5

Prysmian Group Insight

QUARTERLY OVERVIEW

Positive trend for submarine continues

with intense tendering activity

Stabilisation in building wires, decline in renewables offset by O&G

and other industrial sectors

Energy

Sales to third parties amounted

to €4,543 million, compared

with €4,801 million in the first

nine months of 2012, reporting

marginally negative organic

growth (-1.3%) while third

quarter organic growth was

slightly positive (+1.4%).

Adjusted EBITDA came to €353

million, up from €348 million in

the first nine months of 2012.

Utilities

Sales to third parties amounted to

€

1,650 million, recording an organic

change of just -0.8%. The high

profitability of the submarine business

has reflected positively on the overall

Adjusted EBITDA of Utilities, which

increased to

€

192 million from

€

185

million in the first nine months of

2012, thus more than offsetting the

weak performance posted by the

Power Distribution business. In the

High Voltage underground business,

the Group has made up for market

weakness in Europe thanks to its

commercial initiatives in emerging

economies requiring infrastructure

development and by strengthening

its high-end business, with work

on high-tech projects, such as the

underground sections of submarine

links and interconnections. The

order book assures sales visibility for

about one year. Sales performance

and profitability were both excellent

in the Submarine business, thus

confirming the Group‘s leadership in

a strategic and constantly growing

market. The order book assures

sales visibility for about three years,

with the Group constantly engaged

in intense tendering activities The

Power Distribution business line

has shown no signs of recovery in

demand, which remained weak,

particularly in Europe and Australia.

In the Americas, the Group has

implemented selective sales policies

in South America in defence of

earnings, while the upward trend

in volumes has continued in North

America.

Trade & Installer

Sales to third parties amounted

to

€

1,471 million in the first nine

months with signs of stabilisation

and recovery in the third quarter

when, for the first time in many

quarters, organic growth returned to

a positive figure of +1.8%. Adjusted

EBITDA came in at

€

61 million,

broadly in line with

€

62 million in

the corresponding nine months of

2012, with a ratio on sales of 4.1%,

up from 3.7%.

Industrial

Sales to third parties amounted to

€

1,340 million delivering positive

organic growth of 3.0%. The Oil

& Gas sector has confirmed the

positive trend for offshore, with

major projects in the North Sea,

Asia Pacific and South America.

The SURF (Subsea Umbilical Risers

Flowlines) segment has made a

positive contribution thanks to the

execution of Umbilicals projects

in Indonesia and Angola and the

renewed partnership with Petrobras.

Adjusted EBITDA amounted to

€

97

million, compared with

€

101 million

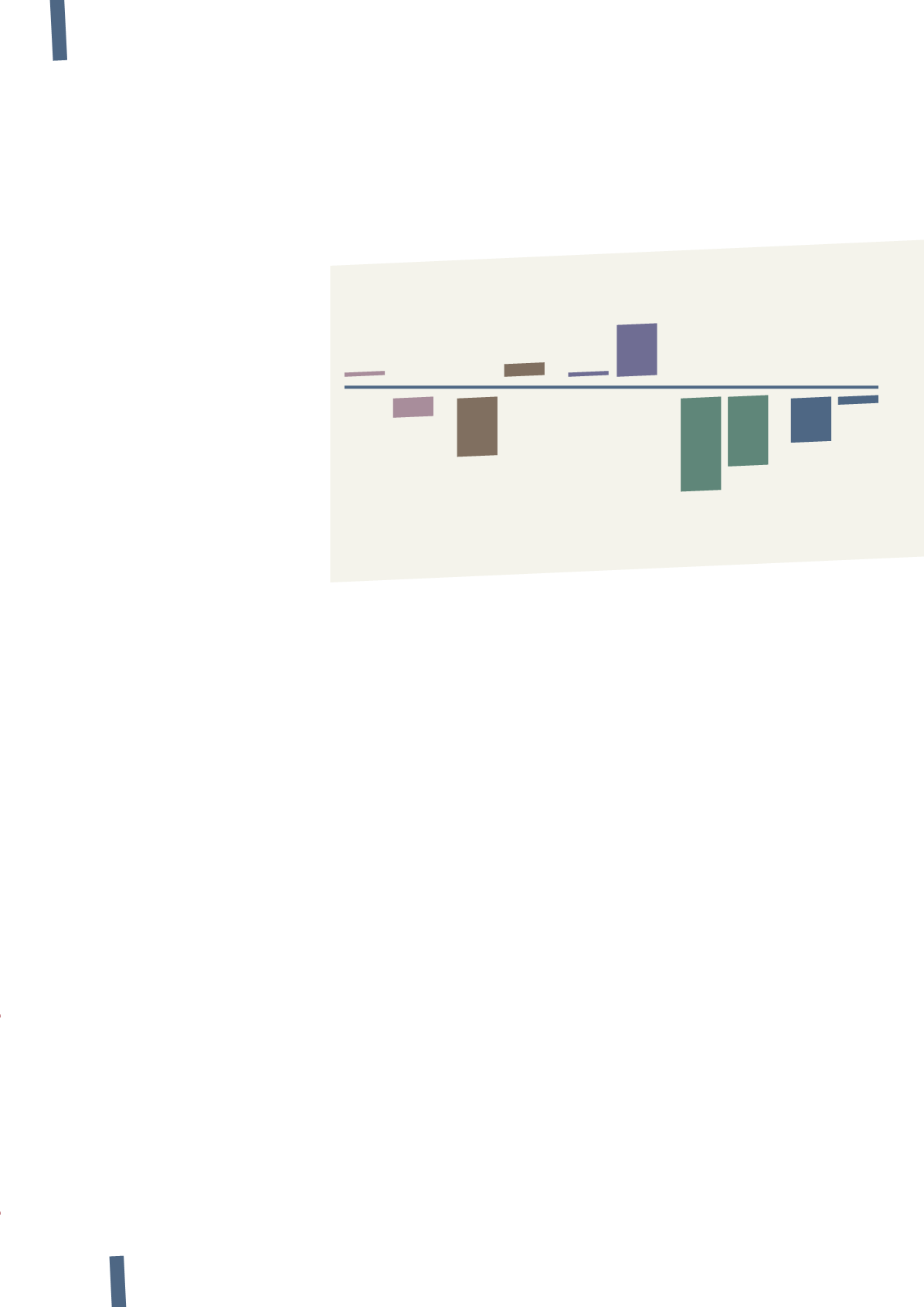

Organic Growth evolution

(% change on previous year period)

Utilities

Telecom

H1’13

H1’13

H1’13

H1’13

H1’13

Q3’13

Q3’13

Q3’13

Q3’13

Q3’13

T&I

Total

Industrial

0.7%

-3.4%

0.6%

-8.5%

1.8%

7.8%

-16.2%

-11.4%

-1.1%

-5.3%

in the first nine months of 2012,

with stable margins on sales.

Telecom

The decline in optical cable

sales continued in North and

South America; there were high

growth rates in China; and the

development of presence in

South East Asia. Profitability is

still declining.

Sales to third parties amounted

to

€

945 million in the first nine

months, down 14.6% organically on

the previous year. Such a decrease

reflects on the one hand the steep

decline in optical cable demand in

North and South America because

of the ending of incentive policies in

the U.S. and Brazil and, on the other

hand, a downturn in Multimedia

Solutions and copper cables

businesses in Europe. Demand is

expected to show signs of recovery

in Europe and South America over

the next few quarters. Optical

cables have nonetheless maintained

high growth rates in China and

Australia, while Multimedia Solutions

continued its expansion in South

America and Asia Pacific. Adjusted

EBITDA came to

€

91 million (

€

120

million one year earlier).