PARENT COMPANY >

DIRECTORS’ REPORT

274

| 2012 annual report prysmian group

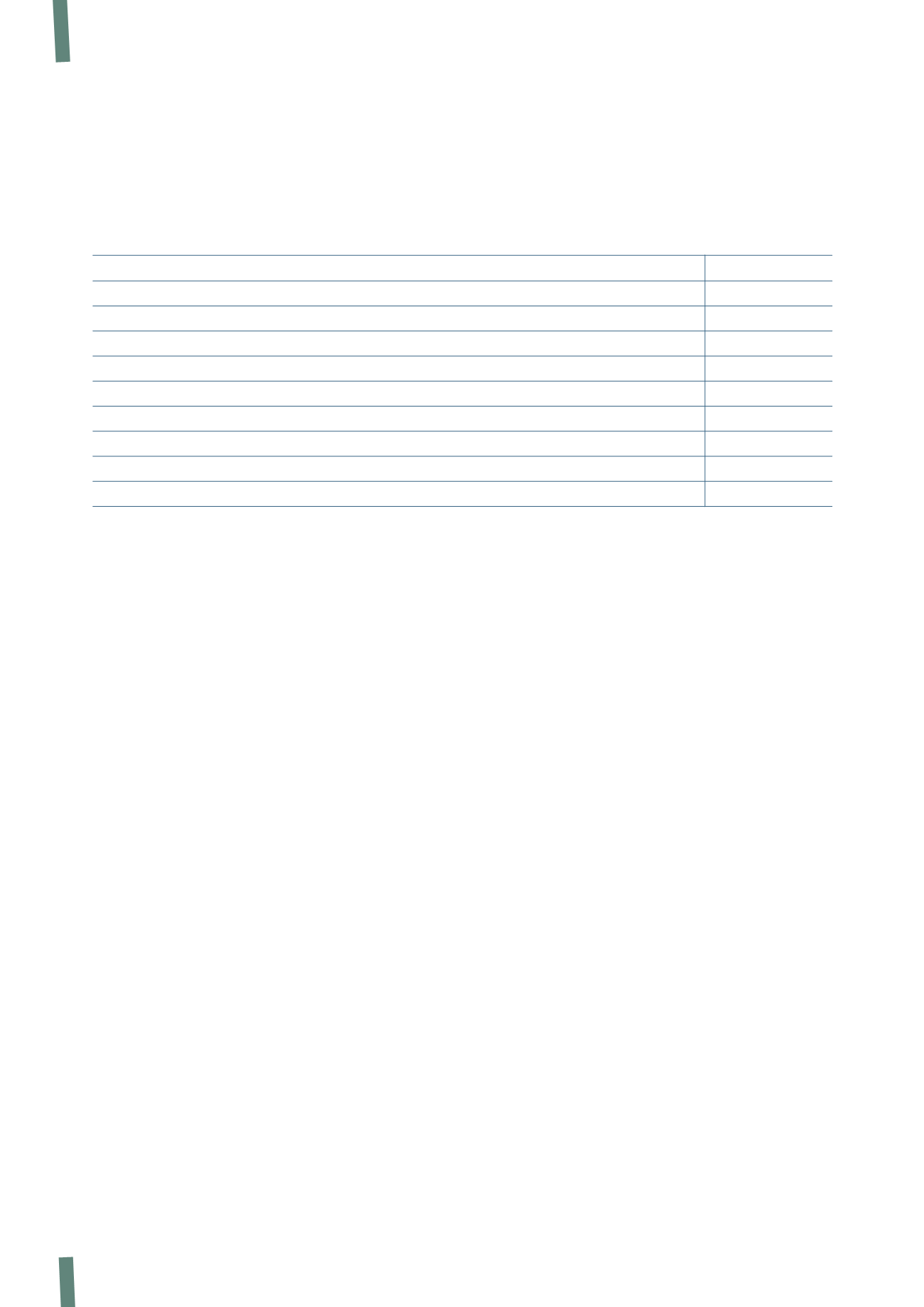

STATEMENT OF FINANCIAL POSITION

The Parent Company’s statement of financial position is summarised as follows:

Fixed assets basically comprise the controlling interests in

Prysmian Cavi e Sistemi S.r.l. and Draka Holding N.V..

• The increase in investments in subsidiaries of Euro 263,821

thousand since 31 December 2011 is due to the acquisition

of 478,878 more ordinary shares in Draka Holding N.V. for

the sum of Euro 8,886 thousand, to capital contributions

made to the subsidiary Draka Holding N.V. for Euro 230,000

thousand, to the subsidiary Prysmian Treasury S.r.l. for

Euro 12,000 thousand and to the subsidiary Fibre Ottiche

Sud – F.O.S. S.r.l. for Euro 12,000 thousand, and to Euro

935 thousand in increases for the compensation-related

component of the stock option plan, with underlying

Prysmian S.p.A. shares, for certain managers employed by

other Group companies.

Investments in fixed assets amounted to Euro 11,573 thousand

in 2012 (Euro 10,029 thousand in 2011), most of which relating

to expenditure on realising the SAP Consolidation project

(more details can be found in Note 2 to the Parent Company

Financial Statements).

Net working capital of Euro 114,087 thousand comprises:

• Euro 80,026 thousand as the net positive balance between

trade receivables and trade payables (see Notes 5 and 9 to

the Parent Company Financial Statements);

• Euro 34,061 thousand in other receivables/payables (tax,

employees etc), net of financial receivables/payables

(see Notes 5 and 9 to the Parent Company Financial

Statements);

The increase of Euro 54,609 thousand compared with 31

December 2011 is primarily due to higher receivables as a result

of extending chargebacks to former Draka Group companies.

Provisions, presented above net of deferred tax assets,

amount to Euro 27,619 thousand at 31 December 2012 (see

Notes 4 and 10 to the Parent Company Financial Statements).

Equity amounts to 871,588 thousand at 31 December 2012,

reporting a net increase of Euro 85,149 thousand since 31

December 2011, mainly due to the increase in the stock option

reserve and to the net profit for the year.

A more detailed analysis of the changes in equity can be found

in the specific table presented as part of the Parent Company

Financial Statements.

The Group’s consolidated equity at 31 December 2012 and

consolidated net profit for 2012 are reconciled with the

corresponding figures for the Parent Company Prysmian S.p.A.

in a table presented in the Directors’ Report contained in the

Group Annual Report.

(in thousands of Euro)

31 December 2012

31 December 2011

Net fixed assets

1,721,587

1,444,443

- of which: Investments in subsidiaries

1,660,977

1,397,156

Net working capital

114,087

59,478

Provisions

(27,619)

(26,998)

Net capital employed

1,808,055

1,476,923

Employee benefit obligations

15,880

7,507

Equity

871,588

786,439

Net financial position

920,587

682,977

Total equity and sources of funds

1,808,055

1,476,923

Note: the composition and method of calculating the above indicators are discussed in the Directors’ Report contained in the Group Annual Report.