Target achieved

Target achieved

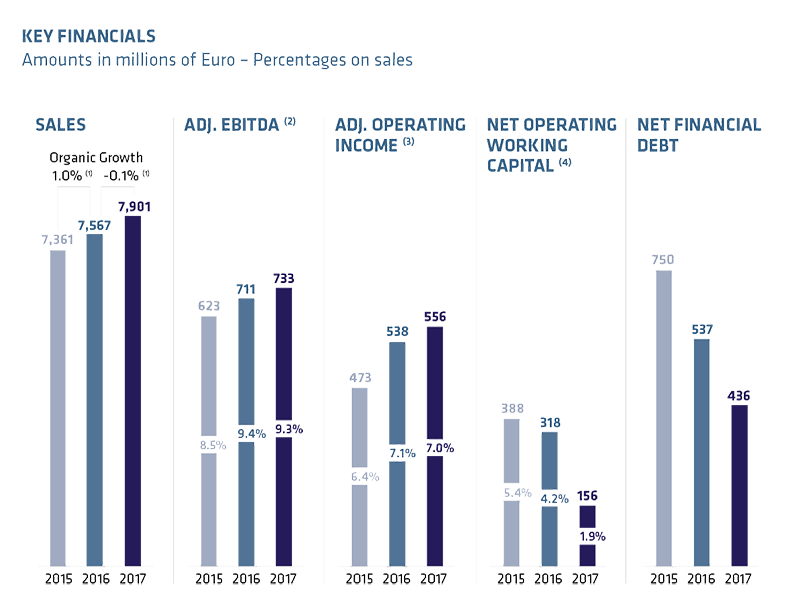

Adjusted EBITDA came in at a new high of €733 million thanks to improved sales margins in the Telecom and Energy Projects operating segments that climbed to 17.0% and 17.8% respectively.

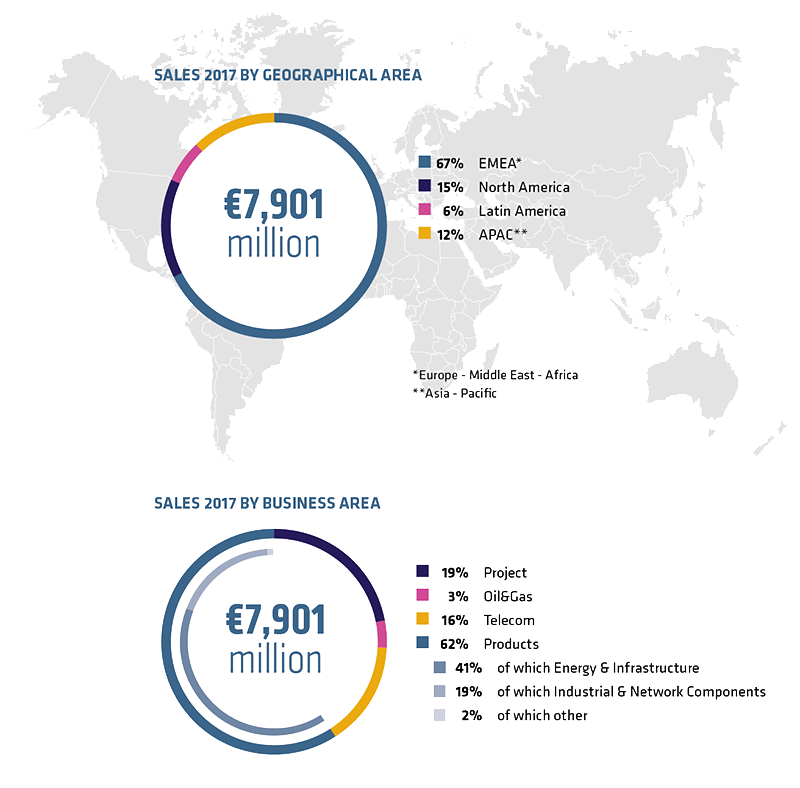

Group sales remained roughly stable at €7,901 million, with a fourth- quarter organic improvement. Adjusted EBITDA for the 2017 financial year came in at a new high of €733 million, topping the 2016 record of €711 million and hitting the target range of €710-750 million. This allowed dividend distribution to shareholders of €0.43 per share.

The results were achieved thanks to improved margins in our Telecom and Energy Projects operating segments, climbing to 17.0% and 17.8% on sales respectively. This positive progress absorbed not only the effects of negative performance by the subsidiary Oman Cables Industry, but also the adverse impact of exchange-rate movements.

Profitability has also benefited from the constant focus on operational and organisational efficiency, manufacturing footprint optimisation, and a favourable sales mix. The Group has also continued to develop its growth strategy by concentrating investments in high value-added tech-driven businesses, with the creation of centres of excellence and expertise.

Acquisition-led growth

2017 marked a further acceleration in Prysmian's acquisition-led growth, confirming the Group's determination to act as an aggregator on a global scale, while raising the quality and competitiveness of the entire cable industry.

Our General Cable merger agreement represents a fundamental step forward in a long history of growth through the aggregation of major players in the global cable industry.

This new landmark deal follows a series of other important transactions, including the acquisition of the assets of Shen Huan Cable in China, that of Corning's copper data cables business in Germany and, less recently, of Gulf Coast Downhole Technologies in the US and Oman Cables Industry.