33

During 2013, the stock’s liquidity recorded average daily trading volumes

of approximately 1.2 million shares.

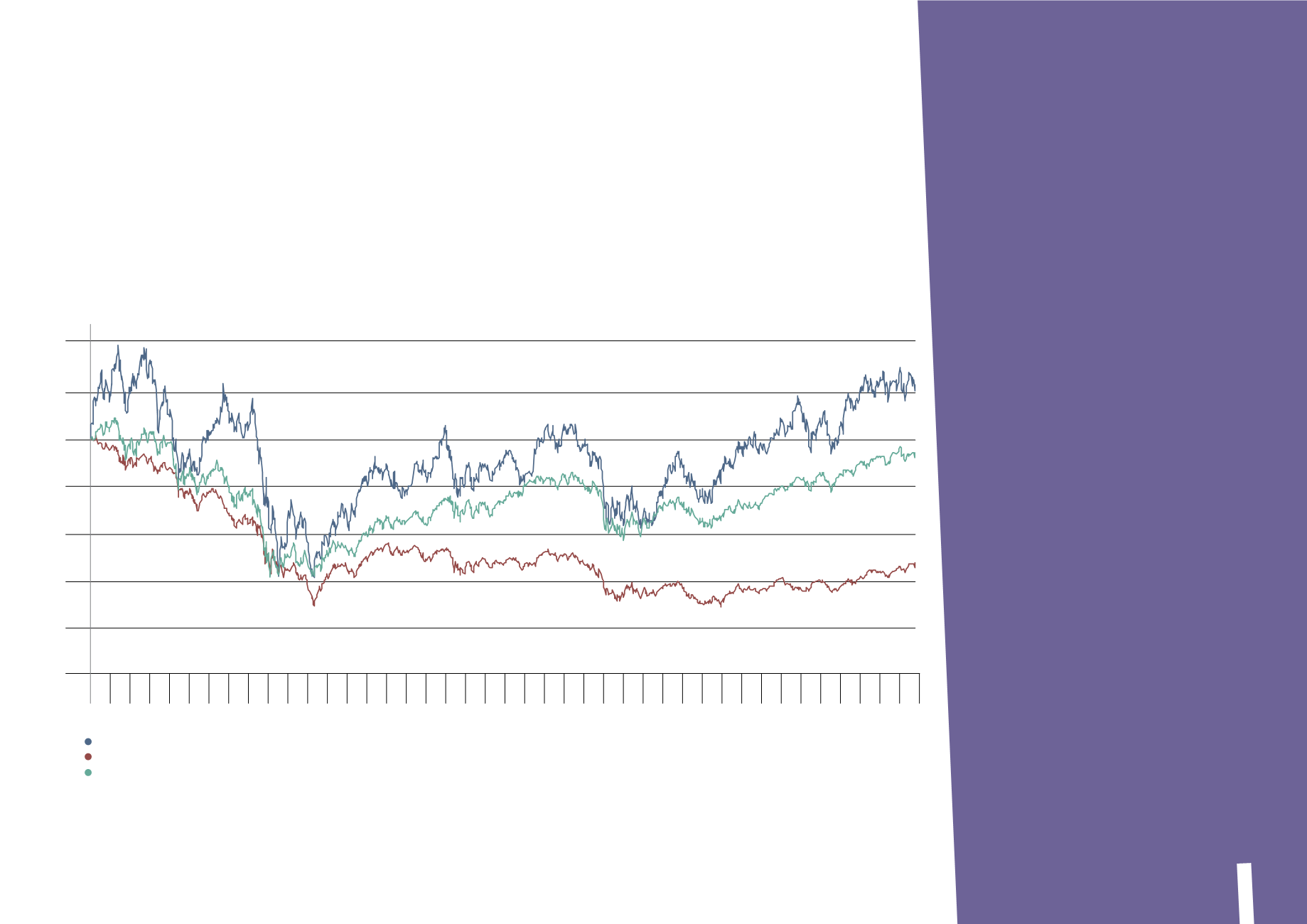

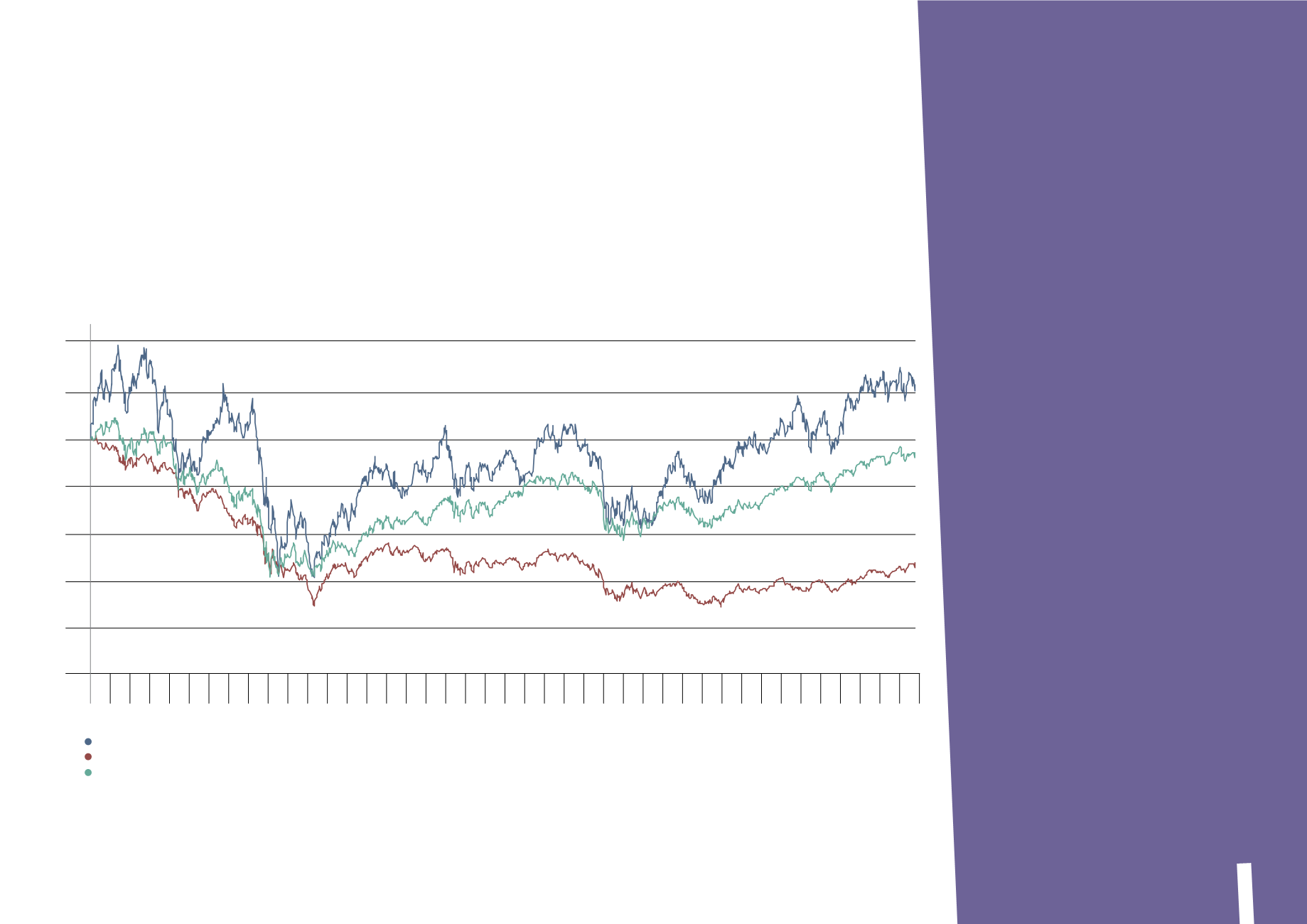

PERFORMANCE OF PRYSMIAN STOCK VERSUS BENCHMARKS SINCE IPO

140,0

120,0

100,0

80,0

60,0

40,0

20,0

0

Prysmian

FTSE MIB

MSCI EUROPE CAP GDS

May-07

Jul-07

Sept-07

Nov-07

Jan-08

Mar-08

May-08

Jul-08

Sept-08

Nov-08

Jan-09

Mar-09

May-09

Jul-09

Sept-09

Nov-09

Jan-10

Mar-10

May-10

Jul-10

Sept-10

Nov-10

Jan-11

Mar-11

May-11

Jul-11

Sept-11

Nov-11

Jan-12

Mar-12

May-12

Jul-12

Sept-12

Nov-12

Jan-13

Mar-13

May-13

Jul-13

Sept-13

Nov-13

Jan-14

Mar-14

Prysmian stock versus benchmarks since IPO

Analysts’ coverage

remained extensive

coverage of prysmian stock remained very

high and globally diversified, even though,

throughout the year, the equity research sector

continued the consolidation process started

in 2012. in 2013, 23 independent analysts

were regularly covering prysmian stock: banca

akros, banca aletti, banca iMi, banca profilo,

barclays capital, berenberg, bofa Merrill

lynch, citi, credit suisse, equita, espirito

santo, exane bnp paribas, fidentiis, goldman

sachs, hammer partners, hsbc, intermonte,

jp Morgan, kepler cheuvreux, Mediobanca,

Morgan stanley, natixis and ubs. prysmian is

one of italy’s few industrial companies with a

global presence that has achieved true public

company status in recent years.