97

CONTENXT RISKS

Exchange rate risk

The Prysmian Group operates internationally and is therefore

exposed to exchange rate risk in the various currencies in

which it operates (principally the US dollar, British pound,

Brazilian real and Qatari riyal). Exchange rate risk occurs when

future transactions or assets and liabilities recognised in the

statement of financial position are denominated in a currency

other than the functional currency of the company which

undertakes the transaction.

To manage exchange rate risk arising from future trade

transactions and from the recognition of foreign currency

assets and liabilities, most Prysmian Group companies use

forward contracts arranged by Group Treasury, which manages

the various positions in each currency.

However, since Prysmian prepares its consolidated financial

statements in Euro, fluctuations in the exchange rates used

to translate the financial statements of subsidiaries, originally

expressed in a foreign currency, could affect the Group’s

results of operations and statement of financial position.

A more detailed analysis of the risk in question can be found in

the “Financial Risk Management” section of the Explanatory

Notes to the Consolidated Financial Statements.

Interest rate risk

Changes in interest rates affect the market value of the

Prysmian Group’s financial assets and liabilities as well as its

net finance costs. The interest rate risk to which the Group is

exposed is mainly on long-term financial liabilities, carrying

both fixed and variable rates.

Fixed rate debt exposes the Group to a fair value risk. The

Group does not operate any particular hedging policies

in relation to the risk arising from such contracts since it

considers this risk to be immaterial. Variable rate debt

exposes the Group to a rate volatility risk (cash flow risk).

The Group uses interest rate swaps (IRS) to hedge this risk,

which transform variable rates into fixed ones, thus reducing

the rate volatility risk. Under such IRS contracts, the Group

agrees with the other parties to swap on specific dates the

difference between the contracted fixed rates and the variable

rate calculated on the loan’s notional value. A potential rise in

interest rates, from the record lows reached in recent years, is

a risk factor in coming quarters.

In order to limit this risk, during 2012 the Prysmian Group

took out additional IRS contracts to mitigate the risk of a

rise in interest rates until the end of 2016. A more detailed

analysis of the risk in question can be found in the “Financial

Risk Management” section of the Explanatory Notes to the

Consolidated Financial Statements.

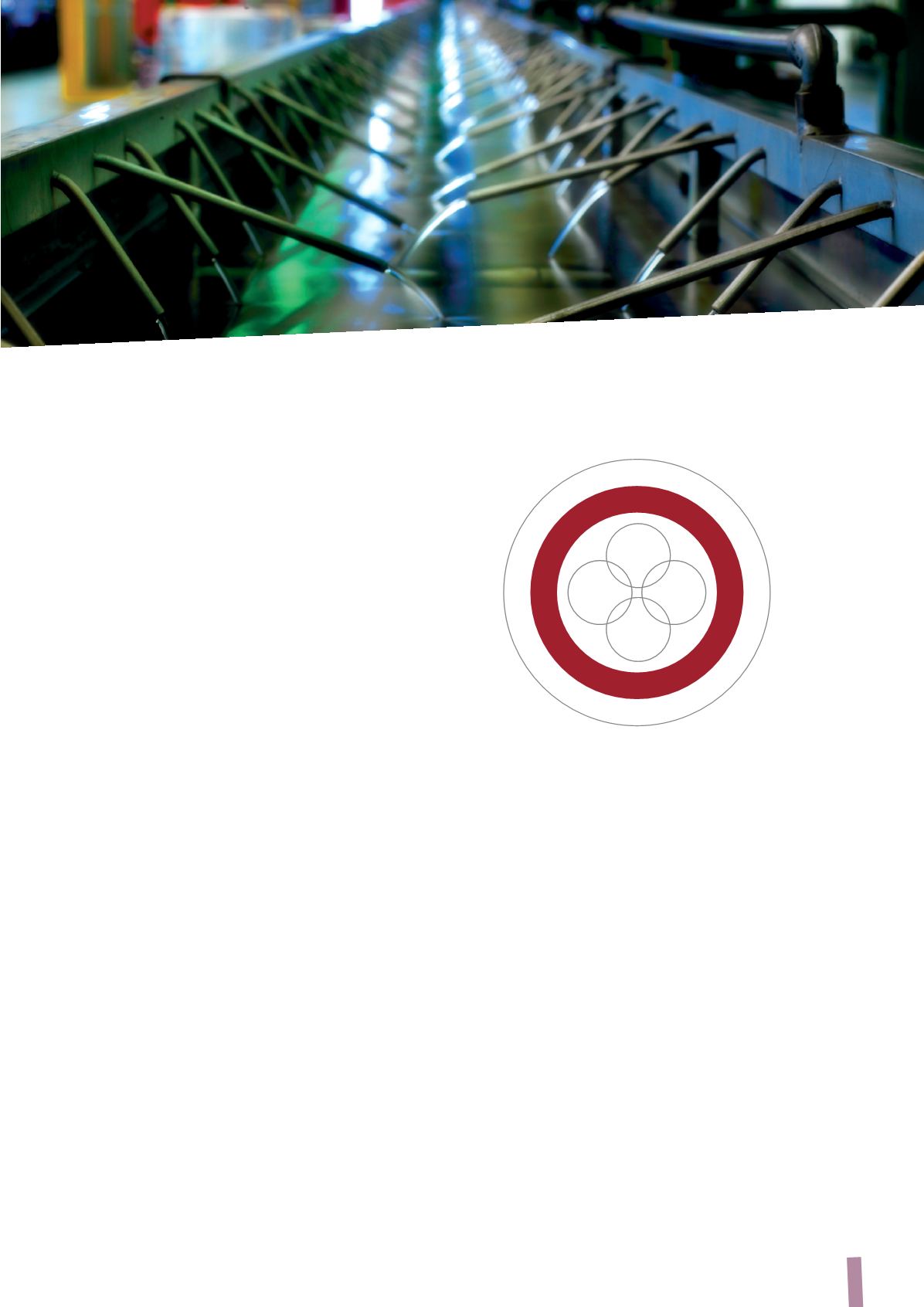

Risks associated with fluctuations in raw material prices

The principal material used for making the Prysmian

Group’s products is copper. The other raw materials used

are aluminium, lead and steel, as well as various petroleum

derivatives, such as PVC and polyethylene.

All raw materials have experienced particularly significant

price fluctuations in recent years, which could continue

in coming quarters. The Group neutralises the impact of

possible rises in the price of copper and its other principal

raw materials through automatic sales price adjustment

mechanisms or through hedging activities; the exception is

petroleum derivatives (polyethylene, plastifying PVC, rubber

and other chemical products), where the risk cannot be offset