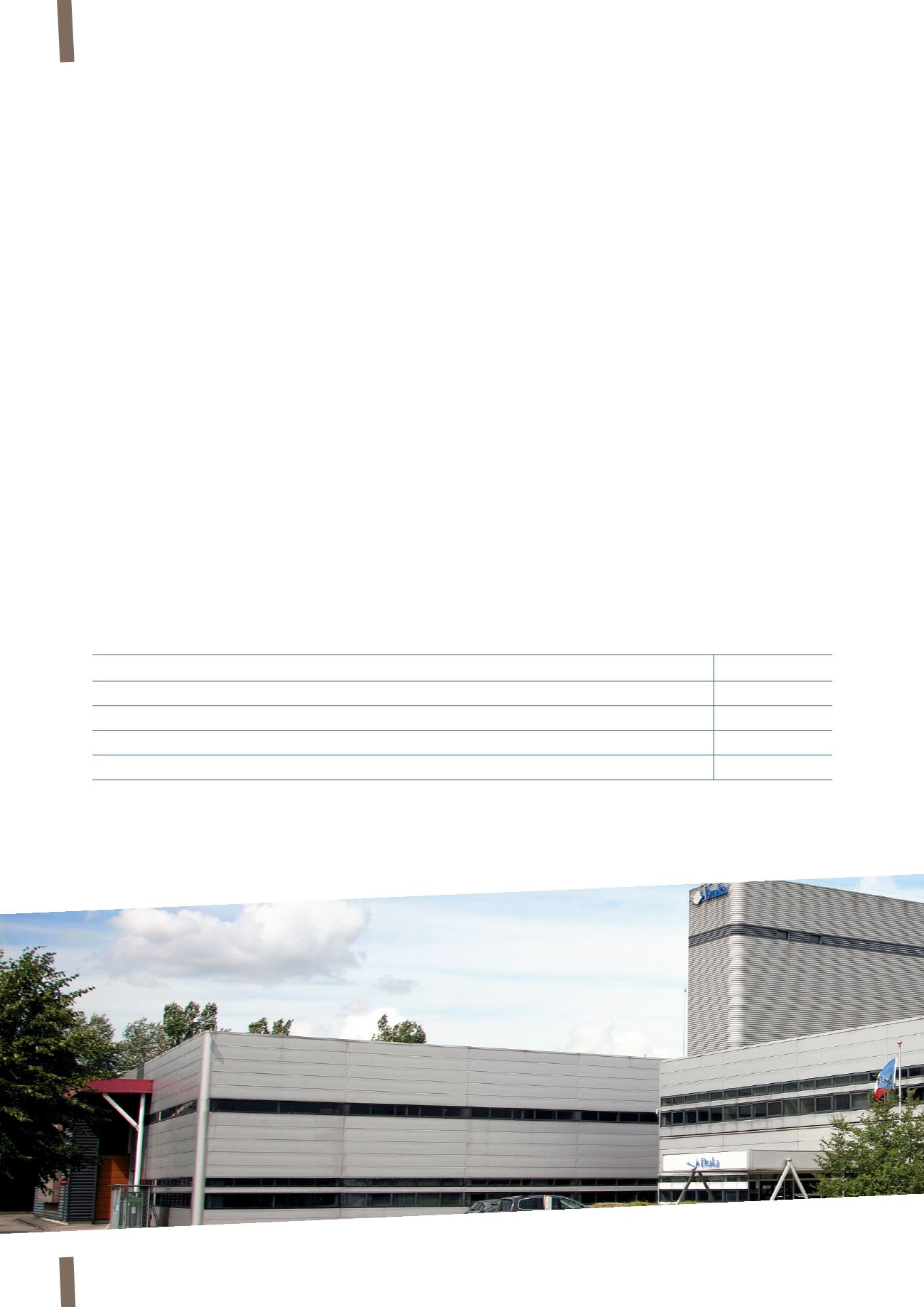

(in millions of Euro)

31 December 2012

31 December 2011

Cash and cash equivalents

812

727

Financial assets held for trading

78

80

Unused committed lines of credit

871

1,033

Total

1,761

1,840

[d] Credit risk

Credit risk is connected with trade receivables, cash and cash

equivalents, financial instruments, and deposits with banks and

other financial institutions.

Customer-related credit risk is managed by the individual

subsidiaries and monitored centrally by the Group

Finance Department. The Group does not have significant

concentrations of credit risk. It nonetheless has procedures

aimed at ensuring that sales of products and services are made

to reliable customers, taking account of their financial position,

track record and other factors. Credit limits for major customers

are based on internal and external assessments within ceilings

approved by local country management. The utilisation of credit

limits is periodically monitored at local level.

During 2012 the Group entered into a global insurance policy

providing coverage for part of its trade receivables against any

losses.

As for credit risk relating to the management of financial and

cash resources, this risk is monitored by the Group Finance

Department, which implements procedures aimed at ensuring

that Group companies deal with independent, high standing,

reliable counterparties. In fact, at 31 December 2012 (like at

31 December 2011) almost all the Group’s financial and cash

resources were held with investment grade counterparties.

Credit limits relating to the principal financial counterparties

are based on internal and external assessments, within

ceilings defined by the Group Finance Department.

[e] Liquidity risk

Prudent management of the liquidity risk arising from the

Group’s normal operations involves the maintenance of

adequate levels of cash and cash equivalents and short-

term securities as well as availability of funds by having an

adequate amount of committed credit lines.

The Group Finance Department uses cash flow forecasts to

monitor the projected level of the Group’s liquidity.

The amount of liquidity reserves at the reporting date is as follows: