3

Prysmian Group Insight

High-tech primacy

offsets the impact

of weak markets

In the

of 2013

Prysmian Group managed to limit

the impact of a negative market

context by focusing on high value-

added businesses, such as power

transmission cables and systems,

which continued to perform well.

The quarter was in fact affected

by the worsening of the crisis in

Europe’s construction industry,

by the additional contraction

in energy consumption and by

the uncertainties surrounding

renewable energy and broadband

stimulus plans in North and South

America, which led to a drop in

global cable demand.

Nevertheless,

Prysmian Group

managed to limit the impact

of this negative context by

focusing on high value-added

businesses,

such as power

Prysmian Group has launched

new commercial initiatives and

actions focused on leveraging the

extensive range of products which

are expected to drive a significant

contribution from additional sales

by 2015. The Industrial business

is expected to deliver over

€

200

million in additional sales resulting

from the development of several

applications – including Specialties

& OEM, Oil & Gas and Elevators

– while the Telecom business is

expected to deliver approximately

€

200 million additional sales from

hybrid 4G cables, access networks

& connectivity, multimedia

solutions and optical ground wire.

To address the further reduction

in demand and of defending the

Group’s profitability, measures to

contain costs have been stepped

up, along with new actions to

rationalise and optimise the

structure.

QUARTERLY OVERVIEW

New initiatives

to defend

profitability

Full year Adj. EBITDA forecasted in the range

of €600-€650 million

transmission cables and systems,

which continue to perform well. With

the goal of supporting medium-term

profitability, the Group has also

launched a series of commercial

initiatives aimed at increasing sales

in the most profitable segments

of the Industrial and Telecom

businesses, by leveraging our

extensive product portfolio.

Along with these measures, Prysmian

is stepping up efforts to contain costs

and rationalise our organizational and

manufacturing structure, allowing

to up the target synergies from

integration with Draka to

€

175 million

by 2015, from the original target of

€

150 million. Based on this scenario,

the Group is forecasting full-year

adjusted EBITDA in the range of

€

600-

€

650 million.

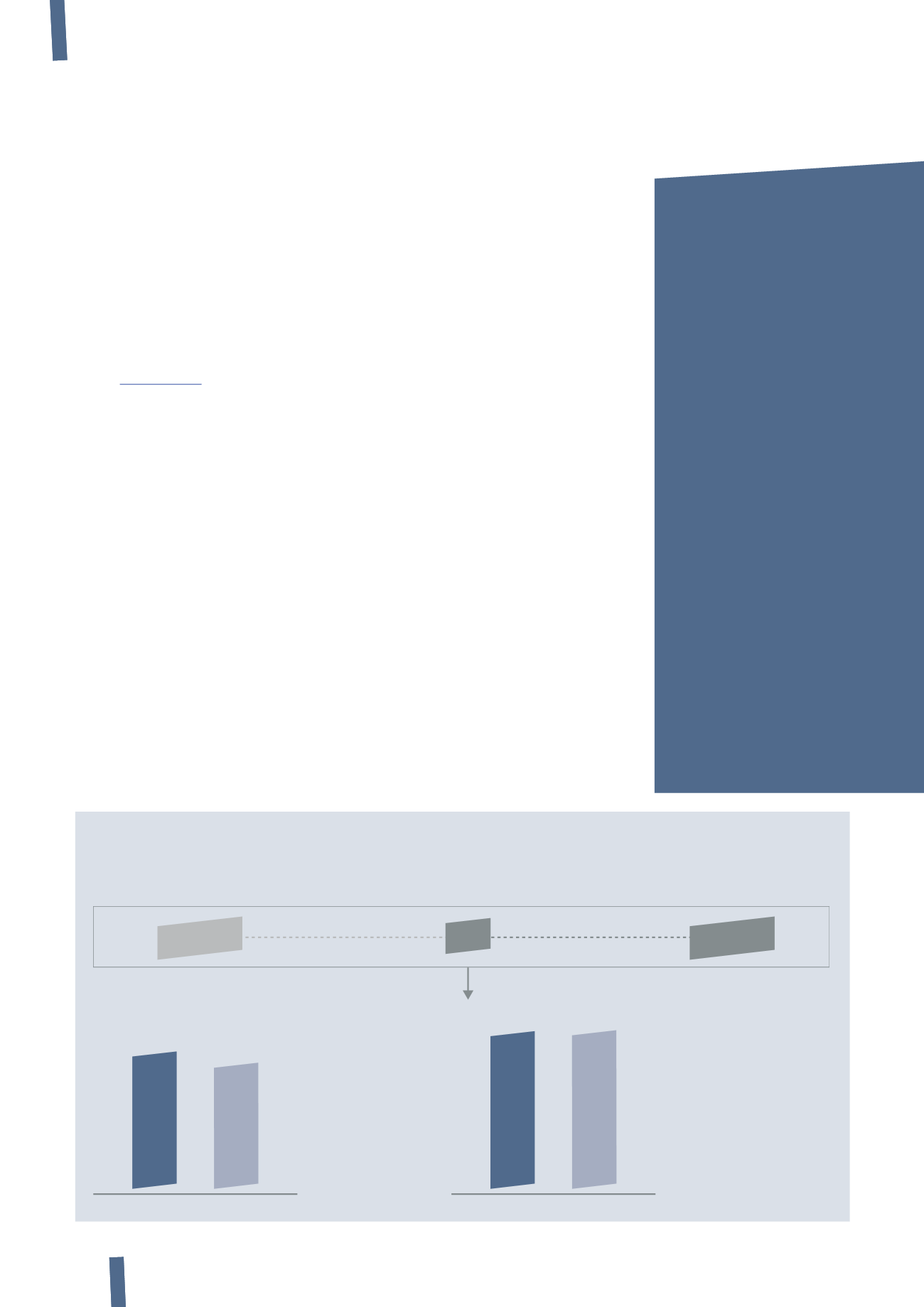

Leverage on additional synergies and transmission to face new bottom in cyclical businesses

2013 Outlook - Profitability recovery expected next quarters

FY 2013 Adj. EBITDA Target (€ mln)

H1 2013E

H2 2013E

308

H1 2012 H1 2013E

600

650

• Worsening of

cyclical businesses

in Europe

• Weak telecom

performance due to

lower demand in US

and South America

• Strong decrease

in Renewables

339

H1 2012 H1 2013E

• Continuous weakness

in European cyclical

businesses

• Growing contribution

from Transmission

• Recovery in Telecom

• Improving

performance in Industrial

• Higher cost synergies