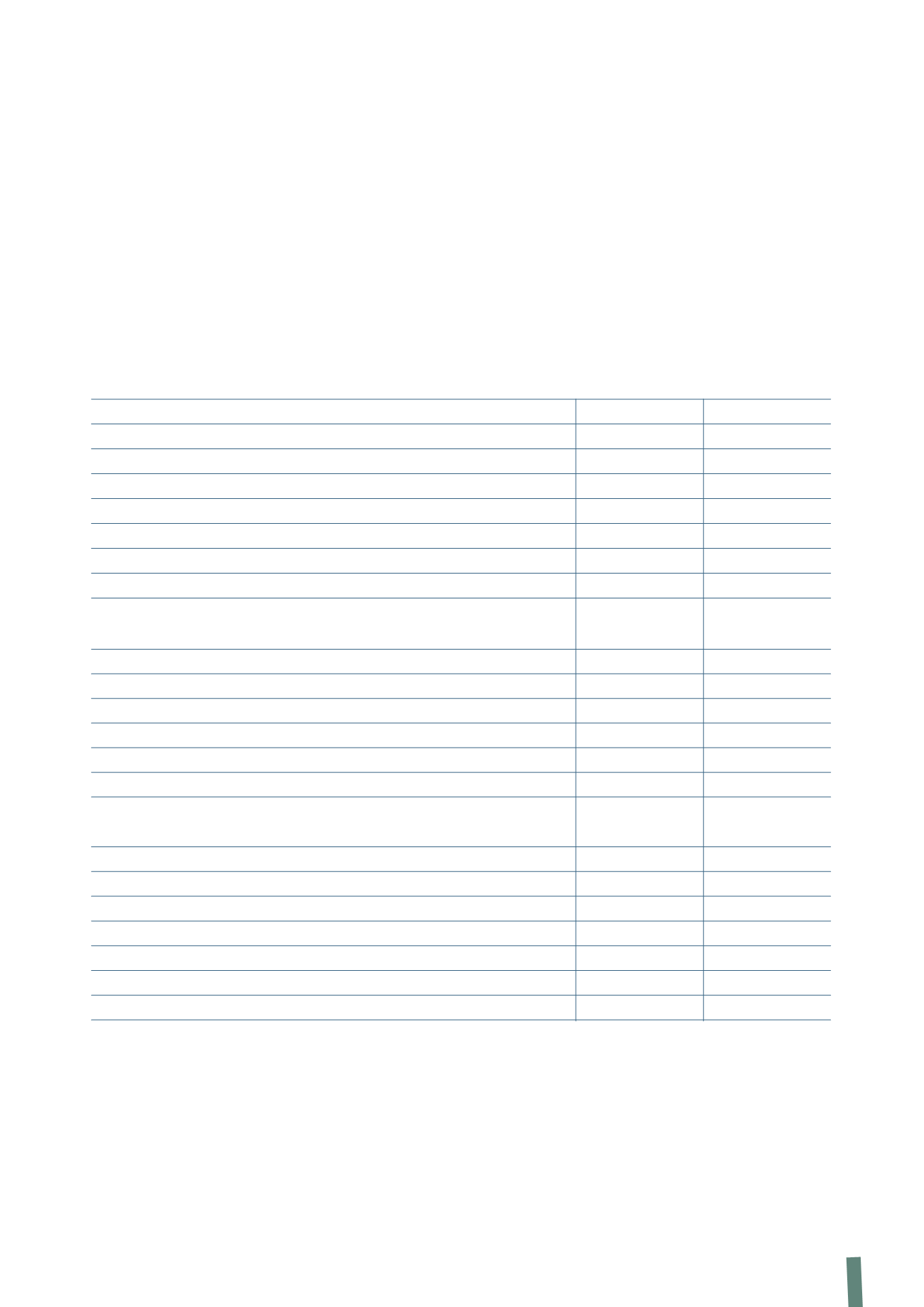

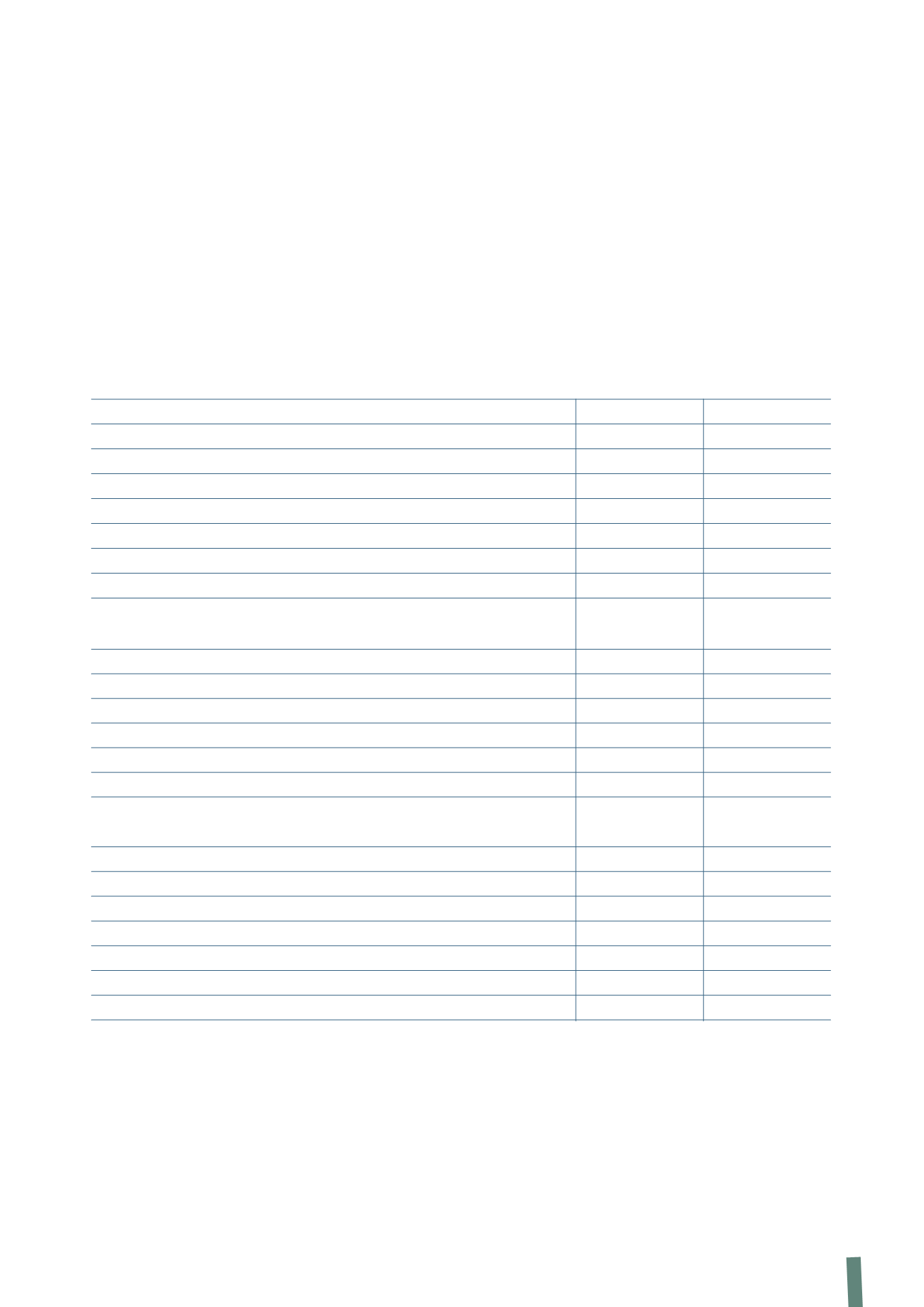

275

The Net financial position reports Euro 920,587 thousand in

net debt at 31 December 2012, compared with Euro 682,977

thousand at 31 December 2011.

The higher level of debt is mainly attributable to the activation

of the “Credit Agreement 2010” on 3 May 2012 (see Note 8 to

the Parent Company Financial Statements).

The composition of net financial position is presented in detail

in the following table.

NET FINANCIAL POSITION

Note 8 to the Parent Company Financial Statements

presents the reconciliation of the Company’s net financial

position to the amount that must be reported under

Consob Communication DEM/6064293 dated 28 July 2006

in compliance with the CESR recommendation dated 10

February 2005 “Recommendations for the consistent

implementation of the European Commission’s Regulation on

Prospectuses”.

A more detailed analysis of cash flows is presented in the statement of cash flows, forming part of the Parent Company financial

statements presented in the following pages.

(in thousands of Euro)

Note

31 December 2012

31 December 2011

Long-term financial payables

- Term Loan Facility

8

660,800

400,000

Senior credit lines

660,800

400,000

- Bank fees

8

(7,326)

(5,621)

Credit agreements

653,474

394,379

- Bond

8

397,515

396,513

Total long-term financial payables

1,050,989

790,892

Short-term financial payables

- Term Loan Facility

8

60,237

67,789

- Bank fees

8

(678)

(51)

- Bond

8

15,304

15,304

- Other borrowings

8

722

2,001

Total short-term financial payables

75,585

85,043

Total financial liabilities

1,126,574

875,935

Long-term financial receivables

5

21

19

Long-term bank fees

5

3,919

15,158

Short-term financial receivables

5

7

69

Short-term bank fees

5

3,919

6,353

Receivables from Group companies

5

197,440

170,169

Cash and cash equivalents

6

681

1,190

Total financial assets

205,987

192,958

Net financial position

920,587

682,977