A 360° public company

A 360° public company

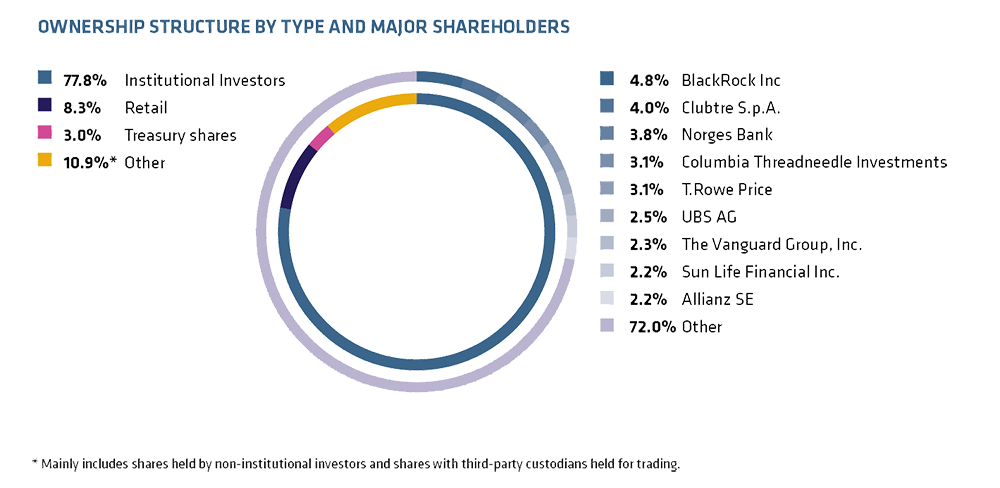

Prysmian Group can be considered a Public Company to all intents and purposes: its free float is equal to 100% of the shares, with nearly 80% of its capital held by institutional investors.

At 31 December 2017, the Company's free float was equal to 100% of the outstanding shares and major shareholdings (in excess of 3%) accounted for approximately 19% of total share capital, meaning there were no majority or controlling interests. Prysmian is now one of Italy's few globally present industrial concerns to have achieved true Public Company status in recent years.

At 31 December 2017, the share capital of Prysmian S.p.A. amounted to Euro 21,748,275.40, comprising 217,482,754 ordinary shares with a nominal value of Euro 0.10 each.

Financial Market Performance

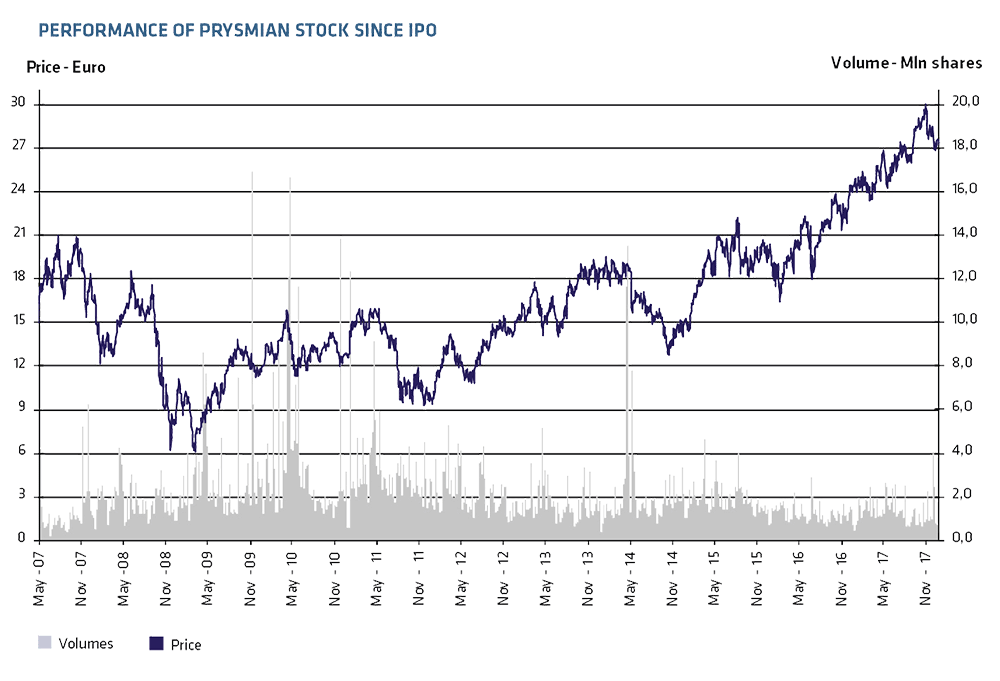

Prysmian S.p.A. was floated on the Italian Stock Exchange on 3 May 2007 and since September 2007 has been included in the FTSE MIB index, comprising the top 40 Italian companies by capitalisation and stock liquidity. The Prysmian stock has since entered the principal world and sector indexes, including the Morgan Stanley Capital International index and the Dow Jones Stoxx 600, made up of the world's largest companies by capitalisation, and the FTSE4Good, composed of a select basket of listed companies that demonstrate excellent Environmental, Social and Governance (ESG) practice.

The Prysmian stock appreciated 11.4% over the course of 2017, climbing to Euro 27.19/share from Euro 24.40 at the end of 2016. On 1 November 2017, the stock price recorded its highest closing level since listing, reaching Euro 30.00 per share.

The average share price was Euro 26.31 in 2017, up from Euro 20.93 in 2016. Including dividend pay-outs, the total shareholder return offered by the Prysmian stock was +13.2% in 2017 and +106.2% since its date of listing.

Continuously talking to investors

Transparency in communication, growth in market confidence in the company and promotion of a long-term investment approach to its stock.

Creating value for shareholders, and other stakeholders, is a key priority for Prysmian, whose policy of strategic and financial communication is directed towards the highest standards of accuracy, clarity and transparency.

There was intense contact with the financial market during 2017, with more than 400 encounters involving conference calls and one-to-one or group meetings at Prysmian's offices. Prysmian also undertook numerous road shows in the major financial centres of Europe and North America, and took part in conferences organized by major international brokers. In addition, the increasing attention paid to the Group's activities by socially responsible investors (SRI) was confirmed by their growing number at SRI dedicated meetings and road shows.