Creating and distributing value

Creating and distributing value

The Prysmian Group makes a constant effort to create and distribute value to its stakeholders. This commitment is monitored every year through the definition of the ‘added value’ generated and redistributed. This allows us to quantify how much wealth has been produced by the Group and how it has been redistributed among all stakeholders, providing a complete picture of the company’s economic impact.

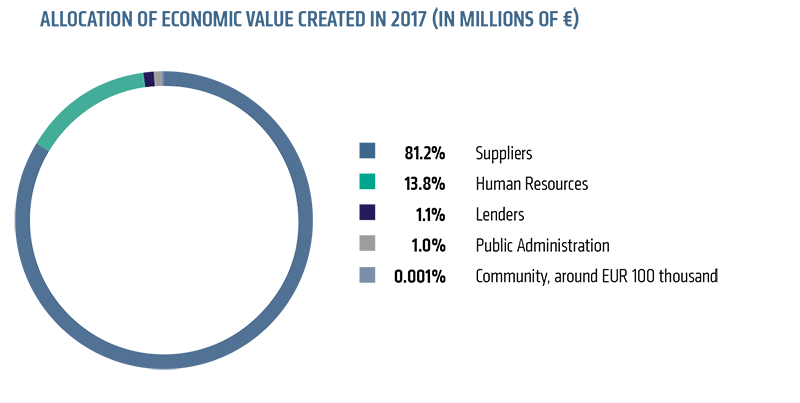

In 2017, the economic value generated by Prysmian amounted to €7,866 million, of which €223 million (2.8%) consisted of profits redistributed to Group Members and interest to third parties, and represented the value withheld. The percentage allocated in the form of spending on suppliers – including raw materials and other services – amounted to 81.2%. As a result, the rest was redistributed respectively to payment to human resources (13.8%), payment to lenders (1.1%), payment to the public administration (1.0%) and contributions to the community of €100,000. The allocations reflected the income statement captions in the consolidated financial statements as of 31 December 2017.

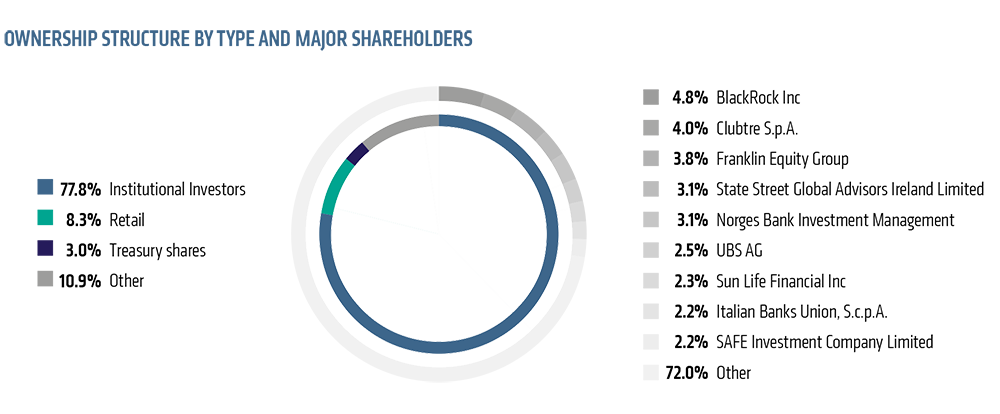

Prysmian is one of the few Italian manufacturers with a global presence that, in recent years, has achieved true public company status. 100% of the Group’s shares, as of 31 December 2017, are owned by floating shareholders, with almost 80% of capital held by institutional investors. Major shareholdings (in excess of 3%) account for around 19% of share capital. Accordingly, there are no majority or relative majority shareholders.

As of 31 December 2017, the share capital of Prysmian S.p.A. amounts to €21,748,275.40, represented by 217,482,754 ordinary shares with a nominal value of €0.1 each. The ownership at that date was structured as follows: institutional investors 77.8%, retail 8.3%, 3.0% treasury shares, 10.9% others.

Geographically, the Group witnessed the predominance of the United Kingdom with 26% of capital held by institutional investors, followed by the United States at 22%.

Italy represented about 14% of capital held by institutional investors, a slight decrease since 2016, while France increased slightly to 10%. The weighting of Asian investors remains largely stable. About 71% of the capital held by institutional investors is owned by Value, Growth or GARP investment funds that have a medium/long-term time horizon. Stable in respect to 2016, there has been a decrease in the number of shareholders adopting an Index investment strategy, based on the principal stock indices, while the Hedge Fund component - with a shorter time horizon – has now increased to reach 5% of the total. Clubtre S.p.A., the Group's historic shareholder after the exit of Goldman Sachs, reduced its stake to 4.01% following the sale of 4 million shares through an Accelerated Bookbuilding process on 18 January 2017. A statement made by Tamburi Investment Partners, a member of Clubtre S.p.A. with a stake of 43.28%, said that this transaction represents a partial realisation of the investment made in 2010, and that it will maintain a significant shareholding in Prysmian through Clubtre.

In April 2017, the Shareholders' Meeting of Prysmian approved the 2016 financial statements, the allocation of exercise and distribution of dividends, authorisation to purchase and dispose of treasury shares and consultation on remuneration policies. 1,700 members participated in the Shareholders' Meeting, directly or by proxy, representing over 54% of the share capital, and approved, with a large majority exceeding 95%, all items on the agenda and the distribution of a dividend of €0.43 per share, in line with the previous year. The payment took place on 26 April 2017, for a total amount of approximately €91 million.

Driven by the principles of responsibility

The Sustainability Report, now in its seventh edition, informs stakeholders about results achieved not just in terms of business, but in all the social, environmental and human development issues which the Group is committed to.

As the global leader in an industry that makes the world go round, by providing through our cables and systems the energy and information that make life and development possible for human communities across the world, our sustainability strategy represents a key aspect of our way of working. In fact, our industry guides growth strategy on key matters such as sustainable, technological innovation, the environmental responsibility of production processes, attention to safety at work and development of talent, as well as managing relationships with customers and local communities.

The principles of ethics

Integrity, transparency, anti-corruption and respect for human rights, which characterise Prysmian's way of operating and guide our Code of Ethics and operating policies, remain a firm point of reference for sustainability matters. The Code of Ethics represents the Group's ‘Constitution’, being the charter of rights and moral duties that defines the ethical-social responsibilities of everyone in the organisation.

Prysmian has developed a Sustainability Policy that defines the vision and values for the areas of business integrity, product responsibility, social responsibility and environmental responsibility and governance. This allows us to provide, make public and disseminate to all Group operations and partners the guidelines and actions needed to achieve sustainable growth in the long term.

From our position as the global leader, we know business excellence means the ability to create value over time for our investors, stakeholders and society as a whole, achieving the goal of growth in a responsible fashion.

A trust-based relationship

Prysmian’s sustainability strategy is notable for its relevance and importance to the Group's numerous stakeholders.

In pursuing its corporate objectives, among which conducting business in a sustainable and responsible manner stands out, it is fundamental for Prysmian to develop forms of constant dialogue and interaction with internal and external stakeholders. In doing this, we will understand the various social, economic, professional and human needs, interests and expectations of everyone involved. Against a background that is dynamic and competitive, being able to anticipate change and identify emerging trends enables the Group to generate constant and shared added value in the long term.

Establishing and developing trust-based relationships, founded on the principles of transparency, openness and listening, enables Prysmian to understand the constantly changing expectations and requirements of those stakeholders that, directly or indirectly, influence the activities of the Group and, in turn, are influenced by us.

At the roots of our business development

At Prysmian, the value of integrity goes well beyond the simple observance of rules and regulations, as it permeates the entire spectrum of company life. Alessandro Nespoli, Chief Compliance Officer, explains how business and integrity can work well together.

"When it comes to ethics, no challenge is too big, or too small, if it means doing things right. This is exactly what Prysmian intends for its integrity initiatives.” Alessandro Nespoli, who joined the Group as Chief Compliance and Internal Audit Officer in 2017, has a special focus on integrity, as he works at integrating the concept into tangible examples and the Group’s culture.

To translate this value into real action, Prysmian launched the ‘Integrity First’ project at the end of 2016 and intends to expand it by developing and sharing a “new compliance ecosystem”, in Nespoli’s words. This ecosystem will cover a series of issues and behaviours that, according to Nespoli, ”will ultimately become part of the DNA of Prysmian Group people". He explains that ethics, “influences our way of working and making decisions, while having an impact on our stakeholders and customers”. Ethics affects reputation, which is why it is the most important asset that has to be preserved, because if customers trust a company, they will do business with it.

The new compliance ecosystem will oversee different issues and even establish behaviours that are not strictly compliance-related. The culture of integrity is reinforced by the company’s Code of Ethics, based on three pillars: ethics in business activities, ethics in internal relations, and ethics in environmental and social matters. This means that ethics, “is pervasive and affects everyone within and outside the organisation,” Nespoli states.