QUARTERLY OVERVIEW

Group sales and EBITDA eased

in the quarter

4

Prysmian Group Insight

In the first quarter of 2013 Group

Sales amounted to

€

1,711 million,

compared with

€

1,874 million in

the first quarter 2012. The Energy

business suffered from the general

decline in volumes for building wires

and for renewables, only partially

offset by strong performance in

the power transmission market,

particularly by the submarine

cables business line. The Telecom

business recorded a drop in demand

for optical cables in the American

continent because of the ending

of broadband stimulus plans in

North America and the temporary

suspension of similar plans in South

America, which are expected to

recover in the next few quarters.

Adjusted EBITDA amounted to

€

115 million, compared with

€

130

million in the corresponding period

of 2012. The integration with Draka

has enabled the Group to reduce

its cost structure, and so limit the

impact of poor performance by

the Energy business’s lower value-

added segments and by the Telecom

business as a whole. Net financial

charges reported a negative

balance of

€

47 million, compared

to

€

28 million in the corresponding

prior-year period. The increase of

€

19 million is due to a number of

extraordinary non-monetary effects,

mostly connected with the partial

refinancing of the Term Loan by

issuing the convertible equity-linked

bond. Adjusted net profit amounted

to

€

39 million, down from

€

45

million in the first quarter of 2012.

Net financial position at the end of

March 2013 amounted to

€

1,213

million, compared with

€

918 million

at 31 December 2012 (down from

€

1,273 million at 31 March 2012),

having been affected by the positive

cash flow from operating activities

of

€

72 million and the negative

impact of

€

351 million from changes

in working capital, mainly due to the

seasonality of the business.

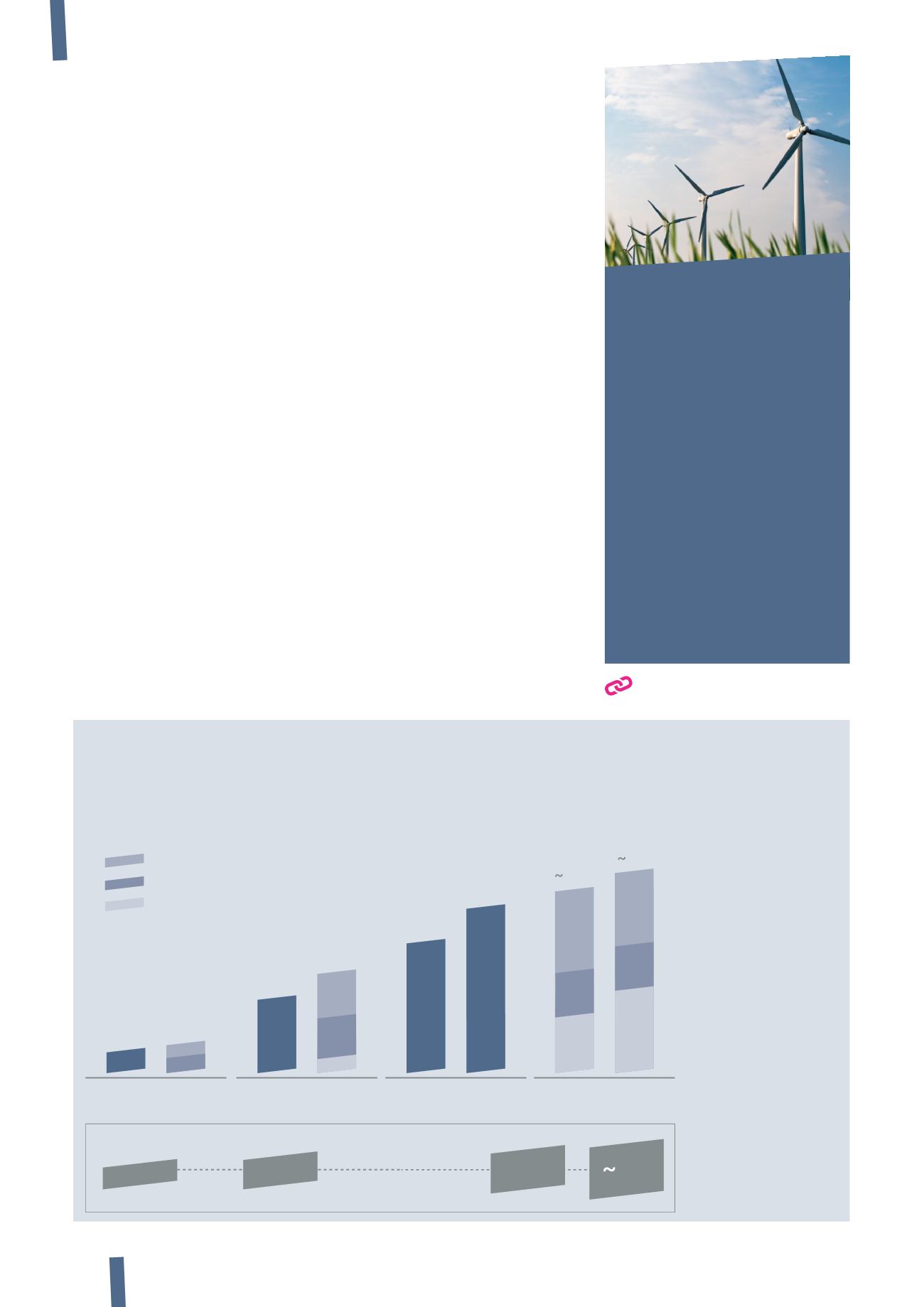

New upgrade in synergies plan with additional actions to face the continuous downturn

Synergies target increased – Increasing efforts

on production rationalization

Update on Synergies Plan 2011-15 (€ mln)

FY11

Target

FY11

Achieved

FY12

Target

FY12

Achieved

FY13

Target

FY14

Achieved

FY15 Old

Target

FY15 New

Achieved

• Strong

decrease in cyclical

demand require new

actions to limit

overcapacity in Europe

• Selective production

rationalization to

improve ROCE in

cyclical segments

• Additional synergies

mainly generated in

Operations

Overheads (Fixed costs)

46

120

250

650

10

45

100

125-150

150

65

13

6

30

60-70

60-70

30

5

7

175

30-40

40-60

30-40

70-80

Procurement

Operations

Restructuring costs

Demand for building

wires and renewables

still under pressure in

Europe

Positive performance

for submarine cables

and systems

Reduced demand for

optical cables in the

Americas

Profitability expected

to recover in next

quarters