PARENT COMPANY >

DIRECTORS’ REPORT

272

| 2012 annual report prysmian group

FINANCIAL PERFORMANCE

OF PRYSMIAN S.P.A.

The tables presented and discussed below have been

prepared by reclassifying the financial statements at

31 December 2012, which in turn have been prepared in

accordance with the International Financial Reporting

Standards (IFRS) issued by the International Accounting

Standards Board (IASB) and endorsed by the European Union,

and with the provisions implementing art. 9 of Legislative

Decree 38/2005.

The income of Prysmian S.p.A., the Group’s investment

holding company, primarily reflects dividends received from

the subsidiary Prysmian Cavi e Sistemi S.r.l., revenue from

services provided to subsidiaries and royalties for the use

of patents and know-how by subsidiaries and possibly even

third parties.

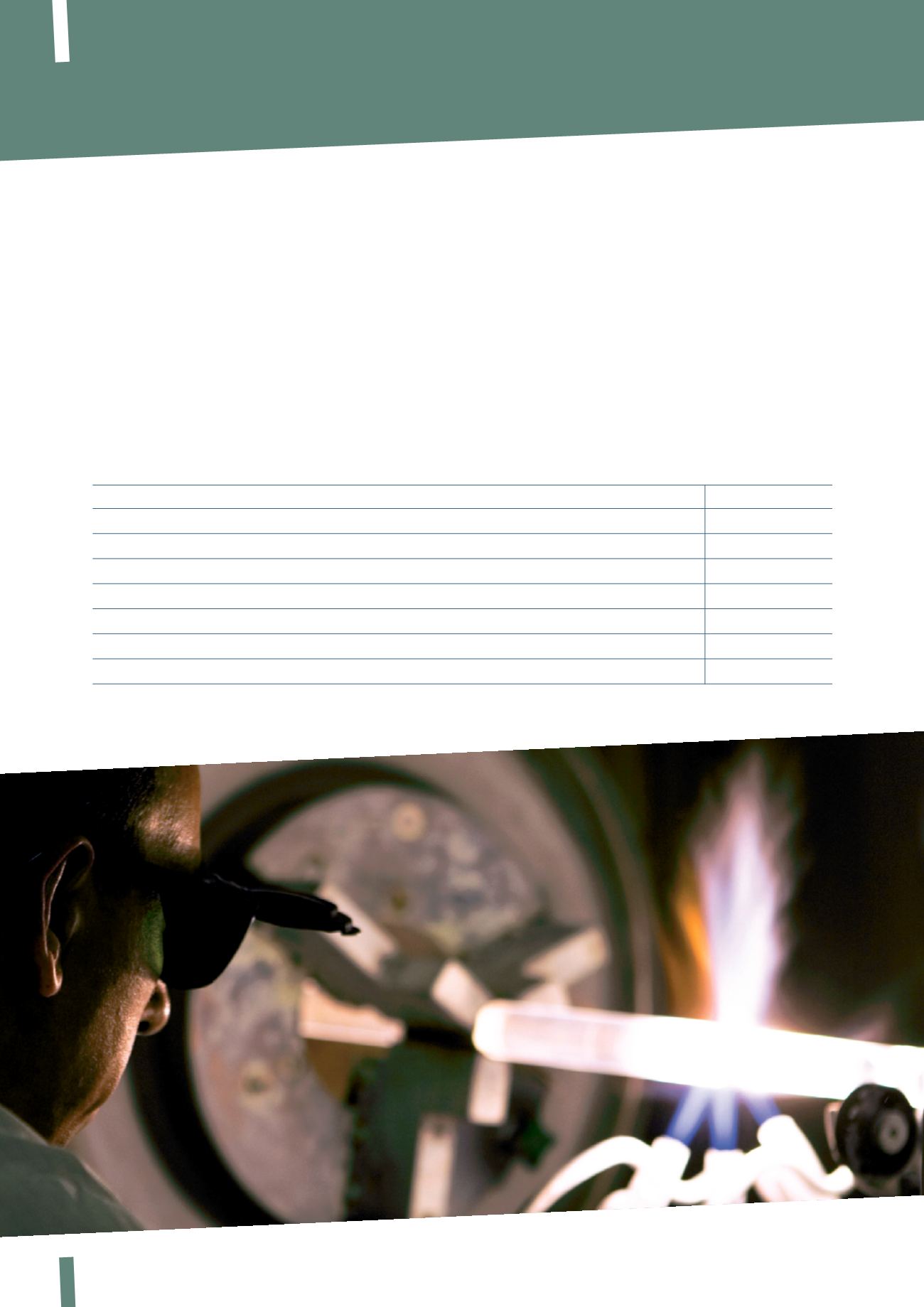

(in thousands of Euro)

2012

2011

Dividends

150,000

161,332

Personnel and operating costs net of revenue and other income

(17,753)

(14,711)

Income from non-recurring transactions

350

-

Costs of non-recurring transactions

(6,267)

(50,380)

Net finance costs

(35,408)

(39,176)

Taxes

21,216

42,367

Net profit/(loss) for the year

112,138

99,432