Economic and financial responsibility

Economic value distributed to stakeholders

The Prysmian Group makes a constant effort to create and distribute value to its stakeholders. Economic value represents the wealth produced by the Group that, in various forms, is distributed to the stakeholders in the following ways: remuneration of human resources (direct remuneration, comprising wages, salaries and severance indemnities, and indirect remuneration in the form of social security and pension contributions), remuneration of lenders (interest expense), remuneration of Group shareholders (dividends paid) and other investors, remuneration of the Public Administration (total taxes paid), gifts and donations to the community. The value retained by the Group is represented by the profit reserves carried forward.

The schedule showing how the economic value generated by Prysmian is allocated was prepared with reference to the income statement captions reported in the consolidated financial statements as of 31 December 2016. The economic value generated by Prysmian in 2016, net of reclassified costs, amounted to about 1,710 million euro or about 23% of consolidated sales. The largest part of this value is represented by the remuneration of human resources (62%), followed by the remuneration of lenders, shareholders and minority interests and the Public Administration (6%), and contributions to the Community of about 120 thousand euro9. The remainder (21%) represents the value retained by the business.

Economic and financial responsibility

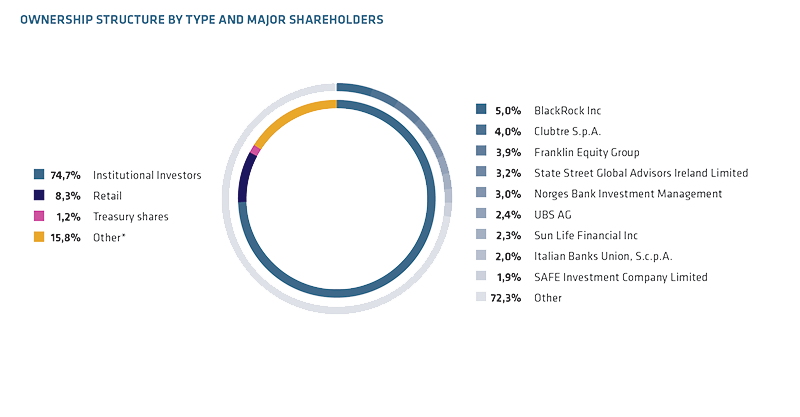

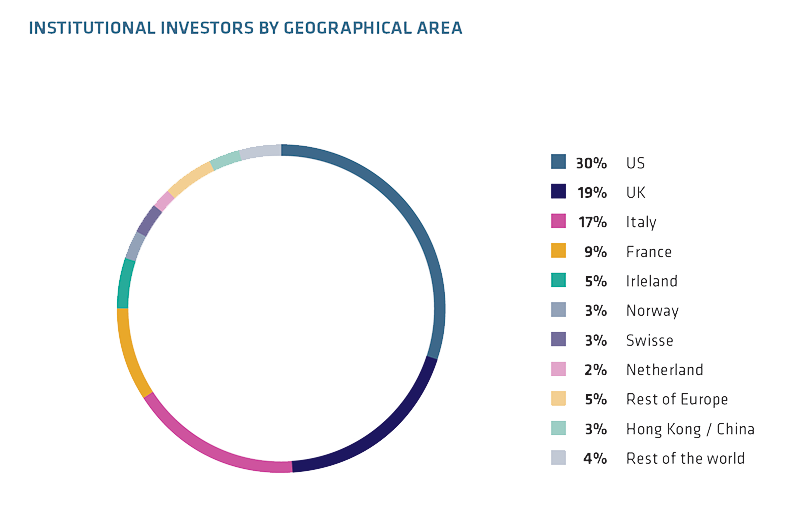

With regard to the economic and financial responsibilities of the Group, relations with the financial market were particularly intense during 2016, involving more than 400 meetings with institutional investors, whether in the form of conference calls or one-to-one or group sessions.

The YES programme has proved to be a real success. It was taken up by more than 7,200 employees: around 44% of the entitled population became shareholders. Participation in the Plan in certain countries was very high throughout the entire three-year period. For example, almost all staff in Romania joined the plan, 85% in Turkey and about 65% at the Milan head office. The results of the programme are summarised below:

- Over 7,200 employees involved, being 44% of those entitled;

- 16.8 million euro invested;

- 420,000 treasury shares assigned to employees.

Following the success of YES, a meeting was held at the Milan Stock Exchange during 2016, where over 200 employees from many countries, acting as YES ambassadors, participated in one day of courses on the programme. The high level of participation convinced Prysmian to extend the programme with a few changes for another three years, with a view to increasing employee share ownership to at least 1.5% of the total. This successful programme seeks to increase the involvement, sense of belonging and business understanding of employees, thus strengthening the internal perception of the Prysmian Group as ‘One Company’.

Values and Code of Ethics

The creation of value for shareholders, investors and other stakeholders is a key priority for Prysmian, being an important aspect of its commitment to accuracy, clarity and transparency in the communication of its business strategy, objectives and results.

The Code of Ethics represent the Group's "Constitution" and "is and important and innovative tool for promoting the fundamental rights of individuals, employment and the territory, and a good policy for fighting corruption" *.

The activities of Prysmian are marked by the following values:

- Excellence: "Doing well is never enough. A rigorous approach and entrepreneurial leadership are combined to offer innovative and complete solutions for every kind of business"

- Integrity: "When it comes to ethics, no challenge is too great or too small, if the objective is to achieve the best".

- Understanding: "We have great respect for different opinions and ideas, and a lively interest in the needs of our customers".

* Source: European Commission

Corporate Governance

As a public company, Prysmian is aware of the important role played a system of corporate governance in guaranteeing the same level of protection for all categories of stakeholders. Precisely for this reason, the Group's system of corporate governance is focused on the creation of sustainable value for stakeholders over the long term, in the belief that pursuit of this objective will activate a virtuous spiral of effectiveness, efficiency and corporate integrity.

Investor Relations

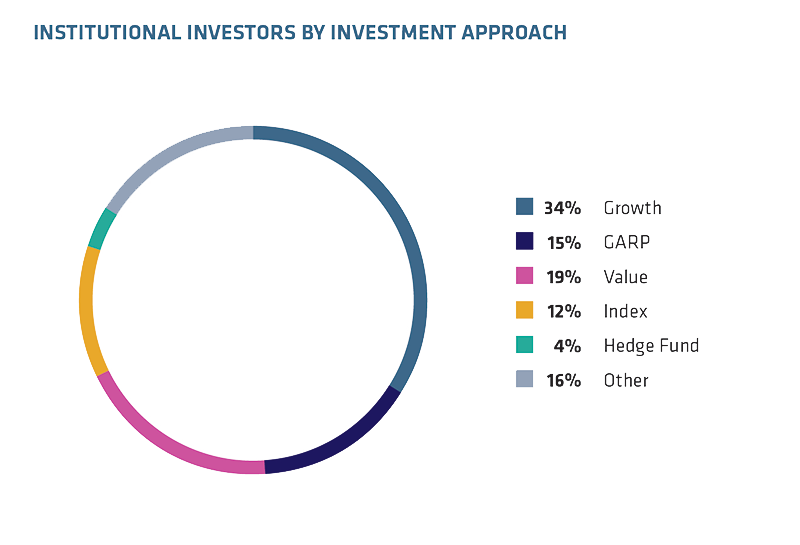

The Group's action and procedures are designed to provide the market with credible information about the business, thus boosting confidence in the Company and encouraging a long-term investment approach to its shares. Every effort is made to avoid biased disclosures and ensure that all investors and potential investors receive the same information so that balanced investment decisions can be made.

In order to guarantee the transparency of information flows, Prysmian organizes conference calls with institutional investors and financial analysts upon publishing its quarterly data, and also invites specialist media representatives to take part. Furthermore, Prysmian promptly informs shareholders and potential shareholders about every action or decision that could have a material impact on their investment.

The increasing attention paid to the activities of the Group by socially responsible investors (SRI) was confirmed by their growing attendance at the road shows and meetings held for them.

Internal Audit, Compliance and Internal Control

In order to strengthen the system of internal control and risk management, commencing from 28 July 2016 the Board of Directors established a Compliance Function and, acting on a recommendation from the director responsible for the system of internal control and risk management approved by the Audit Committee and having consulted the Board of Statutory Auditors, appointed a Compliance and Internal Audit Officer to manage the new Compliance department as well as the Internal Audit department. As a consequence, the Compliance and Internal Audit Officer was granted the rights and duties envisaged in the Code of Self-Regulation for the managers of internal audit functions. The Group decided to maintain a separate Internal Audit organisation, which now reports hierarchically and functionally to the Compliance and Internal Audit Officer. Including the Compliance function, the Internal Audit function has now become larger and more structured.

The Compliance and Internal Audit Officer reports hierarchically to the Board of Directors who appointed him, while also reporting on his work to the Audit Committee and the Board of Statutory Auditors. This person is not responsible for any operational areas, despite having direct access to all the information needed for the performance of his functions.

The Compliance and Internal Audit Officer is mandated to check the adequacy and functioning of the system of internal control and risk management in compliance with international professional standards, both on an ongoing basis and with regard to specific requirements. Accordingly, he prepares an annual Audit and Compliance Plan for the Group, based on the risk assessment carried out as part of the ERM process.